Niger’s uranium remains focus of international interest

Despite recent decisions by Niger’s military leaders to revoke the uranium mining licences of France’s Orano for the Imouraren mine and Canada’s GoviEx for the Madaouela project, interest in Niger’s uranium resources has not abated.

Niger is the world’s seventh largest producer of uranium and has the highest-grade ores on the African continent. It accounts for 4.7% of the world’s natural uranium production. In 2022, Niger provided more than a quarter of the uranium used in the European Union, the second biggest supplier after Kazakhstan, according to Euratom. France has depended on Niger for up to 15% of its uranium needs.

(skip)

In May, Pan African News reported: “With the Nigerien military junta pivoting toward Russia and the dismissal of French troops at the end of 2023 and the pending withdrawal of US troops by mid-September, Paris and Washington have begun monitoring Niger’s uranium mines with satellites. As mentioned by Afrique Intelligence, the US National Reconnaissance Office has been observing the Arlit uranium mines from space for the past few weeks while Washington has enlisted the services of commercial satellite companies to surveil the mines as well.”

Interesting article on Niger’s uranium industry and one of the new players. The last paragraph highlights how the big powers are monitoring what is happening via satellites, which should indicate how important every deposit of uranium worldwide is.

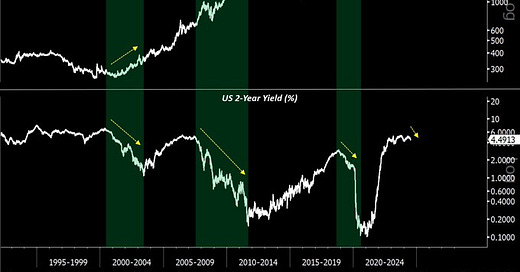

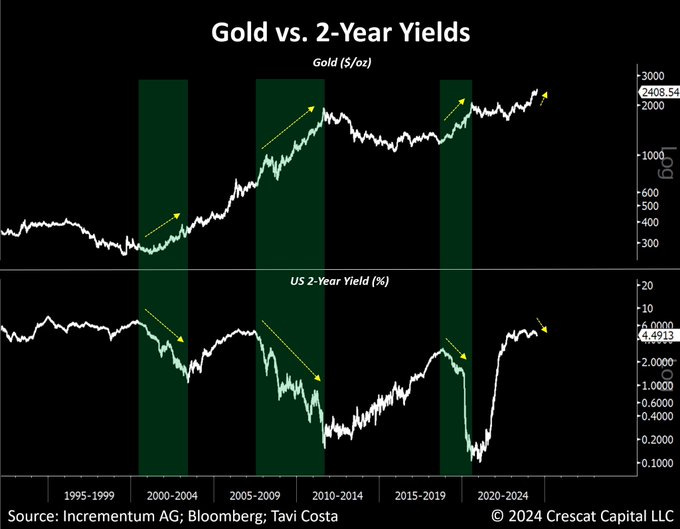

When rate cuts begin by the FED, expect higher gold prices

Why compounding is difficult

According to Akre Capital:

Investor’s own behavior is the main impediment to compounding wealth over time. In particular, pay attention to the second paragraph. How many of these behaviors do you exhibit?

This is How Sanctions Changed Russia's Car Market

I have been talking about the emerging multipolar world and how, in my view, the global east and south will likely come out on top economically and politically.

This video makes a couple of interesting points. The first is that sanctions do not work, as shown by the one guy who is bringing in all kinds of Western cars through the Baltic states (which supposedly hate Russia, by the way) and making huge markups.

To me, the more fascinating topic is the rise of Chinese automakers and their progress toward making relatively cheap, reliable, and stylish vehicles. This does not bode well for Western auto manufacturers. How many other industries will they conquer? How does the West maintain hegemony in a world moving toward Chinese dominance in manufacturing?

How much people’s standard of living has fallen

This compounded inflation is causing the average person angst and contracting living standards. Nevertheless, most people have no idea that the government and central bank are the main drivers of this phenomenon. By the way, the Tuflation site is pretty cool. Here is a link to the site.

Also noteworthy from the Truflation site is the fact that we are certainly in a disinflationary environment currently. This is another reason I believe the FED will be cutting rates soon, as they are already behind the curve and risk outright deflation.

The bear case for the dollar: Crescat Capital

In our view, we stand on the cusp of a major transformation in the foreign exchange (FX) markets: a likely significant depreciation of the US dollar relative to other currencies over the next several years. Allow us to elaborate.

The Federal Reserve’s current interest rate policy is entirely misaligned with the magnitude of the debt problem, putting the US economy in a precarious situation. As illustrated in the chart below, this issue is notably more severe compared to other developed countries. According to the Organization for Economic Cooperation and Development (OECD), by next year the US will face by far the highest cost for servicing its debt among all developed market economies it tracks by next year.

This predicament has swiftly shifted from a long-term issue to an immediate challenge, and we believe it may force several reductions in the Fed funds rate that call into question the Fed’s ability to achieve its dual mandate of maximum employment and price stability.

Such a drastic reversal in policy stance by the Fed is likely to exert substantial downward pressure on the dollar relative to hard assets, but also versus other fiat currencies that do not face the same urgency to reduce debt costs.

The US needs to cut rates as the interest on the growing debt pile is becoming an issue. I project the FED will cut rates massively over the next twelve to eighteen months and may end up back in QE and expanding its balance sheet. Who else is going to buy all this debt except the FED? Hard assets will do well in this environment, but they will be volatile.

Electric vehicle disaster

Peak EVs in the West? I think oil and internal combustion engines will be around longer than most people think. I remain long hydrocarbons and uranium.

That’s it for this week. Thanks for subscribing.

To your investing success,

John Polomny

This service and my work are reader—and listener-supported. The best way to support me is to follow me on Substack, YouTube, and X. You can also buy me a coffee if you are inclined.