Are We Entering A Period Of Stagflation?

How to invest if we are. Plus some wisdom from Munger and Buffett

Another Munger lesson

Many investors are bullish, or not fearful, of the future of stock returns. At Smead Capital Management, we continue to explain to our investors how poor the outcomes will be. Some ask when this view will change. To quote Keynes, “When the facts change, I change my mind. What do you do, sir?” The facts are not changing. Instead, we continue to find mountain evidence of the danger present. In this piece, we will explain an analogous instance from the past.

A Bloomberg article last week pointed out that a closed-end ETF had surged in value since its initial offering and had begun to burn investors. “Destiny Tech100 Inc., which trades on the New York Stock Exchange as DXYZ, spiraled as much as 45%, trimming gains from its debut last month to about 700%. The fund’s shares are incredibly volatile, reminiscent of 2021’s meme stock mania, as trading had to be halted at least four times in the opening 30 minutes of Tuesday’s session.”

(skip)

In Janet Lowe’s book about Charlie Munger, Damn Right, you can read of a product identical to this. During the Go-Go 1960s, products like these were available. Charlie Munger and his partner Al Guerin took control of a product called the Fund of Letters. It was a “venture capital that its founders had formed in a highly touted initial public offering allowing liberal sales commissions to stockbrokers. When it was first organized, the fund raised $60 million…” Lowe goes on to say, “As typically is the case with the closed-end fund, the Fund of Letters soon traded well below its net asset value. Moreover, when the market went into a prolonged decline, the Fund tanked with it.”

(skip)

Since Munger is no longer alive, we will speak for what he stood for. DXYZ is just another form of gambling today like betting on sports on your mobile phone. Many people place bets just to entertain themselves. As they say on the DXYZ’s website, “Everything is more entertaining when you have a stake.”

The bottom line is that everything happening now due to the overvalued markets has happened before. You can either learn from history by studying it or live through it. It is cheaper to read about it than live it.

"Everybody, sooner or later, sits down to a banquet of consequences," Robert Lewis Stevenson

This quote holds a deep and profound meaning that resonates in the unfolding of our lives. At its core, this quote portrays the inevitability of facing the outcomes of our actions. It serves as a reminder that every decision we make has consequences we must eventually embrace. This straightforward interpretation highlights the fundamental principle of cause and effect, emphasizing the importance of being mindful of our actions.

Buffett Lesson

That is a great quote from Warren Buffett. Our advantage as retail individual investors is our ability not to be tied to quarterly results. We have the luxury of being patient, and that allows time for our ideas to come to fruition. As I have said, things normally take longer than you initially thought to play out.

The professional money manager does not have that luxury. He or she is judged quarter by quarter and will get fired if his or her performance dips for a few quarters.

Embrace your advantage.

