Free Weekly Email 3.4.25

Full Faith and Credit of Gold

The recent surge in gold prices reflects what we believe are the inevitable consequences of decades of ultra-loose monetary policies, excessive debt accumulation, and fiscal mismanagement. Those who have long dismissed gold’s role as a safe-haven asset are now witnessing a stark reminder of its historical significance. For centuries, gold has served as the cornerstone of monetary systems, offering a crucial reference point in periods of economic overleveraging. History provides invaluable insights into gold’s role in stabilizing monetary frameworks during times of financial strain.

As illustrated below, US Treasury gold reserves currently account for a mere 2% of total outstanding government debt — one of the lowest levels in history. To dispel any debate, this figure already reflects the mark-to-market adjustment at prevailing gold prices.

The current situation stands in sharp contrast to earlier periods, particularly the onset of World War II, when government debt was 40% backed by gold reserves. Notably, wartime financing drove a nearly 150% expansion in the money supply and a record debt-to-GDP ratio — yet even that remained below today’s levels.

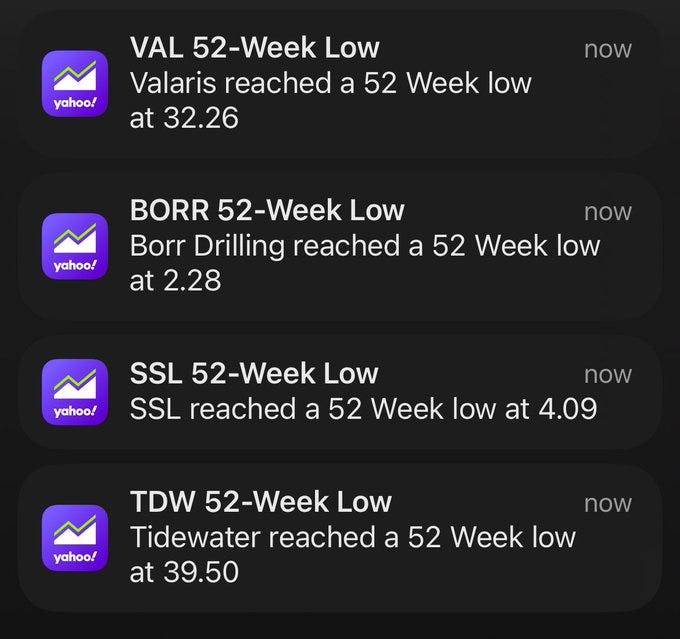

A reminder that things can get cheaper than you think

The drilling companies were already cheap. They are even cheaper now.

I am bullish on offshore oil exploration. I believe the shale plays in the US are topping out. The offshore sector has been starving for investment, which is changing as the IOCs invest more offshore.

I think many people equate the offshore service sector with drilling rig operators. It is so much more, and many of the other service providers are experiencing tremendous order books and increasing cash flows and capital returns to shareholders.

Check out my paid newsletter to discover more.

Berkshire Annual Letter

I liked this part about Japanese stocks.

Berkshire made its first purchases involving the five in July 2019. We simply looked at their financial records and were amazed at the low prices of their stocks. As the years have passed, our admiration for these companies has consistently grown. Greg has met many times with them, and I regularly follow their progress. Both of us like their capital deployment, their managements and their attitude in respect to their investors.

I have been investing in Japanese stocks for quite some time. I don’t own the ones Berkshire owns, but I fish for small net-nets and cash and asset-rich businesses that are selling well below NAV.

Japan is going through a financial transition, and the Tokyo Stock Exchange and the Japanese Finance Ministry are aggressively encouraging companies to unlock their value, pay more dividends, and make more buybacks.

I don't publish this in the newsletter as the interest is not there, but Buffett did this type of investing early in his career. So far, it has been rewarding—lots of places to make money if you want to do the work.

