Commentary

I think that as time goes by, it is becoming increasingly apparent to me that the Trump administration is slowly abandoning its three-arrow economic policy. One of the central policies was to bring the US fiscal house in order. Running yearly deficits of 6% plus of GDP seems unsustainable, but we appear locked into doing it anyway.

The chart above, from the St. Louis Fed website, shows that the US has been running deficits consistent with wartime activity. One of the economic targets of the Trump administration was to reduce the deficit to below 3% of GDP.

Lowering the deficits would ostensibly allow for the FED to lower interest rates, which would lead to greater economic growth. The current levels of fiscal spending and deficits are having the opposite effect, pushing interest rates up as bondholders become nervous that the US is not committed to running its finances in an orderly manner.

The higher rates are acting as a drag on the economy, especially the housing market. In addition, higher rates are causing the interest payments on the Federal debt to balloon.

Interest on the debt is now the third-largest component of Federal spending behind Social Security and Medicare.

I contend that the notion that the administration would drastically cut spending, thereby reducing the deficit from 6% of GDP to 3% of GDP, was naive and likely to fail.

We now know that the DOGE effort will not be sufficient to materially reduce the deficits. Elon Musk has now left the administration, and on his way out, was critical of the 1BBB (One Big Beautiful Bill).

Elon Musk says he is "disappointed" by the price tag of the domestic policy bill passed by Republicans in the House last week and heavily backed by President Trump. The billionaire who recently stepped back from running the Department of Government Efficiency, or DOGE, made the remark during an exclusive broadcast interview with "CBS Sunday Morning."

"I was disappointed to see the massive spending bill, frankly, which increases the budget deficit, not just decreases it, and undermines the work that the DOGE team is doing," Musk said.

So, if Plan A is on the shelf, what about Plan B? Plan B, in my view, is that the administration will adopt the “Run It Hot” plan. The new plan appears to be passing the 1BBB to lower taxes, and the administration will lower regulations, hoping that the economy will take off and show above-average nominal growth.

At this point, there is really no choice, as there is almost zero support for cutting spending in Congress or among voters. Even rooting out waste, fraud, and abuse has faced resistance from members of Congress and the courts.

Sentiment in the markets has shifted from tariffs and DOGE cuts are going to tank the economy to tariffs are being dialed back and DOGE is likely a nothing burger.

If the US intends to “run it hot” what about the EU and China? They are also going to stimulate their economies.

In May 2025, EU ministers approved the establishment of a €150 billion arms fund named the Security Action for Europe (SAFE), aimed at bolstering European defense capabilities amid concerns about potential Russian aggression and diminishing U.S. security assurances. They are also pursuing something called Readiness 2030. Proposed by European Commission President Ursula von der Leyen in March 2025, this initiative aims to mobilize up to €800 billion to strengthen Europe's defense infrastructure in response to geopolitical threats.

China plans to issue a record 3 trillion yuan ($420 billion) in special treasury bonds in 2025, up from 1 trillion yuan in 2024. These funds aim to spur business investment and consumer spending. They are also pursuing subsidy programs that include subsidies for trading in old cars or appliances for new ones and subsidizing large-scale equipment upgrades for businesses. Households will also receive subsidies to purchase digital products like cell phones, tablets, and smartwatches.

China has set an ambitious economic growth target of around 5% for 2025 and plans to raise the budget deficit to 4% of GDP, the highest in over three decades.

Three of the world's largest economies will likely be pursuing various stimulus programs. In my view, many are underestimating this, and the world economy will perform better than anticipated. This increased spending could end up being very bullish for economies and commodities.

I think the market is in the middle of shifting its thinking from a recession, based on the tariff war and US fiscal austerity, to the realization that the whole world is going to “run it hot”.

What about fiscal responsibility and inflation? Hey, we have elections coming up, and we will cross the inflation bridge when we get there. Lyn Alden discusses this in depth and has dubbed it “Nothing Stops This Train”.

If the entire world is going to run hotter, that likely means increased energy demand. I have discussed my bullish stance on oil prices and oil stocks. Oil is one of the most out-of-favor sectors in the market.

At $1.5 trillion, the market value of the energy sector has fallen to less than 3% of the S&P 500 index, versus a long-term average of 8%. The market capitalization of the energy sector is basically unchanged from the 2016-2020 period, when the average oil price was also in the high 50s.

