Commentary

I was thinking hard about what I should write about this month. The trade situation is at the top of most market watchers' lists. You can find any opinion that will satisfy your biases if you look at “X” long enough.

It has also become evident that many people commenting on the potential trade outcomes allow their personal view of Trump or his administration to influence their prognostications. Everyone seems to know what the outcome of the trade talks and the economy will be.

I freely admit that I am not smart enough to know how this situation will resolve.

However, I think something had to be done, as previous administrations had allowed other countries to take advantage of the trade situation for too long, and things were becoming too skewed against the US.

I also realize that Trump’s base is not Wall Street or the coastal elites. It is the working class, lower middle class, and tradespeople. He aims to raise their wages and standards of living by deporting cheap labor. This will allow for higher wages as the labor supply tightens and get specific industrial sectors of the economy moving again.

Trump’s critics will say that we don’t need to try to bring underwear and sock production back to the US (I agree, and this simplifies the issue). I think they are just mad because their overvalued stock portfolios got hit.

You will note that the government is trying to get more manufacturing jobs back to the US (this began during the Biden Administration).

A boom is particularly prominent in computer, electronic, and electrical manufacturing sectors. The Infrastructure Investment and Jobs Act (IIJA), Inflation Reduction Act (IRA), and CHIPS Act have provided direct funding and tax incentives for these projects.

Real manufacturing construction spending has doubled since the end of 2021, with a record $233 billion in manufacturing-related construction last year.

The construction boom reflects a broader strategic shift in the US, focusing on strengthening domestic manufacturing capabilities, particularly in key areas like semiconductors.

The Biden administration used taxpayer money to incentivize reindustrialization. Trump is trying to use trade policy to continue the reindustrialization of the US and get higher-paying jobs for his base.

Will it work? Time will tell. It does seem chaotic, as the policy seems inconsistent and arbitrary, and is done via social media posts on “X” or Truth Social. Most commentators don’t think this will work.

The contrary view is what if other countries realize they must cut a deal and negotiate an end to this trade war? What if they agree to set up more manufacturing in the US to circumvent tariffs? Could we get a boom?

What if the Chinese ship products to Vietnam and rebox them with a "made in Vietnam" sticker? I saw this in the renewable business with solar panels when the panel tariffs were implemented under Biden. Iran already does this by sending its oil shipments to Malaysia and then onto China.

The bottom line is we don’t know what will happen.

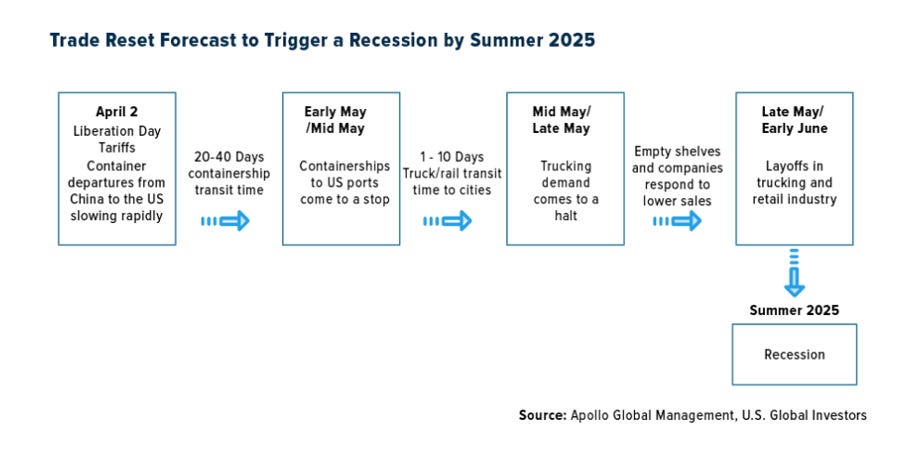

I want to post this timeline, which Apollo Global Management put out, showing a trade reset-triggered recession timeline.

The video above is from the economist from Apollo who is forecasting a recession beginning this summer.

As I have said, I believe the administration is pushing hard and fast policy-wise, as they have a limited time window to make significant policy changes that may cause a recession.

This goes back to my Volker/Reagan gambit that I think they are attempting. In a nutshell, take the economic pain early and make the significant changes that hopefully show a gain before the midterm elections.

The party out of power usually wins seats in the midterm elections. If we are in a recession and inflation is up due to supply chain issues, then the Democrats will do well as people become disillusioned with Trump and his policies.

Hakeem Jefferies can’t wait to get his hands on the Speaker's gavel. Start up the impeachment organ grinder.

Time will tell if they can pull a rabbit out of a hat.

This is all very entertaining, but does it get us anywhere, investment-wise? A recent tweet thread on “X” helped to focus my thinking.

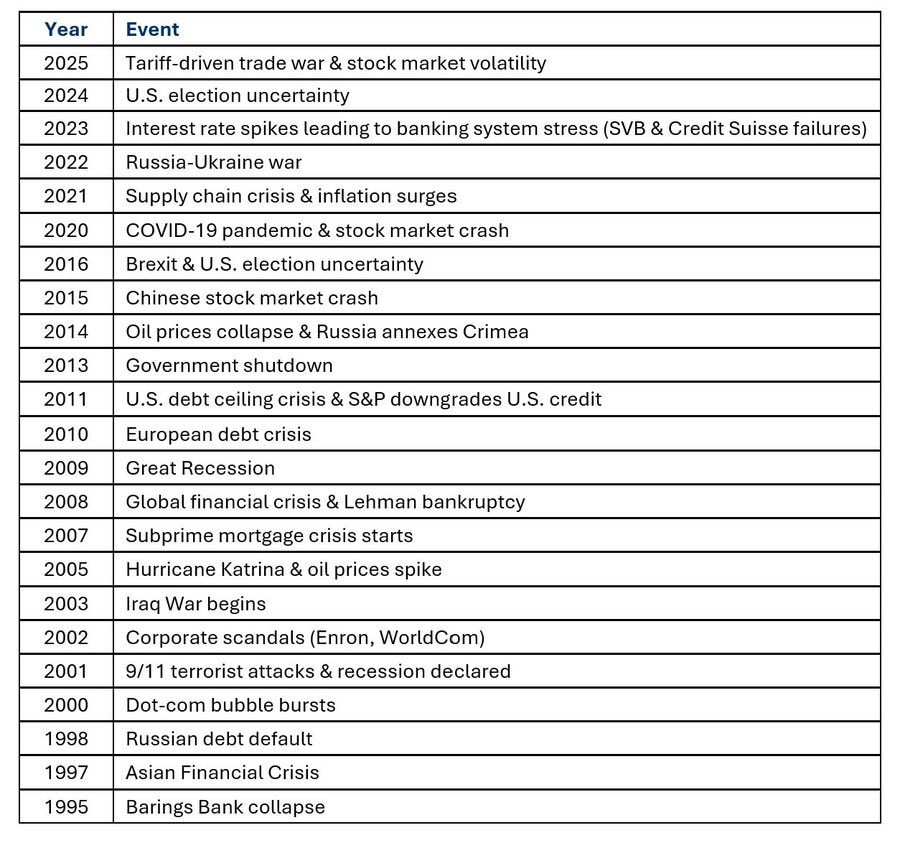

The point is that every few years, another crisis comes along. If we live by the newspaper headlines and allow them to drive our actions, we will be locked into a perpetual cycle of fear and stasis. I have often said that things are never as bad as we think or as good as we believe. We need to look for value and buy it when we see it.

We can now access markets and opportunities all over the world. There is always an opportunity somewhere.