Google’s Net Zero Plans Are Going Up In Smoke

In 2017, Google declared it had reached “100% renewable energy for our global operations.” The company continued, “Google became carbon neutral in 2007, and since then, our carbon footprint has grown more slowly than our business — proof, 10 years later, that economic growth can be decoupled from environmental impact and resource use.”

That “decoupling” didn’t last long.

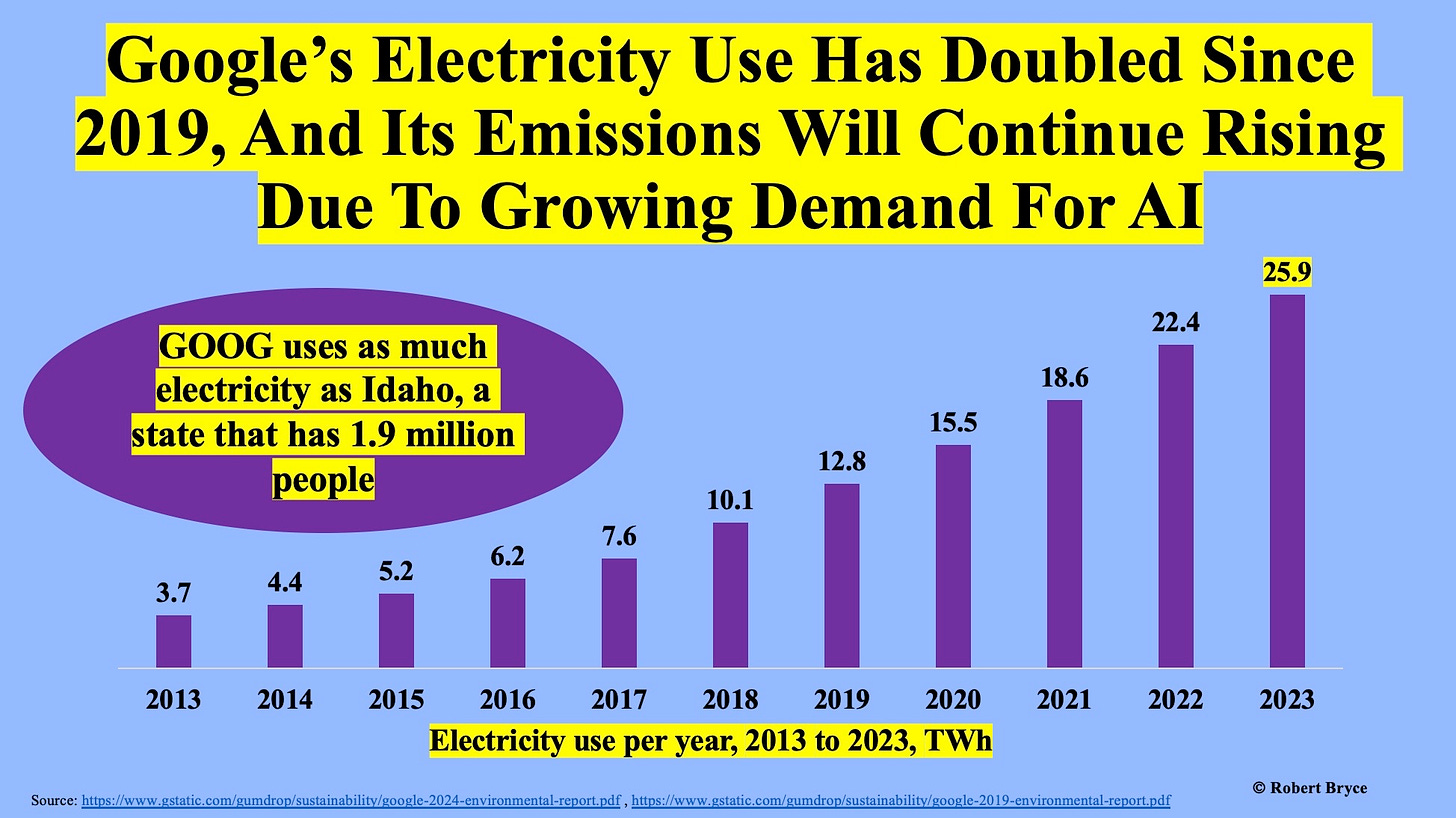

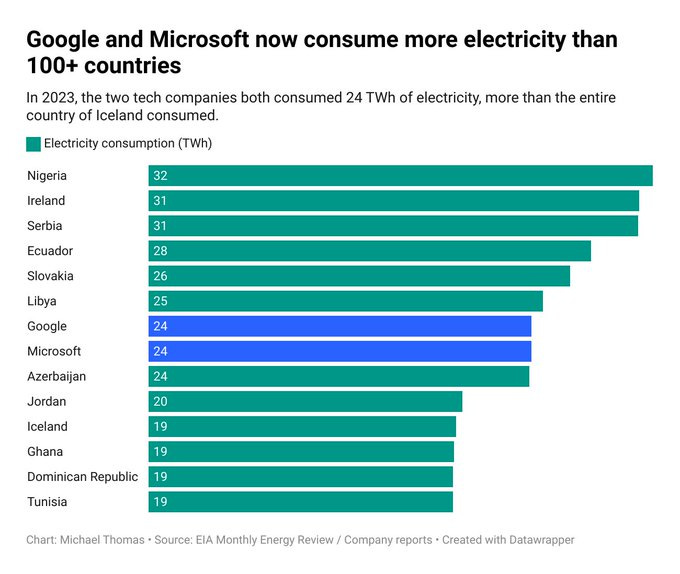

In fact, since 2017, Google’s environmental reports show that the company’s electricity use, CO2 emissions, and carbon intensity have soared. The most recent numbers came out last Tuesday when the search and advertising colossus released its 2024 environmental report. And the numbers don’t lie.

