Commodities Have 'Never, Ever' Been More Undervalued Than Today: Leigh Goehring

Leigh Goehring brings his decades of experience as an investor in natural resources to send a message: now is the time to invest in commodities, as they have never been more undervalued in the history of markets. Leigh goes in-depth on his investment thesis for gold, silver, uranium, copper, energy, and agriculture, along with explaining the cyclical nature of commodities and why today is when you want to be invested in the sector.

This is one of my favorite commentators. I appreciate his honesty in admitting that there are, in fact, times when one does not want to be involved in resources and commodities. This is not one of those times. Commodities are the cheapest they have been relative to the S&P 500.

He also discusses sunspot cycles (one of my favorite subjects) and the fact it may be time for agriculture to rally. The fertilizer stocks are bombed out.

2024 In Gold We Trust report

This is free and comes out every year. There is a long version and a shorter condensed version. If you are interested in central banking, gold, monetary theory, and general market history, then I think this resource will be useful.

NOAA Predicts Above Average Hurricane Season

NOAA National Weather Service forecasters at the Climate Prediction Center predict above-normal hurricane activity in the Atlantic basin this year. NOAA’s outlook for the 2024 Atlantic hurricane season, which spans from June 1 to November 30, predicts an 85% chance of an above-normal season, a 10% chance of a near-normal season and a 5% chance of a below-normal season.

NOAA is forecasting a range of 17 to 25 total named storms (winds of 39 mph or higher). Of those, 8 to 13 are forecast to become hurricanes (winds of 74 mph or higher), including 4 to 7 major hurricanes (category 3, 4 or 5; with winds of 111 mph or higher). Forecasters have a 70% confidence in these ranges.

The upcoming Atlantic hurricane season is expected to have above-normal activity due to a confluence of factors, including near-record warm ocean temperatures in the Atlantic Ocean, development of La Nina conditions in the Pacific, reduced Atlantic trade winds and less wind shear, all of which tend to favor tropical storm formation.

Why am I bringing this up? The hurricane season begins June 1 and extends until November 30. It is difficult to make predictions, but this bares watching as many times tropical storms and hurricanes can affect Gulf of Mexico oil and gas production.

The GOM accounts for roughly 15% of total U.S. crude oil production, and federal offshore natural gas production in the Gulf accounts for 5% of total U.S. dry production. Any disruptions could lead to higher prices, sending oil and gas prices soaring. This is especially important as we will be having an election in November.

Pump prices soaring into an election would tank an already precarious Joe Biden bid for a second term.

I posted these on my weekly video this week. The chart on the left is from 2005 when Hurricane Katrina hit. The one on the right shows the current conditions. Record warm water conditions make for a fertile environment for the development of tropical storms and hurricanes.

Optionality Helps Us Navigate Uncertain Times

I follow Dave Iben, the CIO of Kopernik Capital. Here is a video that discusses optionality and their views on how fragility can used to obtain high optionality and market-beating returns.

You may not be surprised that they are bullish on gold and gold miners.

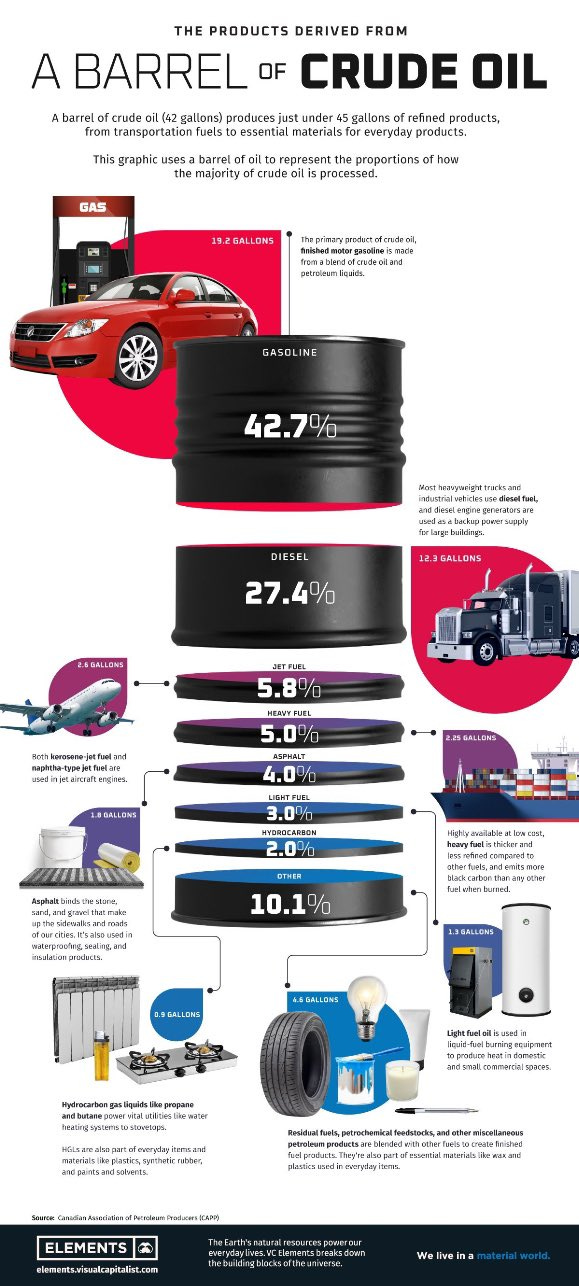

Oil is not just used as a transportation fuel

As you can see from the graphic, only about half of a barrel of oil is used for gasoline and diesel. Many other products also come from a barrel of oil. Many people miss or do not consider this. I guess if the world is going to pursue net zero and get off oil, it will need to find substitutes for these oil-based products.

Clown World

Of course, it is. There is no need for me to comment. According to the former mayor of South Bend, Indiana, everything is attributable to climate change.

That is it for this week.

This service and my work are reader—and listener-supported. The best way to support me is to follow me on Substack, YouTube, and X. You can also buy me a coffee if you are inclined.

Subscribe to the paid version of AIA for specific ways I invest in the themes discussed in these weekly emails.

Happy Memorial Day!

John Polomny