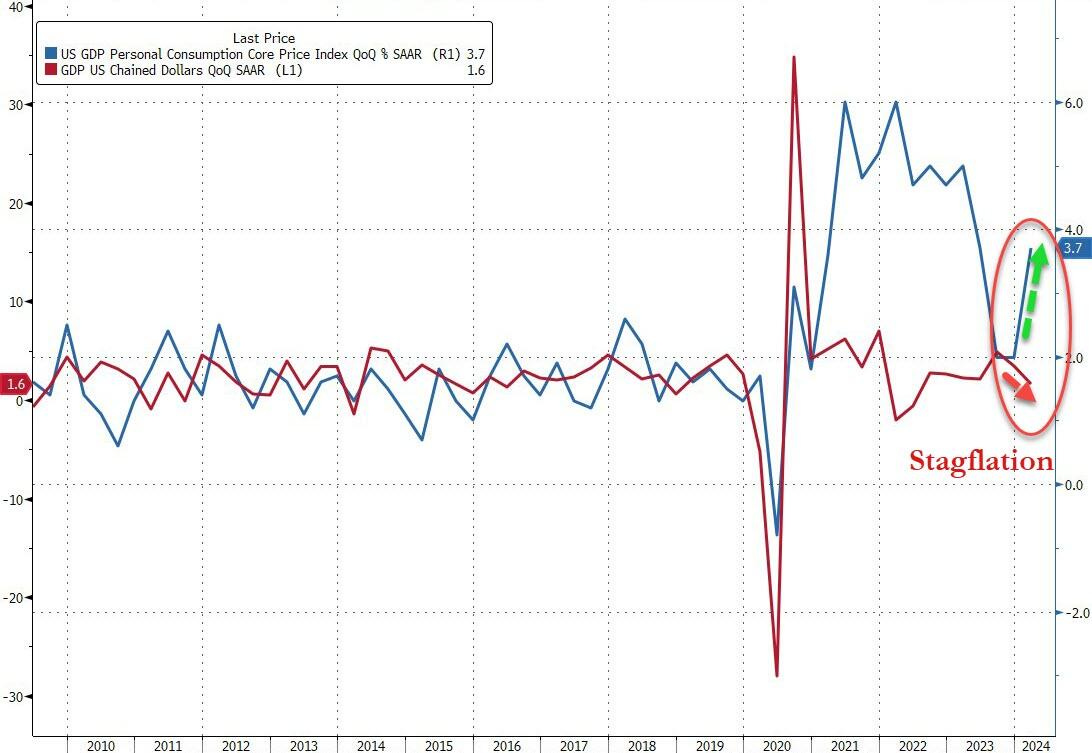

Stagflation Nation?

I am not sure if we are entering a period of stagflation, but the evidence is continuing to mount that it may be asserting itself. What is stagflation? From Investopedia:

Stagflation is an economic cycle characterized by slow growth and a high unemployment rate accompanied by inflation. Economic policymakers find this combination particularly difficult to handle, as attempting to correct one of the factors can exacerbate another.

What kind of investments do well in a stagflationary environment? We discussed this in this week’s Weekly Market Update Video.

Another chart shows what performed best during the last stagflation in the 1970s.

Forward Guidance Interviews Harris Kupperman

Some interesting views on the uranium market.

A guy I follow on “X” had a different perspective on Kuppy’s view. This is why I like X, as you have various views and opinions that challenge each other. It also demonstrates why each person needs to do their own work and not blindly follow someone on the internet.

Here is a link to the thread.

Tracking The Demise Of The U.S. Green Energy Transition

From the Manhattan Contrarian blog:

We’re coming up on three and a half years into the Biden presidency — a presidency which from the outset promised an “all of government” regulatory onslaught to force a transition away from fossil fuels and to “green” energy. And the regulatory onslaught has indeed come forth. But how about the actual transition in energy use? Not so much.

(skip)

Our current rulers think that they have infinite ability to tell the people how to live, and infinite money to force the people to change their ways. They are wrong, and reality will catch up to them, if only gradually.

I point this out because the inevitable failure of the energy transition will eventually lead to higher energy prices and further profit opportunities for speculators like us. All this is caused by economic distortions caused by know-nothing politicians inserting themselves into economics.

Blinken warns China. Sanctions, Proxy War and Regime Change

The US is way over its skis here, and Blinken and the Biden administration are in way over their heads. But what do you expect with a declining empire?

I am staying away from Chinese stocks even though they are cheap. I learned my lesson with Russian stocks.

Germany Lied About The Nuclear Phaseout

In 2018, everyone laughed at Donald Trump—German politicians actually laughed in his face—when he suggested that Germany would “become totally dependent on Russian energy if it does not immediately change course” at a UN conference. Just four years later, Russia rolled into Ukraine and the German government had to do something it had spent a decade avoiding: ask itself hard questions about its energy policy.

(skip)

In a piece out from German magazine Cicero, journalist Daniel Gräber exposes how members of the Green Party, including Minister Robert Habeck, colluded to mislead the German public, claiming that nuclear was too expensive and too dangerous to keep, despite the government’s internal analysis that nuclear was both cheap and safe to continue operating.1 So, they lied. And closed the plants anyway.

“Their aim from the outset was to prevent an exit from the phase-out. No matter what the cost,” writes Gräber.

This is just another example of the political class doing what the donors and controllers tell them regardless of how it affects the majority of the citizens. I am convinced the political class in the west hates their own populations. It can reversed if the people have the courage to clean them out.

I believe in the end Germany will revive its nuclear power plants and build new ones.

That’s it for this week.

If you like the information I provide in these emails, consider supporting me by buying me a cup of coffee. I am listener and reader-supported.

Are you interested in how I translate the information in these emails into actionable investment ideas?

If you want to know how I invest in the themes discussed in this post please consider a subscription to my paid newsletter, “Actionable Intelligence Alert.” You can check it out by following the link below.

To your investing success,

John Polomny

tremendous post with great insights…..