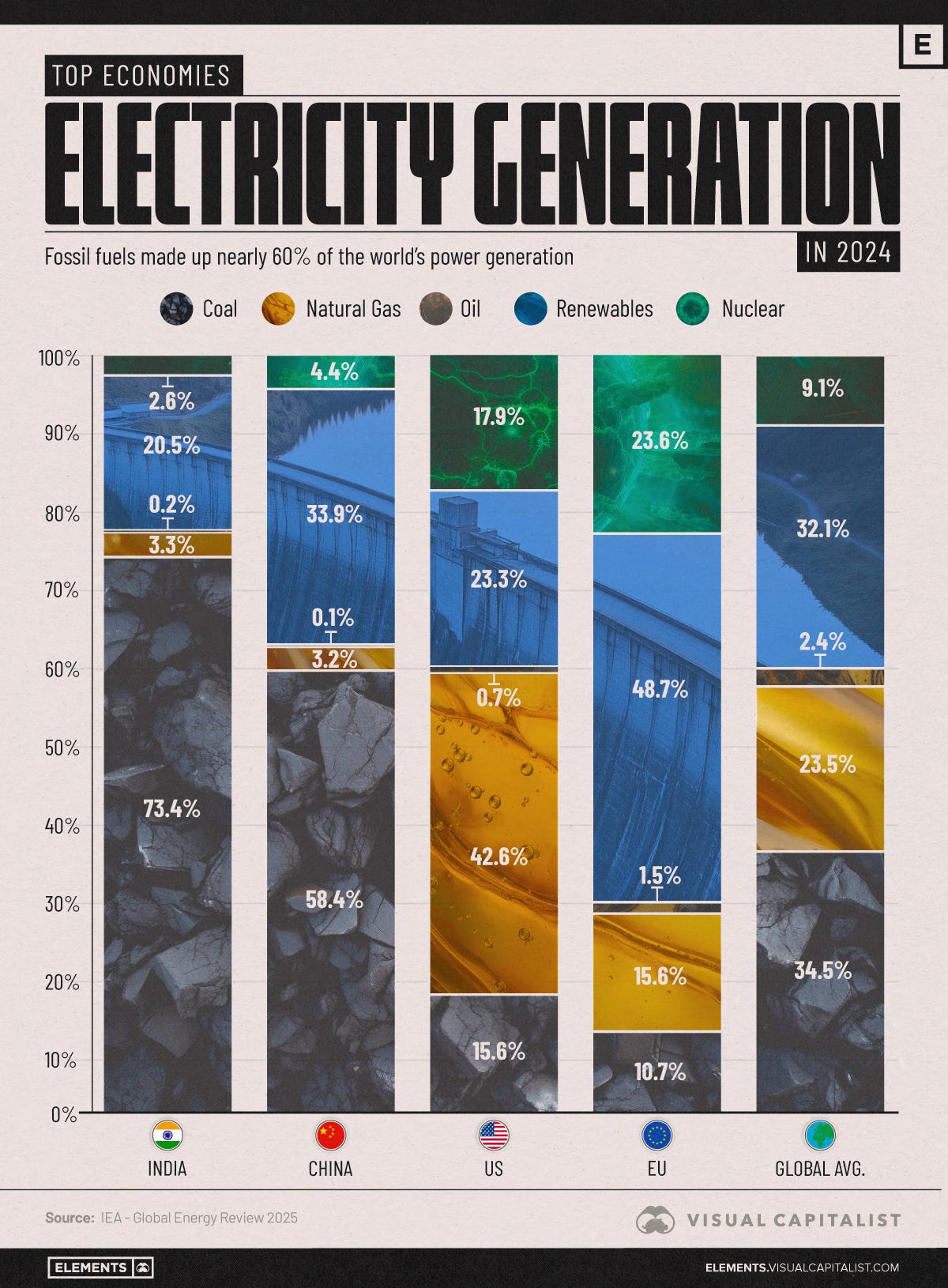

Coal is another sector of energy that I have been getting more bullish on recently. Contrary to what many people may think, coal use for electricity production is actually on the rise.

Coal is a primary source of energy in many countries around the world. Regardless of what the West does concerning coal use, demand from India and China will more than compensate. Considering many other emerging market countries’ energy mix around the world, coal use is unlikely to decline anytime soon.

China’s construction of new coal-power plants ‘reached 10-year high’ in 2024

The country began building 94.5 gigawatts (GW) of new coal-power capacity and resumed 3.3GW of suspended projects in 2024, the highest level of construction in the past 10 years, according to the two thinktanks.

India is no slouch either. India has a significant number of coal power plants under construction, with an estimated 30.4 GW in active development and 35 GW in the pre-construction stage. This includes plants that are already permitted, pre-permitted, and those that have been announced.

Additionally, the Indian government plans to add at least 53.6 GW of coal-fired power capacity over the next eight years, in addition to the 26.4 GW currently under construction.

Below the paywall, I highlight a coal company that is priced as if coal use is going to end in the next few years. Instead, this company has a growing cash pile that is being used to pay a large dividend and to buy back shares. I believe the stock is another example of the market mispricing an industry and a specific company.