AI will bifurcate society further between haves and have nots

Insulate yourself by becoming an investor

Kazatomprom, world's largest uranium producer, flashes red

Kazatomprom, world's largest uranium producer, flashes red

Informative article about Kazatomprom challenges from the Oregon Report.

Kazatomprom is the world's largest and, arguably, most important uranium producer, accounting for 23% of global supply in 2022. To put in context, that's double the next largest producer, Cameco in Canada.

The company has now warned production will be 20% below levels allowed by permits in 2024, with production impacted possibly into 2025. The warning comes just as uranium prices are approaching historic highs with significant fallout across the global energy and nuclear sector.

But this may not even be the biggest challenge facing Kazatomprom's uranium supply to the West, with geopolitical tensions threatening to spillover into Kazatomprom's joint venture partnerships across Kazakhstan, which make up a staggering 43% of global supply.

Cameco also reported earnings this week. I was traveling all week and have not had time to digest the report or the potential impact fully so that I will reserve judgment. I have seen many people bagging on Cameco management, but the stock is up 5x during this bull market, so there is that. I will say what I have said in the past. This uranium market is heading higher, but the trip will be volatile and nerve-wracking. Being able to stick to your thesis, which should lead to conviction (assuming you have a thesis), leads to being able to ignore short-term market gyrations and focus on the long-term results.

Speaking of nuclear, I did like the conversation between Eric Townsend of MacroVoices and Gavekal Research partner Louis Gave.

Louis Gave is one of my favorite commentators because of his knowledge of international markets and opportunities, and the fact that he lived in Hong Kong for many years gives him a more balanced view of China in my view than many US-based analysts.

The conversation drifted into energy policy and how China is outpacing the US and Europe on nuclear development. The point that was made is that the country with the lowest cost energy costs will likely have a real competitive advantage. The Chinese seem to believe the key to cheap and reliable energy is nuclear. I, of course, agree with this view and would like to see the US go on a nuclear buildout with the same zeal as we pursued the space race with the Soviets in the 1960s and 1970s.

The impact of AI is coming sooner and harder than many think.

