How “The Mother of All Bubbles” will pop

Part 1 “The Mother of All Bubbles”

Almost no one foresees an imminent pop. Virtually every Wall Street analyst predicts US stocks will continue outperforming the rest of the world in 2025. But all this enthusiasm only tends to confirm that the bubble is at a very advanced stage. If the consensus on “American exceptionalism” is so overwhelming, who is left to hop on the bandwagon and inflate it further?(skip)

The bulls say America can remain dominant, owing to impressive earnings of the country’s corporations. But US earnings growth would not look so exceptional if not for the supernormal profits of its big tech firms, and massive government spending. Over time, supernormal profits get competed away. Growth and profits are also getting an artificial lift from the heaviest deficit spending ever recorded at this stage of an economic cycle, by far.

But every hero has a fatal flaw. America’s is its sharply increasing addiction to government debt. My calculations suggest it now takes nearly $2 of new government debt to generate an additional $1 of US GDP growth — a 50 per cent increase on just five years ago. If any other country were spending this way, investors would be fleeing, but for now, they think America can get away with anything, as the world’s leading economy and issuer of the reserve currency.

This is a contrarian view, for sure.

Everyone is on the same side of the canoe (bullish). Do I want to buy the US stock market at record overvaluations? The US Federal government must roll over 31% of its debt in 2025. That is about $8 Trillion, not including the new debt that must be sold to finance the ongoing budget deficits.

If long-term interest rates are forced higher to entice people to buy the debt, what do you think that will do to the stock market? Maybe the DOGE committee will cut $2 trillion from the budget without causing a recession, but I would not bet on it.

Sell overvaluation, Buy undervaluation.

Is Oil The Contrarian Play Of 2025?

Exxon, the biggest and arguably one of the best-run oil companies, is the most oversold since the COVID-19 lows. I will remind readers that buying at those lows was a terrific entry point. Is history poised to repeat? I am bettig that it will.

Eric Nuttall: Ninepoint Energy Market Update | Key Trends from 2024 & What to Expect in 2025

In this week’s energy market update, Senior Portfolio Manager Eric Nuttall reviews the key energy trends from 2024 and shares his insights on what to expect in 2025. With a focus on global oil inventories, OPEC cohesion, U.S. shale dynamics, and the outlook for energy stocks, Eric provides a comprehensive analysis of the energy sector’s challenges and opportunities.

Eric is perpetually bullish it seems (he runs an energy fund), but he still makes some great points in this video.

Argentina exits recession in win for libertarian president Milei

Argentina has come out of a deep recession in a major victory for the country’s unorthodox President Javier Milei, who has spent the past year enacting sweeping — and painful — reforms in Latin America’s third-largest economy.

Gross domestic product grew 3.9% in the July-to-September quarter compared with the previous three months, Argentina’s statistics agency said Monday. The agriculture and mining sectors drove the expansion, with consumer spending also growing strongly. But manufacturing and construction suffered sharp declines in output.

(skip)

Argentina’s flagship Merval stock index, which tracks around two dozen of the country’s most valuable listed companies, closed more than 7% higher Monday. So far this year, the index is up 174% as investors have welcomed Milei’s radical reforms.

The Argentina stock market is way up and likely overbought currently. However, it is still undervalued, and as the economy continues to respond to reforms, the market will follow.

I am looking at other areas in Latin America facing elections and where the current liberal-left party or candidate is lagging in the polls. In 2025, that is Chile. The election is next November, and the incumbent President is polling extremely low. I am not saying that if a market-focused candidate wins in Chile, it will react as Argentina reacted, but it is worth watching.

Recall Druckenmiller's statement: Don’t look at what is happening now. Look out 12-18 months and trade based on what will happen then. It appears Chile will potentially shift from a left-wing to a right-wing government. This could lead to a re-rating of its stock market upward.

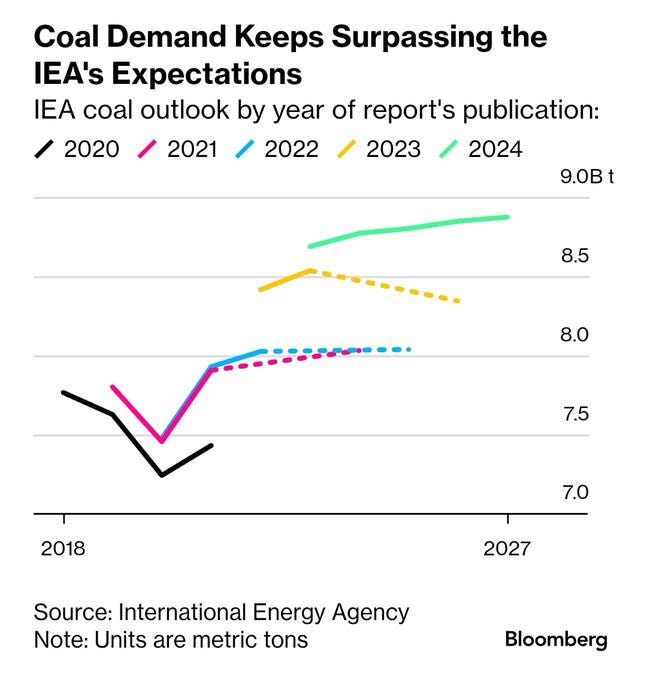

Coal Demand Keeps Exceeding The IEA’s Forecasts

The IEA has consistently been wrong about coal demand. This is because it has decided to engage in ESG nonsense instead of reporting energy facts. Nevertheless, the graph does not lie. Coal demand will continue to increase, primarily in the developing world, where cheap energy is needed.

Is Germany in Terminal Decline?

So goes Germany, and so goes the EU. I am not optimistic based on current trends and lack of leadership. In fact, the leadership in the EU is actively working against the average person’s interests.

That’s it for this week.

Readers and listeners support this service and my work. The best way to do so is to follow me on Substack, YouTube, and X. You can also buy me a coffee if you are inclined.

Regards,

John Polomny

Thank you John !!!! Your the best