Free Weekly Email 10.16.24

Global Liquidity Will Lead To Higher Economic Activity

Following the three previous periods of substantial global central bank easing, we saw an acceleration in global growth and corporate profits. We anticipate a similar outcome with the recent round of central bank rate cuts, which should bolster stocks in 2025 and provide a much-needed lift to the economy. Our Global Stimulus Index (depicted in red below) supports this view, indicating that the next peak in manufacturing is unlikely to occur until late 2025 or early 2026, as measured by the ISM Manufacturing PMI (shown as the black line below).

If history follows, we will likely have a tremendous tailwind behind the AIA portfolio. Time will tell.

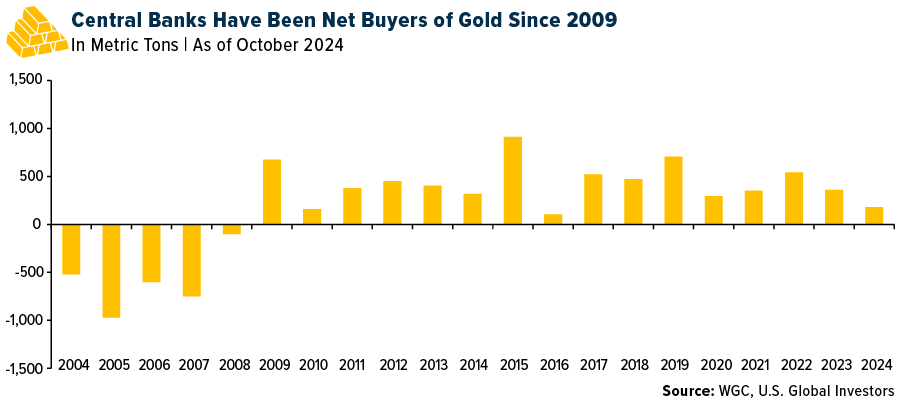

Central Bank Gold Buying

If these guys are loading up on gold, shouldn’t that tell you something about where your own portfolio should be?

While fiat currencies can be printed at will (and we’ve seen plenty of that lately), gold remains a finite resource. I believe that makes it the go-to asset when economic uncertainty rears its head. Countries all over the globe have realized this, and they’ve been buying gold in bulk.

We are just beginning what I believe is a remonetization of gold. The bifurcation of the globe into opposed political blocks is accelerating this process. As various countries in the global south and east seek to deemphasize the US Dollar, I expect them to turn increasingly to gold as a reserve asset.

Americans lost $5.6 billion last year in cryptocurrency fraud scams, the FBI says

Americans were duped out of more than $5.6 billion last year through fraud schemes involving cryptocurrency, the FBI said in a report released Monday that shows a 45% jump in losses from 2022.

The FBI received nearly 70,000 complaints in 2023 by victims of financial fraud involving bitcoin, ether and other cryptocurrencies, according to the FBI. The most rampant scheme was investment fraud, which accounted for $3.96 billion of the losses.

“The decentralized nature of cryptocurrency, the speed of irreversible transactions, and the ability to transfer value around the world make cryptocurrency an attractive vehicle for criminals, while creating challenges to recover stolen funds,” wrote Michael Nordwall, assistant director of the FBI’s criminal investigative division.

This is why one should stay inside one's “circle of competence.” Most people's desire to get rich quickly leads to these problems, as they play around in areas without experience or advantage. Caveat Emptor (Buyer beware).

Chart of the Week - Energy Sector Value

US Energy Sector (Oil & Gas) relative valuations have reached their second cheapest level vs the S&P500 in the past 40+ years. This also comes at a time where portfolio allocations by investors to this sector have dropped back toward record lows as fossil fuels remain out of favor.

Basically this makes the sector an undervalued and underappreciated alternative hedge (against geopolitical risk, oil shocks, energy-driven inflation resurgence) — and implies that pretty much no one expects energy to outperform.

Energy is cheap relative to the S&P 500. It is the most inexpensive in 40 years.

Nuclear Energy Is Back

The nuclear renaissance is a global phenomenon.

Asia’s share in global nuclear generation is expected to reach 30% in 2026, surpassing North America as the region with the largest installed capacity.

The US should be leading in nuclear, but we allowed politics, emotion, and flat-out lies to derail our atomic power industry, and it has atrophied. We are now trying to bring it back, but we will find out it will cost tens of billions of dollars and years. That is just the economic cost. We don't have the trained people, which will also take years to develop.

And the positives for uranium just keep coming!

And Google also.

Individually, these decisions do not move the uranium needle. Still, collectively, they are a massive tailwind for uranium demand, which, I remind you, is already in a massive supply/demand deficit.

That is it for this week. Thanks for subscribing.

John Polomny

This service and my work are reader—and listener-supported. The best way to support me is to follow me on Substack, YouTube, and X. You can also buy me a coffee if you are inclined.