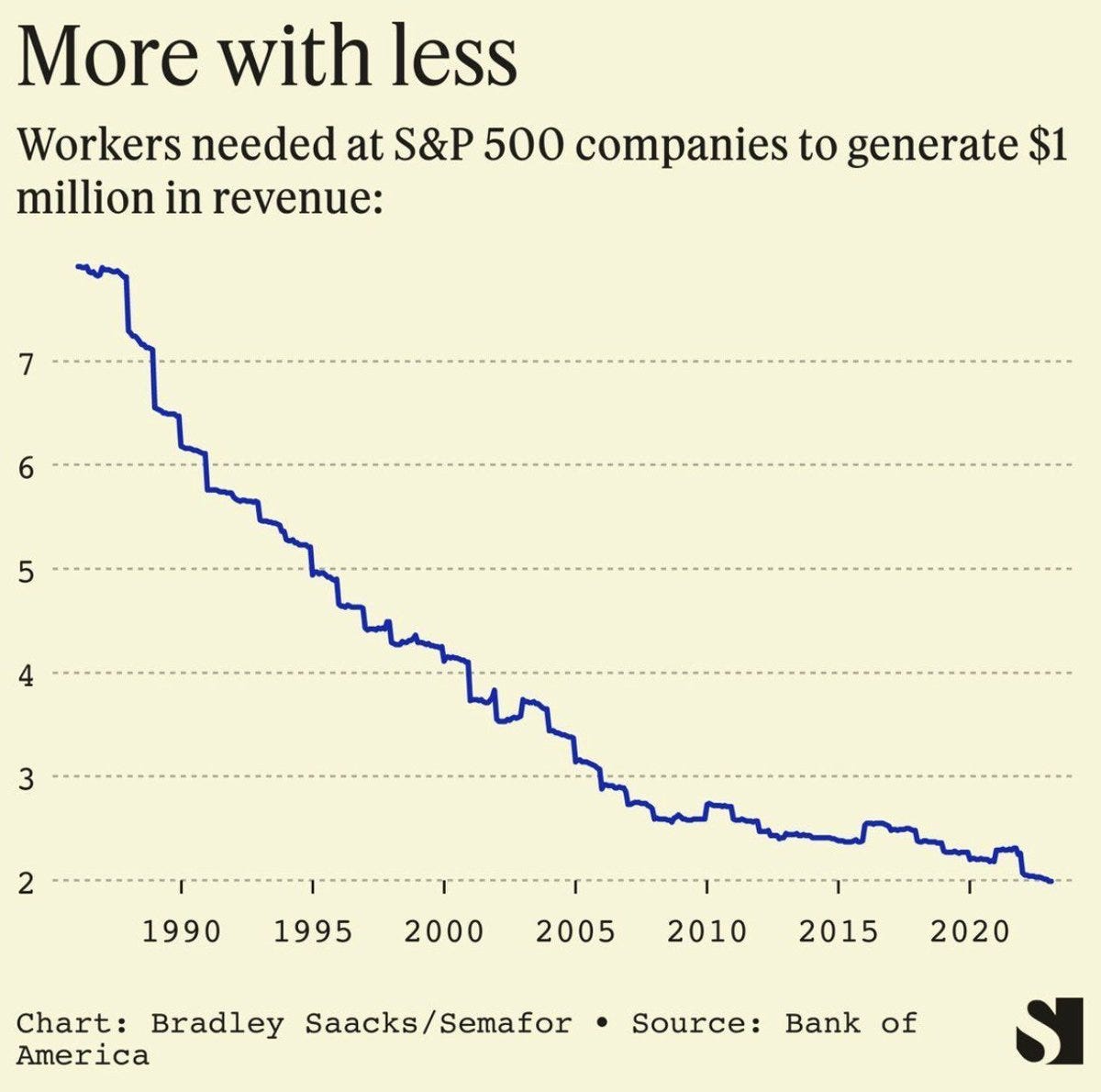

Companies have been and are doing more with fewer workers. Now, think about how AI will impact the need for workers. I have said for many years that one must put together a grub stake and participate in the capital markets. The economy will always have opportunities, but I expect technology to relentlessly push down labor costs and eliminate the need for many workers. Many commenters have said knowledge jobs could be the first to go, but based on how much robotics are advancing, how long before many manual labor jobs go away?

There will be pushback from labor groups and social justice people, but the pressure will always be to use robots as they get cheaper than humans. Employers will like it because the robots show up for work and will not complain, do not take vacations or call in sick, and don’t ask for raises.

Participating in the capital markets allows one to hedge against being displaced by technology and AI. Don't be surprised if a company can get along without you; they will if they can. The bottom line is always the bottom line.

2024 Ten Surprises Tribute to Byron Wien: Remembering His Legacy

In memory of the legendary Byron Wien, we have assembled an all-star cast of Byron’s colleagues and friends to create a tribute to honor his legacy. This video includes a history of the Ten Surprises, a forecast featuring a new 2024 Ten Surprises list, stories about how these titans of the investment community first met Byron along with unique memories from their time together over the past five decades. To download the Surprise Slide Deck and for additional information, please visit https://bluefoxadvisors.com/tensurpri..

Investment Wisdom

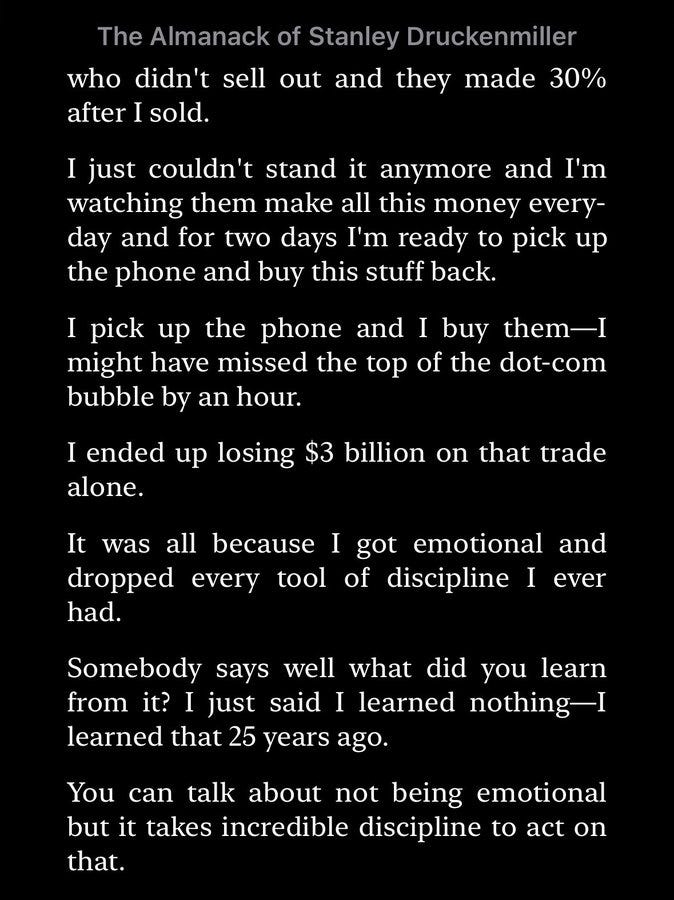

Even the best can lose control of their emotions and get sucked into FOMO thinking.

If one of the best investors in the world, Stan Druckenmiller, can get sucked into tech FOMO what chance does the average investor have? All I can say is one has to know oneself. This is something that each investor has to face on his/her own. There is no book to read or magic formula. One tool I have advocated for is to have a written plan and follow it.

Understand that you will likely not sell at the exact top tick nor buy at the precise bottom. At least half or more of your ideas will not work. I have said it before the average investor has many advantages over professional money managers, but everyone is human and subject to emotions of fear and greed. It will be an ongoing wrestling match with yourself over your entire investing career.

That is it for this week.

If you want to know how I and my paid subscribers take advantage of the themes discussed in these free weekly emails, consider a paid subscription to the Actionable Intelligence Alert newsletter.

To your investing success,

John Polomny

https://apptronik.com/

The humanoids are coming and they are coming fast.