Free Weekly Email 1.14.25

Assessing Oil's Risk Reward

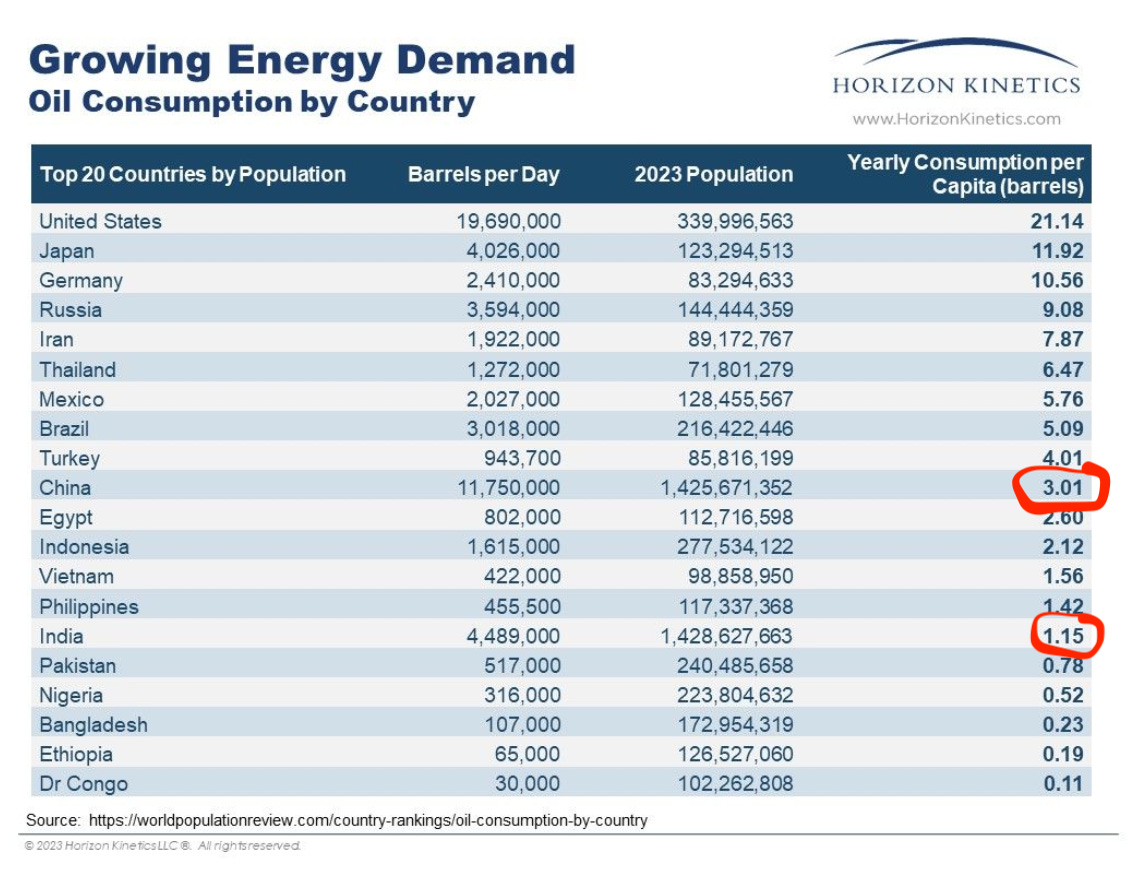

You have to devise an extremely bearish scenario to keep oil consumption growth down or even negative. The simple fact is that 6.9 billion people in developing countries consume an average of 3 barrels per person per year and fight to increase that/their standard of living.

Plus, those same developing countries will add 2 billion people over the next 20 years who will need their 3 barrels at a minimum.

Trader Ferg article on the oil market. Covers both supply/demand, Chinese and Indian demand, the IEA’s oil glut scenario, and much more. This is a very well-written and pervasive case of why oil could be a surprise upside market in 2025.

Bullish Outlook for 2025 | Eric Nuttall: Ninepoint Energy Market Update

In this week's update, Eric shares his bullish outlook for energy stocks, analyzes the latest developments in global oil demand, and discusses the implications of historic low oil inventories.

Key topics:

• Historic Low Oil Inventories: What this means for the energy market.

• The Twilight of U.S. Shale: Why 2025 marks a turning point in U.S. shale production growth.

• Canadian Energy Sector Outlook: How upcoming political changes could remove the political risk discount for Canadian energy stocks.

• OPEC+ Cohesion: Why OPEC+ remains key in stabilizing the market.

• Oil Price Predictions: Expected trading ranges for oil and natural gas in 2025.

• Global Energy Sector Trends: Insights from meetings with top energy executives.

I know Eric Nutall runs an energy fund, and one should be careful asking an oil fund manager if they are bullish on oil. They are always bullish on oil. Nevertheless, I find his commentary is full of good information, and I think one should measure his opinions on the facts.

Gold's Comeback in the West, Uranium's Bright Future, and Why Oil is Undervalued

Jesse Day interviews GoRozen. They are bullish on gold, uranium, and oil/natural gas. The discussion around the peaking of the shale basins is very worth watching.

A Challenging Year Ahead For The S&P = Opportunity For Active Investors | Dave Iben

So, where are the biggest inefficiencies in markets today? And what opportunities are they presenting? To find out, we have the great fortune to speak today with highly respected money manager Dave Iben, Chief Investment Officer, Managing Member, Founder, and Chairman of the Board of Kopernik Global Investors, as well as Portfolio Manager of its main funds.

I have been following Dave Iben and Kopernik Global Investors for years. He is a true value investor with a global perspective. Although he does not get much press or do a lot of media, this is a great interview if you are interested in value investing with a global focus.

Energy & Emerging Markets: Top Value Stock Picks for 2025 🚀 With Actionable Intelligence

Another recent interview I did. I like Ben’s channel you should follow it as he has great guests.

That is it for this week.

Readers and listeners support this service and my work. The best way to do so is to follow me on Substack, YouTube, and X. You can also buy me a coffee if you are inclined.

Regards,

John Polomny