China is cheap but I don't trust the US Government

WW3 is ongoing even if it isnt obvious to most

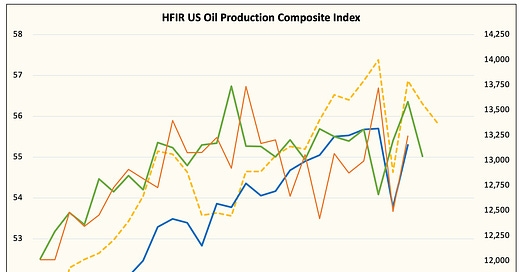

Is US shale peaking?

Prof. Douglas B. Reynolds's academic article on Permian shale peaking and its implications was posted on Anas Alhajji's substack, “Energy Outlook Advisors.”

Peak Shale Production?

Given the challenges of estimating a Hubbert Curve trend before the peak occurs, even assuming appropriate characteristics are in place, and noting that a straight-line estimate for the U.S. shale oil trend is almost as accurate as a simple Quadratic Hubbert Curve with data ending in 2019, there is no discernible evidence that U.S. shale oil has or will peak soon.

During all of 2019 the drilling rig count declined even as oil prices modestly improved, and where the trend of drilling follows a 25-week lag in price. The 2019 decline in rigs mimics the 1956 to 1958 decline in conventional oil rigs. This is the exact point at which a Hubbert trend for the U.S. conventional oil was estimated by Hubbert, giving substantive evidence of a near term peak in production. That is, a roughly 50% increase in the cumulative production amount from the drilling rig signal point denotes where peak oil will be. The plateau of oil rig count numbers starting in June 1 of 2018 suggests that a Hubbert peak for U.S. Lower 48 shale oil is imminent.

This is an important debate as US shale production, and in particular Permian shale production, has carried the world's load with respect to new supply meeting global oil demand.

I am not a Malthusian, and I am not suggesting that the world is going to run out of oil. Obviously, if the price of oil goes up, previously uneconomic deposits become economic, and demand is curtailed or shifted.

However, what is being suggested is that the cheap, easy-to-exploit oil era is going to end, and that means higher prices and more reinvestment into new deposits and reserves.

Copper made it above $5.00 per pound.

It is likely that copper is currently overbought in the short term. However, I am interested in the long-term story, which is continued infrastructure buildout in emerging markets and increased electrification of the world economy.

I have discussed Glencore and Amerigo Resources publicly as ways I am playing copper in my personal portfolio.

The global economy will continue to underpin prices for raw materials as the global PMI is showing growth.

Global PMI at ten-month high while price pressures remain elevated

The global economic expansion unfolded at the fastest pace in ten months at the start of the second quarter of 2024, supported by broad-based growth across both manufacturing and service sectors. Selling price inflation remained elevated, however, even as it eased in April.

The J.P.Morgan Global PMI Composite Output Index - produced by S&P Global - rose to 52.4 in April, up from 52.3 in March. The headline PMI, despite remaining below the survey's long-run average of 53.2, is the highest in ten months and is consistent with annualized quarterly global GDP growth of approximately 2.7%. The latest acceleration in global growth was supported by faster services activity growth, though manufacturing output continued to expand for a fourth successive month, altogether reflective of well-balanced improvements in global economic conditions at the start of the second quarter of 2024.

China is cheap, but I don’t trust the U.S. government

I like to invest and speculate on contrarian ideas. A contrarian theme that keeps popping up in my research is China. It is meeting all the criteria for me to take a major position. Nevertheless, I am going to pass on this.

The reason is I believe we have entered a new Cold War with the emerging global south and east (BRICS countries). I already had my Russian stocks frozen and sold out from under me when the US decided to sanction Russia. As the Anglo-American hegemon continues to lose influence it is weaponizing the US dollar, sanctioning other countries it does not agree with. A perfect example is the tariffs Biden signed this week.

President Joe Biden slapped major new tariffs on Chinese electric vehicles, advanced batteries, solar cells, steel, aluminum and medical equipment on Tuesday, taking potshots at Donald Trump along the way as he embraced a strategy that’s increasing friction between the world’s two largest economies.

The Democratic president said that Chinese government subsidies ensure the nation’s companies don’t have to turn a profit, giving them an unfair advantage in global trade.

“American workers can outwork and outcompete anyone as long as the competition is fair,” Biden said in the White House Rose Garden. “But for too long, it hasn’t been fair. For years, the Chinese government has poured state money into Chinese companies ... it’s not competition, it’s cheating.”

I am not going to argue the merits or downside of sanctioning China. I do know that the Chinese and other emerging markets are challenging the US hegemonic position, and the US will use whatever tools it thinks necessary to bring the Chinese to heel. That could eventually include the prohibition of US citizens investing in Chinese securities. We can no longer scoff at such an idea.

I believe I can take advantage of potential growth in these markets by investing in raw materials and commodities, which I consider an investment by proxy.

The EPA’s Emissions Rule Will Strangle AI In The Crib

The rise of artificial intelligence has re-ignited concerns about electricity availability and strains on the power grid. Over the past two decades, worries that data centers would overwhelm local electricity providers have been muted because our computers keep getting more efficient. But this time, the concerns that there won’t be enough juice for AI and data centers are justified.

Yes, this time is different. And the key difference is Joe Biden’s EPA. On May 9, that agency published a rule in the Federal Register that, if it survives legal challenges, will force the closure of every coal-fired power plant in America and prevent the construction of new baseload gas-fired plants. If the rule survives those challenges, it will strangle AI in the crib.

We will see who wins this argument from now on, the US EPA or the tech billionaires who are part of the ruling class and control the government. I suspect that natural gas-fired power plants will come back into favor as the power for these data centers has to come from somewhere. It is worth watching this development as we could be talking about a resurgence in demand for natural gas and gas turbines.

This service and my work are reader—and listener-supported. The best way to support me is to follow me on Substack, YouTube, and X. You can also buy me a coffee if you are inclined.

That’s it for this week. Thanks for subscribing.

John Polomny

I bought a little BABA recently and may have caught the bottom, but it's a small position. I had Russian stocks taken, too. I don't trust any of it--see Daniel Webb's 'The Great Taking'. Have you covered that John? If so, I missed it.