Argentina's Energy Production is surging

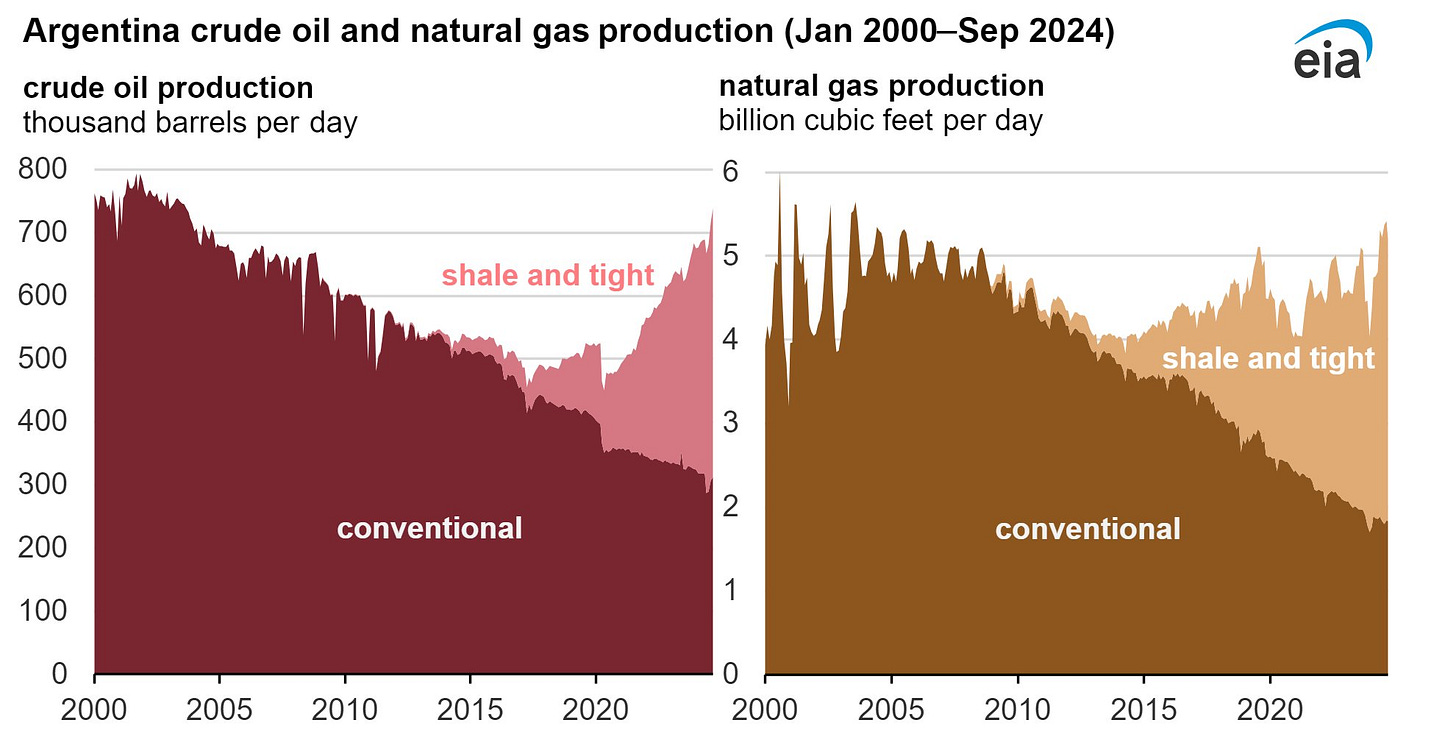

This is production from the emerging Vaca Muerta shale basin in Argentina. Some say it could be as large as the Permian shale in the US. Whatever it ends up being, it will be a huge benefit for Argentina and the Javier Milei regime. The country and Milei will benefit from this expanding shale basin, which is another positive for Argentina. I am still bullish on Argentina and LatAm in general.

Speaking of Javier Milei

Lionheart: Milei's First Year in Office

An overview of Milei's first year and upcoming challenges in 2025

Great article. Lots of progress and a chance for even more, but there are still potential pitfalls.

MacroVoices #457 Justin Huhn: The Fundamentals For Nuclear Keep Getting Better

MacroVoices Erik Townsend & Patrick Ceresna welcome back, Justin Huhn. They’ll explore the nuclear renaissance, Justin’s bold prediction about the bottom of the nearly year-long correction in uranium mining stocks, the key fundamentals shaping the sector's future, and much more.

Some people like Justin, and some people bag on him. I have known him for years, and he has always been straight up to me. I will credit him as one of the more knowledgeable people in Fintwit regarding uranium. On a side note, he is an example of what one can do on the internet by focusing on a niche and learning more than most about that niche.

Speed Skates-Palm Valley Capital

Investing differently and being a contrarian is easy in theory. When the herd is overpaying for popular stocks, avoid them (technology stocks in 1999-2000). Conversely, when investors are aggressively selling undervalued stocks, buy them (energy stocks in 2020-2021). It’s not that complicated, but in the investment management industry, common sense investment philosophies like buy low/sell high have been losing share to passive funds and active managers with minimal tracking error. In effect, there are fewer and fewer managers remaining that invest differently.

(skip)

As investors race by us with their fancy speed skate portfolios, we sit patiently in our boring brown high-tops, loaded with T-bills and out-of-favor small cap equities. Participants in fads and manias often walk away asking, “What was I thinking?” But for now, owning what’s working is working, so let the good times roll. For us, we’ll stick with investing differently. Just like we’ve done in prior stock market bubbles, we plan to remain disciplined even if that means getting lapped by our peers and benchmarks. As much as we’d like to participate, the price of looking cool, in our opinion, has never been more expensive.

I like these guys' commentaries, and I believe one can learn a lot by reading and contemplating the methodology they use at their fund. The problem I, and the investment management business and the newsletter business, for that matter, have is the old saw of “What have you done for me lately?” When a sector is booming and outperforming, clients want exposure to that sector. They want to know why you are not buying the industry and may be underperforming. People hate to be left out, hence FOMO. If you do not feed that desire, they will move on and find someone who will. I wish them well but doubt they will find long-term and consistent success in the markets.

People have become accustomed to outsized returns and rolling bubbles. However, history teaches that one may catch a bubble and outperform in the short term, but can this performance be replicated over long periods? My experience is no, it cannot. I have found that buying undervalued assets and avoiding overpriced “hot” sectors or stocks is the key to long-term wealth compounding.

Robotti & Company Annual Meeting 2024

Robotti & Company Annual Meeting 2024. Bob Robotti, Theo van der Meer, and David Kessler discuss their views on the market and investing.

Talks about the opportunity in the ignored small caps (“Zombie 1000”)

One of my favorite investors. I watch and listen whenever he speaks.

That’s it for this week.

This service and my work are reader—and listener-supported. The best way to support me is to follow me on Substack, YouTube, and X. You can also buy me a coffee if you are inclined.

Regards,

John Polomny