Free Weekly Email 11.12.24

Stan Druckenmiller | Podcast | In Good Company | Norges Bank Investment Management

Stanley Druckenmiller: Inside the mind of a legendary investor

This week, Nicolai Tangen visits Stan Druckenmiller in New York — one of the most renowned investors of our time, known for his insights into macroeconomics and markets. In this conversation, Druckenmiller shares his approach to major trades, like his groundbreaking bet against the British pound, and offers a unique perspective on today’s market, discussing inflation risks, AI’s potential in investing, and what keeps him ahead of the curve. The investor shares his reflections on the Fed’s role, the future of tech, and lessons learned from mentor George Soros.

Classic Druckenmiller. I have heard several of these stories before, but this is a reminder that even top investors can be overcome with FOMO (Druck buying into the tech boom after he sold, and the market kept going up). I also like his advice to think about where a stock or investment theme will be 18-24 months in the future, not where it is right now. Great interview.

Horizon Kinetics Q3 2024 Market Commentary

From the commentary:

In the past couple of decades, it was thought that all manner of business and investing could be done through financial instruments and more novel and sophisticated securities, while hard assets, commodities, and inflation beneficiaries were essentially crowded out of the indexes. Information Technology, aside from being the crowder-outer, had an airy, intangible feel: virtuality, the “cloud”; commuter trains out, workfrom-home in. But the world, maybe especially the I.T. sector, seems to be returning to those hard assets and basic physical resources. They’re not much owned in asset allocations, and not much understood.

If you are interested in contrarian investing, hard assets, or an alternative way to play AI, do yourself a favor and read the commentaries from Horizon Kinetics. In my view, this is genius-level thinking being given out for free. I think they are onto something, and they make the case with these land bank investments to play the growth in data centers. One of the sections of the commentary is titled “The World of Technology Has Been Introduced to the World of Energy. Next Up: When AI Meets the Permian Basin.”

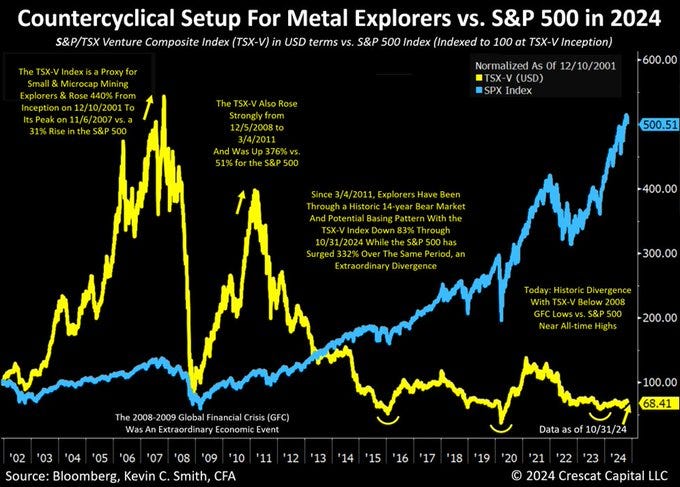

Counter-Cyclical Setup in Metal Explorers

In my opinion, the countercyclical setup for deeply undervalued precious metal explorers today is particularly attractive.

The S&P/TSX Venture Composite Index (“TSX-V Index”) is a proxy for precious metal explorers as explained below. Based on historical analysis the TSX-V Index performed extremely well during commodity bull markets, rising 440% since its inception on 12/10/2001 to its peak on 11/6/2007 versus a 31% increase in the S&P 500 over the same period.

The TSX-V also rose 376% from its Global Financial Crisis (GFC) lows on 12/5/2008 to its high on 3/4/2011 versus a 51% gain for the S&P 500. But from its high on 3/4/2011 until 10/31/2024, the TSX-V came down 83% while the S&P 500 rose 332% over the same period. Note that the TSX-V is now trading below its 2008 GFC lows.

I think the setup is perfect, but as long as tech keeps rolling, it will be difficult for these mining stocks to get traction because fund flow is into tech because it is working and recency bias. Nevertheless, history shows that it is a matter of time. How much time is always the question, and what is the opportunity cost in waiting for the turn?

China Facing Largest Drop In Foreign Investment In 30 Years

This is China's most significant drop in foreign direct investment in thirty years. Are the China bears correct? Has China finally succumbed to its internal contradictions and the final nail in the coffin, a real estate bubble collapse?

I am betting that the news is so negative and that most people think China is uninvestable I need to take a contrarian view. I have recently added a few China-themed equities to the portfolio, which I believe can yield big returns if I am correct. I believe President Trump will move to get some mutually beneficial deal with China.

That is it for this week.

John Polomny

This service and my work are reader—and listener-supported. The best way to support me is to follow me on Substack, YouTube, and X. You can also buy me a coffee if you are inclined.