What could make the music stop for technology stocks?

A great business bought at the wrong multiple is a losing bet. Words to that effect are one of the first lessons a budding equity analyst learns. The usual example is Cisco Systems which, if bought in March 2000, would have been in the red as recently as October last year. This is despite growth in earnings per share (EPS) through that time of over 6% a year, ahead of the broader S&P 500 Index. The catch: you paid a 140x multiple.

The DotCom parallel is hackneyed, but clichés are useful sometimes, and this one might be all we’ve got. There have only been two other US equity bubbles in the last 100 years (the ‘roaring twenties’ and the ‘nifty fifty’), and both were much more broadly dispersed, covering sectors as variant as railroads, consumer goods, automobiles and financials, as well as nascent technologies. The DotCom bubble was different in terms of its concentration of performance around internet innovation. In the two-and-a-half years between March 2000 and September 2002, the MSCI USA Technology Index ran at a compound annual growth rate (CAGR) of -48%. Communication Services was -43%. The next steepest decliner (Consumer Discretionary) was only half that. Staples (+7%) and Real Estate (+5%) were positive. The present iteration, if we are to call it a bubble, has likewise been concentrated around technological advance. Decade-to-date, the Magnificent Seven have yielded an annualised total return of +43%. The remaining 493 stocks in the S&P 500 Index have delivered less than +11%. A sample size of one makes a statistician feel uncomfortable, but when it’s all you’ve got, even that thin gruel can be worthy of study.

This is a well-reasoned argument for the current AI craze's failure to meet expectations. Not meeting expectations with stock valuations at very high levels is never a good thing, and it seems to be leading to a sentiment shift. Capital appears to be leaking out of tech.

I am still bullish on nuclear power and, therefore, uranium

When is the US going to get into the nuclear plant-building game?

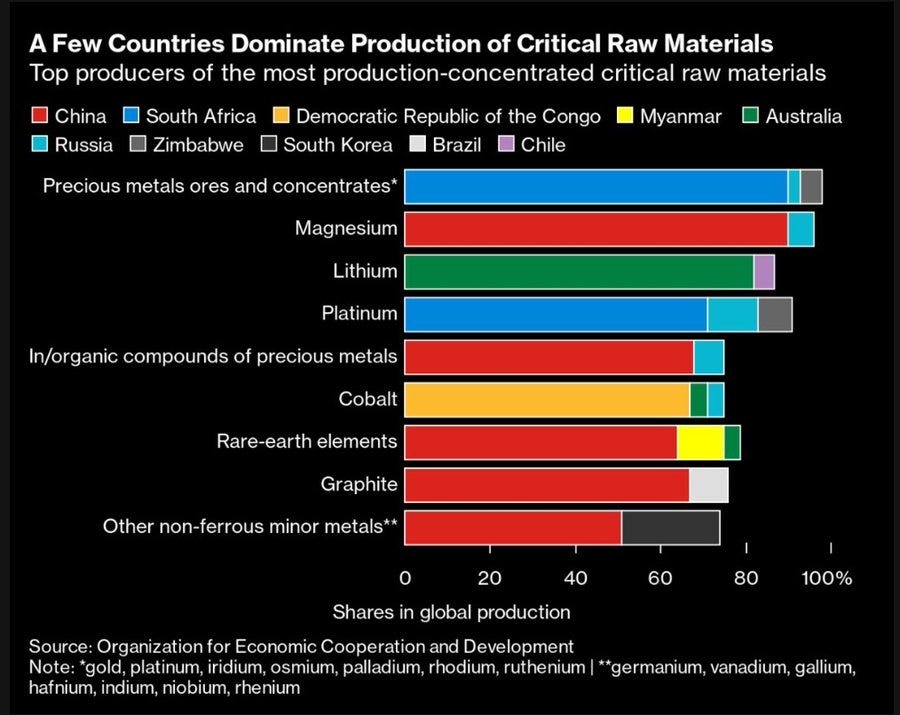

A few countries dominate critical mineral production and it isn’t the US

In the April issue of the Actionable Intelligence Alert, I discuss how the Trump administration recognizes this issue and what it plans on doing to fix it. It could be a bigger investment theme than the shale oil revolution.

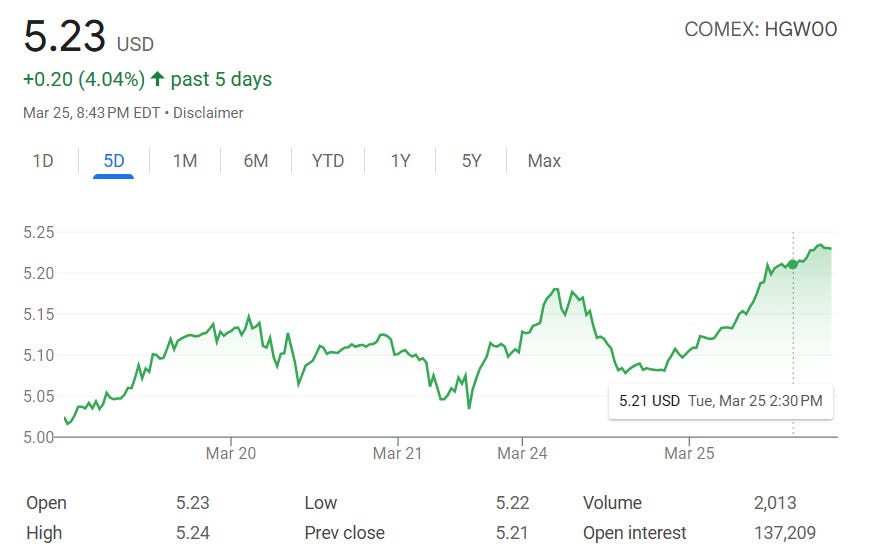

Copper above $5.00

Is this just about stockpiling before tariffs or something with some legs under it? Time will tell.

Per Jander: Uranium Still "Very Early" in Cycle, What to Watch in 2025

In his view, uranium is still "very early" in the current cycle.

"Utilities have not contracted for a lot of uranium in quite awhile now, so there's a lot more to come," said Jander, emphasizing that a little more patience from investors is needed even after last year's price pullback.

That’s it for this week.

Readers and listeners support this service and my work. The best way to do so is to follow me on Substack, YouTube, and X. You can also buy me a coffee if you are inclined.

Regards,

John Polomny

Thanks John

Gotta agree with the "dotcom feeling"-- people I know who have trouble using cellphones are loudly enthusiastic about their bright-and-shiny AI investments... and have no idea what the companies actually DO. I suspect we haven't hit the top of the Hype Cycle yet, though. Concur Uranium-- but long copper, gas and power generating/distributing as well. (OPINION: sooner or later the "privacy and copyright" enthusiasts are going to find a way to fight the use of "their" data for training the things. "Synthetic data" is indistinguishable from "making things up.)