It is amusing to out these environmental frauds but what are the investment implications? The article discusses this.

Last week, I talked to Doug Hohulin, a Kansas City-based technologist who works on AI and closely follows the data center sector. He summed up the predicament facing Google and the other power-hungry members of Big Tech. “There’s just not enough wind and solar available,” he said. “Nuclear used to be seen as bad, and now it’s good.”

Both of those statements are true. Right now, it appears that Google and other Big Tech companies will see continuing increases in emissions until the U.S. and other countries get lots of new reactors built and online.

We know that nuclear power will be the answer, and barring another Three Mile Island or Chornobyl accident, the world will move increasingly to nuclear power. We have no idea where the uranium will come from, but that is what makes this the potential investment of a lifetime.

Speaking of Three Mile Island, restarting it is being discussed

It's been half a decade since Three Mile Island provided power to Pennsylvania, but one of the nuclear plant's decommissioned reactors might have a restart in its future.

Three Mile Island owner Constellation Energy Corporation is in talks with Gov. Josh Shapiro's office and state lawmakers to potentially bring the site's Unit 1 reactor back online, according to a recent report from Reuters. That reactor is separate from the infamous Unit 2 reactor, which suffered a partial meltdown in 1979, and has been dormant ever since.

One of the reactors at the site that was unaffected by the meltdown continued operating until 2019, when it was finally shut down. This is the reactor that is potentially going to be restarted. I have no idea if it will be restarted or not. What is important is that this renaissance in nuclear power is even being discussed, and how the zeitgeist has moved from demonizing nuclear power to ionizing it. This is bullish news for uranium.

Cantillon Marries the Red Queen

We recently read a book titled Essay on the Nature of Commerce in General by Richard Cantillon, who developed the concept of relative inflation, now known as the Cantillon Effect. Cantillon (an Irishman) posited that the introduction of new money into an economy is not distributed evenly across all sectors. Instead, it benefits certain groups first, creating a ripple effect or waves. The result is that different sectors are affected unevenly, with some benefiting more than others, leading to economic imbalances (sound familiar?). He suggested that inflation occurs gradually and that the new money has a localized effect, eventually creating broader inflation as it circulates. We would agree.

Cycles are an inescapable attribute of markets just as in nature. Cantillon’s theory helps further illuminate how these cycles are created and behave within economies. It also explains why we find oil and gas companies so attractive. Since 2014, most have written off oil and gas companies as perennially un-investable for a myriad of reasons, many we have covered in previous missives. What is often not taken into consideration is how the role of monetary interference and the Red Queen Effect have fundamentally altered the oil and gas companies for the better. Both are critical factors that compelled these companies to evolve in order to compete in this new environment.

The book mentioned, Essay on the Nature of Commerce in General by Richard Cantillon, is available for free online as a PDF, and I highly suggest taking a look at it. The Cantillion Effect has become one of my main views on understanding how money printing and government currency inflation affect markets. As we are on the cusp of an era of increased monetary malfeasance by indebted Western governments, it behooves one to understand the implications on various investments.

Optionality (Jul 2024)

Uncertainty is the only certainty in life (except for death and taxes). As Elroy Dimson said, “More things can happen than will happen.” From an investor’s perspective, some things will be bad, but not all of them. Our main message here is that this situation, while undoubtedly creating risk, creates bountiful opportunities as well. Good things can happen too. The investment strategy that outperforms in the long run is one that is hurt minimally when things do not go as expected and benefits greatly when things work out in our favor. This is an antifragile strategy.

An antifragile strategy has optionality. Optionality, at its core, means having options, choices, different paths to success. Options, but, importantly, not obligations. Choices can be agonizing, but it is better to have agonizing choices than to have no choices at all. It is generally understood that optionality in life is a good thing, and that we should strive to increase it. We can increase our optionality by getting an education, staying out of debt, having a variety of skills, or any number of other choices. When one has options, one can limit the downside if things in life don’t go as planned, with the potential for great upside if they swing in one’s favor.

I really respect Kopernick Global Investors and religiously read their periodic reports. These are the folks who introduced me to the Cantillion effect. The report goes on to show examples of undervalued sectors and undervalued companies in those undervalued sectors—kind of a double undervaluation option. They discuss gold, agriculture, telecom, and railroads in emerging markets and show how cheap they are relative to developed market examples.

Only A Few Investors See This Opportunity: Aaron Edelheit Reveals

In today's episode, Aaron updates us on the state of the cannabis sector after a rough couple of years. He touches on possible Federal regulatory changes, the key characteristics he looks for in cannabis companies, and why he refers to cannabis as the great replacement. As we wind down, Aaron talks about why he's so excited about the opportunity with low-dose hemp beverages.

I am interested in investing in things that no one is looking at. This is one of those sectors. The problem is that although states are allowing cannabis usage, it is still a Schedule 1 drug as far as the Federal Government is concerned. I think more states will continue to legalize cannabis, and eventually, the FEDs will also legalize it. This will likely take longer than we anticipated. In the meantime, patience will be required before we see a payoff. Position sizing is important, but there is an opportunity cost.

That’s it for this week.

To your investing success,

John Polomny

This service and my work are reader—and listener-supported. The best way to support me is to follow me on Substack, YouTube, and X. You can also buy me a coffee if you are inclined.

Thanks for pointing me towards the Kopernik publications. The article is a super interesting read and very useful to me for a better understanding of investing.

Thank you John, I am new in investment and you are light house for many people like me.