I believe the “Cigar Lake Moment” is here in the uranium market

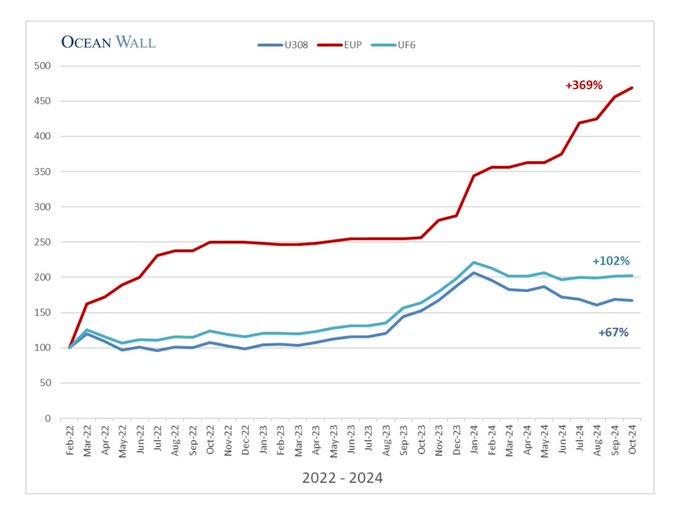

Nick Lawson, the CEO of Oceanwall, and his protege Ben Finegold were interviewed this week about the potential upside in the uranium price due to Russia’s ban on enriched uranium to the US.

More on the Russian uranium ban

Russia's bold move to impose a uranium export ban in 2024 has sent shockwaves through the global energy market. Why now, and what does it mean for the world? This video dives deep into Russia's uranium ban explained, uncovering its impact on the US nuclear power industry crisis, and how it could reshape the global uranium market. With the U.S. relying on 27% of its uranium imports from Russia, this decision has exposed vulnerabilities in the uranium supply chain crisis and raised critical questions about US nuclear power reliance.

Leigh Goehring: Gold's "Massive Bull Market" Just Starting; Uranium and Copper Outlook

Leigh Goehring of Goehring & Rozencwajg discusses his outlook for gold, outlining calculations that show the yellow metal potentially rising to the US$15,000 to US$25,000 per ounce range during this cycle.

He believes price dips should be bought, and said gold stocks are "radically undervalued."

Goehring also shares his thoughts on what's next for silver, uranium and copper.

The Reading Obsession

“I just sit in my office and read all day.” - Warren Buffet

Every once in a while, I come across this quote. Usually by someone painting an idealized picture of an investor ingesting information all day in a library-like office. Just like the oracle does. I hate to say it: it grinds my gears.

Don’t get me wrong: I love to read. But what ticks me off is when a specific behavior gets taken out of context and fetishized.

(skip)

Did a young Buffett read a lot? Yes, he certainly did. Did he spend all his time churning through annual reports, newspapers, books, and trade journals enough? No. Buffett understood how to balance his stack of reading materials with a solid travel schedule. He did not expect to solve the world’s investment puzzles solely from the comfort of his desk.

He built and maintained relationships that allowed him to source and discard ideas and evolve as an investor (not to mention enrich his life). Just think about the influence that Munger had on his pivot towards quality investing.

This is a great article that gives significant insight into how Buffett actually became the successful investor he is. It wasn’t just by sitting in his office reading books and annual reports all day.

He also invested time in travel and visited friends, contacts, and business associates all over the country. Networking allowed him access to investment ideas and to people with different perspectives. This is an outstanding article and accurately describes the methodology of his success. 7

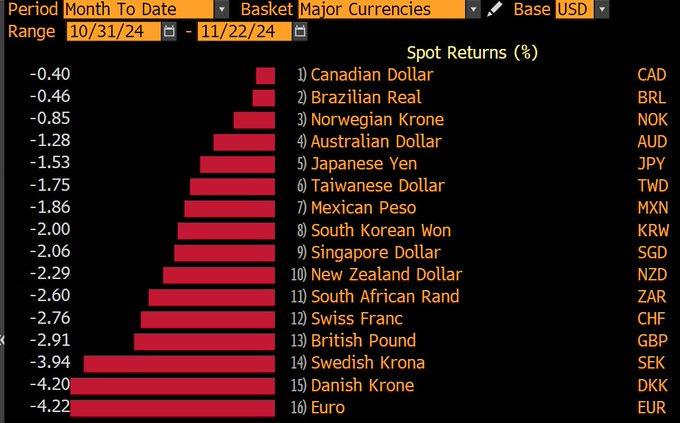

The Euro is being crushed. Here’s Why.

Can it be turned around? Yes, but it will take a herculean effort at this point. Do the Europeans have it in them? I'm not sure they do. I expect the eventual dissolution of the EU (don’t ask me when).

The place will likely become a museum where Chinese and Indian tourists visit old castles. They will also recruit butlers and nannies to work for them.

That’s it for this week.

This service and my work are reader—and listener-supported. The best way to support me is to follow me on Substack, YouTube, and X. You can also buy me a coffee if you are inclined.

Regards,

John Polomny

John you are simply the best !!!