World’s biggest miners cut back on exploration investment

The world’s biggest mining groups have cut back spending on exploration in the past two years as inflation, higher interest rates and lower commodity prices have stalled the market.

That has come in spite of a flurry of spending this decade on the search for copper and lithium, metals crucial for the energy transition.

Total exploration spending fell for the second consecutive year in 2024, sliding 6 per cent to $12.5bn, after rising in the years following the pandemic, according to S&P Capital IQ.

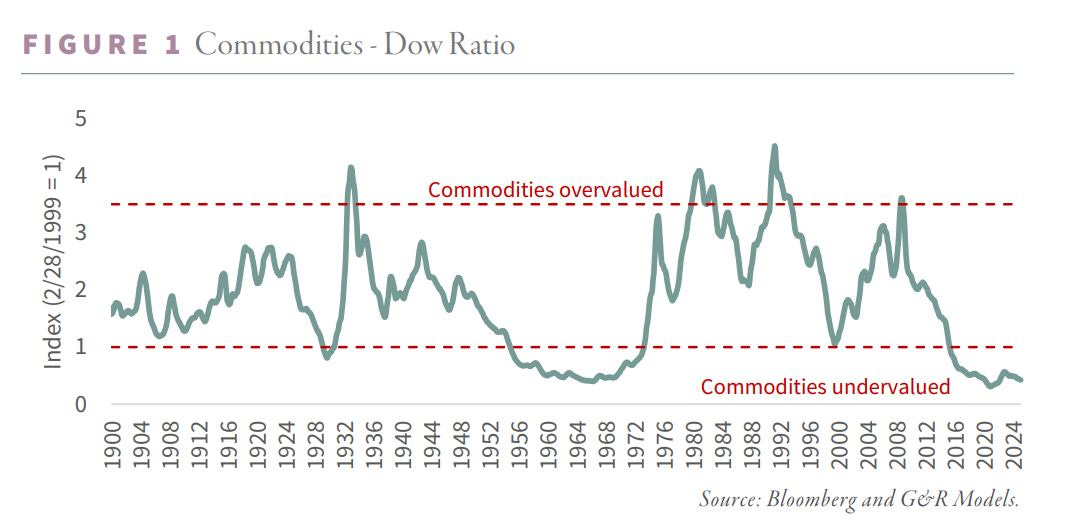

I believe we are at a critical inflection point. Capital will rotate from overvalued AI/tech stocks into undervalued value sectors like resource stocks.

We have seen relative overvaluation before. Look at the chart back in 2000. Stocks were overvalued versus commodities, and commodities went on a decade-long period of outperformance.

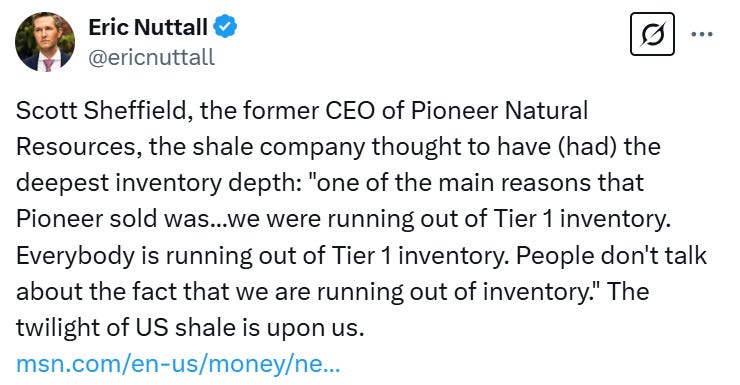

We are running out of Tier 1 locations, says former CEO of Pioneer

This is what I have been arguing for a while. If this is true, we can expect higher oil prices in the future.

Two years ago, analysts said Pioneer had 16 years of reserves.

Maybe Exxon regrets buying Pioneer?

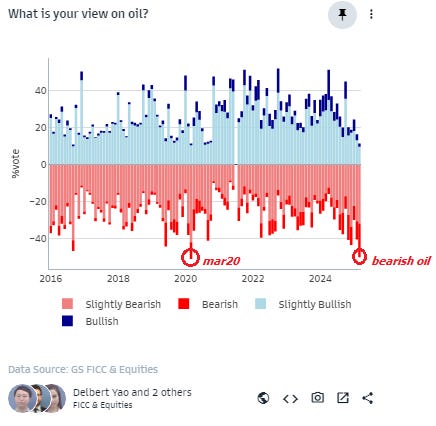

All of the bearish news may be extreme sentiment reading (possible contrary indicator)

WW3 RESTARTS! Europe Calls for Military Draft THIS YEAR!

Danny at CapitalCosm interviewed me last week. If you don’t like my political views, don’t watch, as this is one hour of me riffing on geo-politics.

That’s it for this week.

Readers and listeners support this service and my work. The best way to do so is to follow me on Substack, YouTube, and X. You can also buy me a coffee if you are inclined.

Regards,

John Polomny

You’re the best !!!