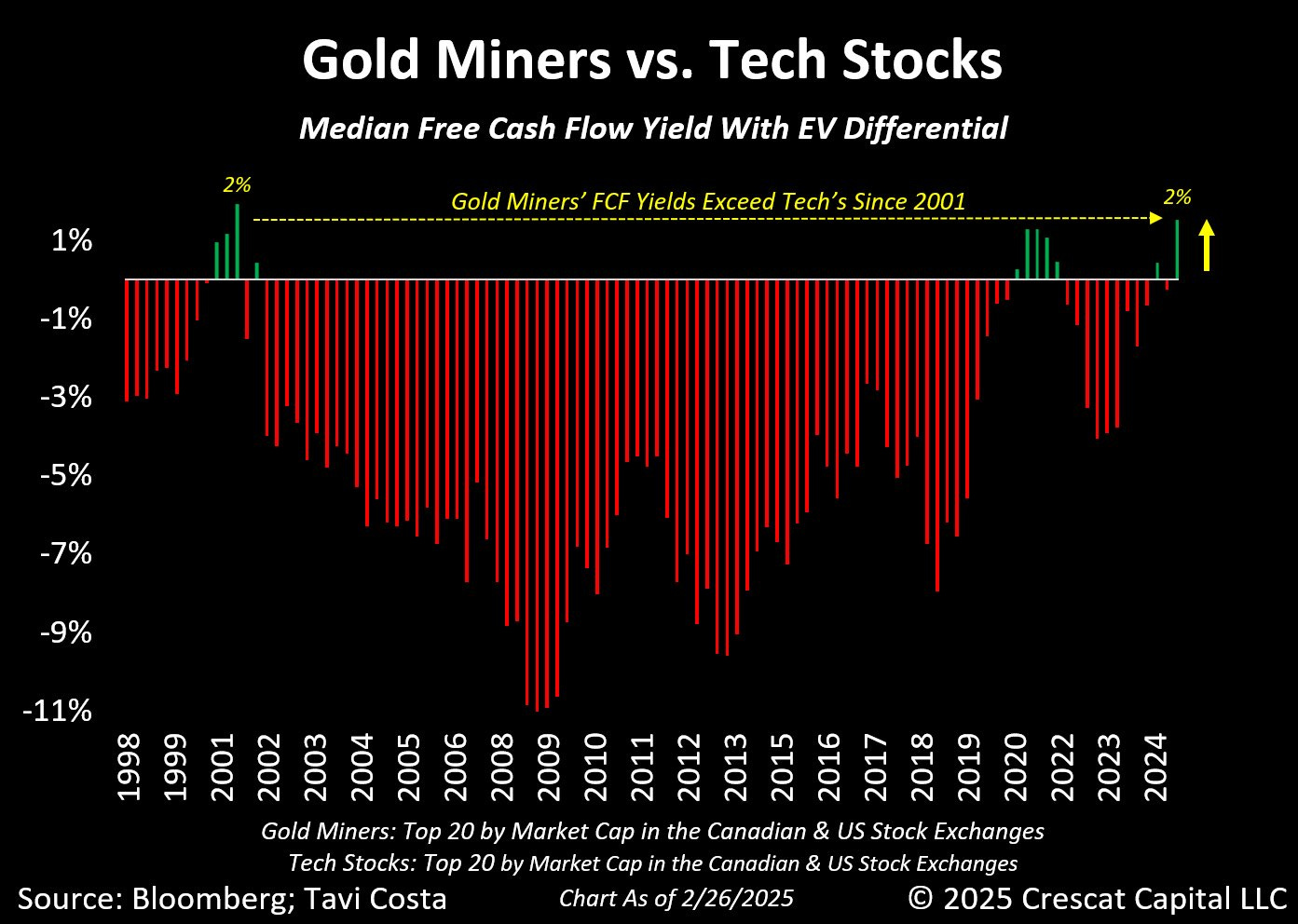

Gold Miners have better cashflow yields than tech stocks

That’s it for this week.

Readers and listeners support this service and my work. The best way to do so is to follow me on Substack, YouTube, and X. You can also buy me a coffee if you are inclined.

Regards,

John Polomny