AIA Free Email 12.4.24

Even more bullish uranium news. Cant stop, won't stop!

Argentina ETF sees record inflows as traders buy Milei’s efforts

An exchange-traded fund tracking Argentine stocks saw record inflows as Wall Street embraces President Javier Milei’s efforts to quell inflation and reverse years of endemic budget deficits.

The Global X MSCI Argentina ETF, known by its ticker ARGT, absorbed US$144 million of inflows for the week that ended on November 22, with US$88 million coming in on Friday alone, according to data compiled by Bloomberg. The fund, which is a vehicle for traders to pile into equity bets on a country where access to local markets is complicated by capital controls, saw assets jump roughly seven-fold from US$104 million when Milei took office to some US$750 million on Monday.

The market has responded well to Milei’s reform agenda. Can it continue? Yes, I think it can. However, a lot of good news is already priced in, and the ETF is at least overbought in the short term.

One must remember that Argentina has been in economic trouble for many decades. If the reforms continue and the economy responds, there is potential for much more upside.

I believe there is a coming rejection of statist economic policies gaining momentum worldwide. This could be especially true in Latin America. I am looking at other Latin American countries that will be having elections soon and could possibly develop into turnaround situations, as leaders in Chile, Peru, and Colombia are polling terribly, and these countries are ripe for change. I write about this more extensively in the December issue of the paid version of AIA.

Capital rotation into emerging markets. Why?

I know both of these guys and can recommend following their work. Scott is the Uzbekistan Fund's CIO, spending most of his time in Tashkent and traveling around emerging markets.

Ladislas runs the Wandering Investor site and Youtube channel and is engaged in international real estate and highlighting international diversification.

Great discussion about emerging markets with some specific ideas.

Meta Becomes Latest Tech Giant To Embrace Nuclear Power With Open Arms

We wrote back in early November that Mark Zuckerberg reportedly told Meta workers that plans to build an AI data center powered by nuclear energy were scrapped after rare bees were discovered on the proposed site.

Now it looks like things could be back on track, according to new reporting from Axios, who writes that Meta is joining industry heavyweights like Amazon and Google in exploring nuclear energy as a zero-carbon solution.

Like Microsoft, Amazon and other giants, Meta is making a bold move to embrace nuclear energy as a cornerstone of its sustainability strategy.

The tech giant has issued a sweeping "request for proposals" (RFP) aimed at identifying developers capable of bringing nuclear reactors online by the early 2030s to support its energy-intensive data centers and surrounding communities.

Axios wrote that Meta's RFP targets an ambitious pipeline of new generation capacity ranging from one to four gigawatts. The company seeks partnerships with entities that can streamline the entire lifecycle of nuclear projects—from site selection and permitting to design, construction, and operation.

All the major tech companies are now pursuing nuclear power. They all realize that the power needs for their data centers will only be met with baseload nuclear power.

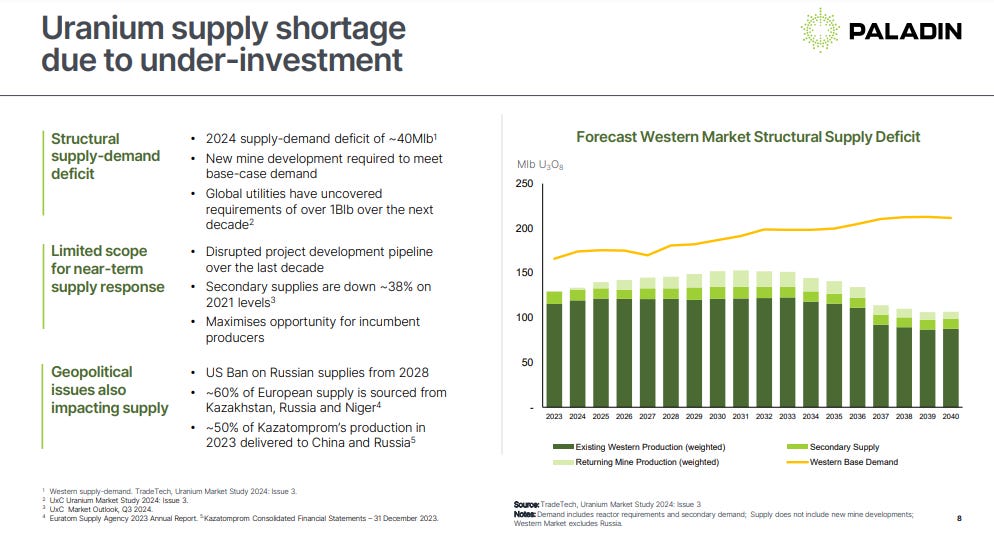

This is extremely bullish for the uranium price. Paladin pointed out in their annual meeting just how much of a uranium deficit the world is facing.

I would also note that Paladin recently restarted their Langer-Heinrich mine in Nambia, and they have already run into some issues that forced them to downgrade their production forecast. Just about every uranium miner is having some difficulty bringing back these older mothballed mines, which is also bullish.

Germany can still save some of their reactors

The above visual came from Mark Nelson, who I follow on X. You should also consider following him if you are interested in nuclear power and uranium.

Just a friendly reminder

A lot of people have attacked me about investing/speculating in uranium and say they have made no money. Most of the arguments end up being something like, “You uranium bulls said uranium is the best-looking risk/reward speculation out there, but my uranium junior mining company has not gone up. Ergo, all of you are wrong, and I am mad.”

Just a reminder, choose your fighter well.

Note: this is not a recommendation to buy Cameco

Time is your advantage

The problem with most investors is that they want to get rich quickly. This leads to all types of mistakes and, more often than not, subpar returns.

That’s it for this week.

This service and my work are reader—and listener-supported. The best way to support me is to follow me on Substack, YouTube, and X. You can also buy me a coffee if you are inclined.

Regards,

John Polomny

John, I am a subscriber. Is your December issue out yet? I'm asking because I don't think that I received November.