Taking A Look At Single Stock Ideas Across The Energy Sector | Jon Costello (HFIR Ideas)

On Friday I had Jon Costello on the podcast to focus on the energy sector, and some of the individual ideas he likes in different subsectors and geographies. He writes on the HFIR Ideas side for HFI Research. It was the perfect follow up conversation after I had Wilson on the podcast last Wednesday. If you’re looking for a starting point for your research on some single stock ideas in the energy space, you will enjoy this podcast.

White House Drafts Orders To Radically Expand Nuclear Power, Aiming To Quadruple Capacity By 2040

Drafts of executive orders reportedly circulating within the White House reveal a potential sweeping overhaul of U.S. nuclear power policy, with the aim of quadrupling nuclear energy capacity by 2040. The proposals, if enacted, would significantly shift authority to federal departments, streamlining approval processes for reactor designs and projects.

According to a review by Politico’s E&E News, four separate draft orders outline a plan to dramatically expand nuclear power by restructuring the Nuclear Regulatory Commission (NRC), empowering the Department of Energy (DOE) to lead nuclear research and development, leveraging other departments to boost production, and having the DOE streamline the nuclear supply chain.

These orders could potentially allow a second-term Trump administration to aggressively expand nuclear technology.

(skip)

Other draft orders emphasize the need to power the rapidly expanding tech industry, with some categorizing energy expansion as a national security imperative.

The second draft calls for the DOE to lead at least three pilot and demonstration reactor projects on federal lands and national laboratories, with a goal of completing construction by July 4, 2026. “The Department [DOE] shall approve at least three reactors pursuant to this pilot program with the goal of completing construction of each of the three reactors by July 4, 2026,” according to the draft.

I am hopeful that the Trump administration will kick-start a nuclear renaissance in the US. They want to aggressively expand nuclear, but talk is one thing and action is another.

The Time the United States Ran Out of Money

In 1971, the US ran out of money and defaulted on its debts. Now, they didn’t say it that way. But by moving away from the gold standard, money as we understood it ended.

I expected the stock market to plunge, but it went on to rise nearly 25%. That surprised me. But when I looked into it, I discovered the exact same thing happened in 1933 and it had the exact same effect.

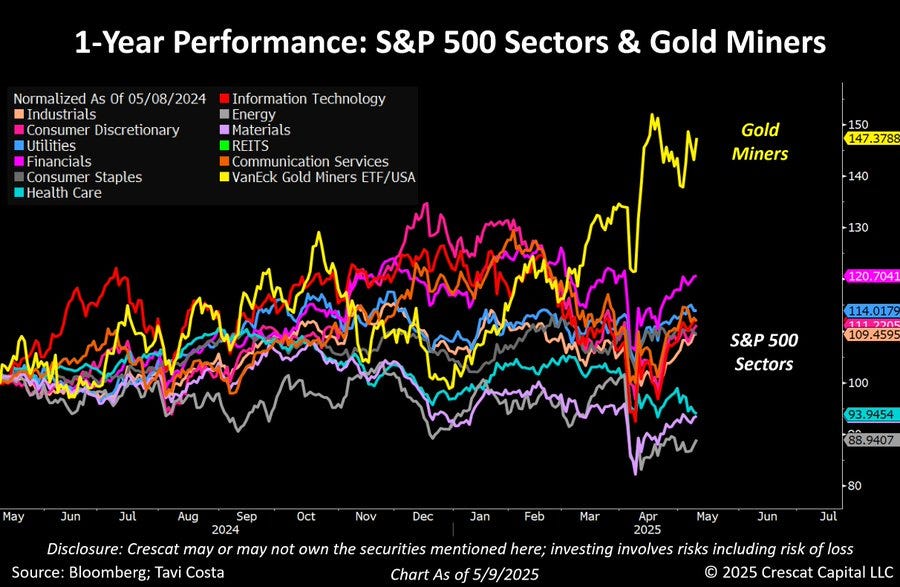

Gold miners have outperformed

"If gold miners were considered a sector, they would have outperformed every other one over the past year. It wasn’t long ago that most investors dismissed them as uninvestable... yet here we are. History has a way of proving its relevance. Those who ignored gold are now being forced to pay attention. In times when hard assets are in demand for capital allocation, the companies that produce those assets can represent not only a strategic position—but a highly profitable one as well." - Tavi Costa

In Gold We Trust 2025

The 19th annual report on gold. I look forward to this every year. Over 400 pages of data, and it is free.

That’s all for this week. Stay safe out there.

John Polomny

Excellent information as always.

the market rises when there is spending due to stimulus boosting earnings, since earnings are nominal... so long as rates don't rise it's "good" for the market (in reality just keeping up with inflation, like gold)