The reactors are coming!

Fermi America, Texas Tech share vision for massive power and data complex

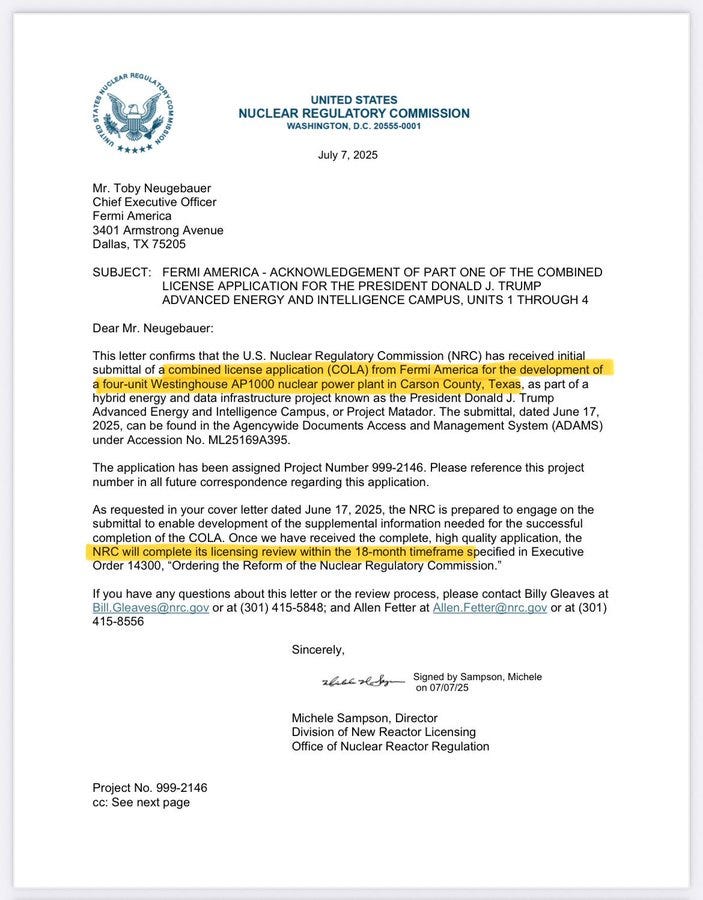

Texas Tech University and Fermi America shared plans on June 26 to build “the world’s largest advanced energy and artificial intelligence campus” in Amarillo, Texas, near the Pantex nuclear weapons plant. Fermi America is a company cofounded by former Texas governor and energy secretary Rick Perry and his son, Griffin Perry, a cofounder and past senior advisor at Grey Rock Investment Partners. The announcement—a first press release from relative newcomer Fermi America—says the company “proudly answers President Donald J. Trump’s call to deliver global energy and AI dominance.”

Fermi America and Texas Tech envision a behind-the-meter “hypergrid” that would “integrate the largest nuclear power complex in America, the nation's biggest combined-cycle natural gas project, utility grid power, solar power, and battery energy storage” to provide “highly redundant power” on a 5,769-acre campus. The site would have “up to 11 gigawatts” of power and 18 million square feet of “artificial intelligence capacity.”

Tremendous if, in fact, it moves forward.

The Saudi Mirage — Why Oil Is Going Higher, Sooner Than You Think

What’s playing out in oil markets right now is a supply mirage, stage-managed by Prince Abdulaziz and blessed by Trump’s political timing. And frankly, it’s enabled by the absence of anyone in the administration sitting Trump down and saying, “Sir, U.S. shale is spent.” Inventories are exhausted. Frac crews are maxed. “Drill, baby, drill” isn’t a domestic production strategy anymore—it’s a geopolitical talking point. I’ve long argued it’s about preserving oil and gas in the global mix, not pretending the Permian can bail us out again. If Mr. Wright can’t convince Mr. Trump of that, Saudi will exploit it for everything it’s worth.

So, the under-educated world (regarding oil and gas production) sees “Saudi barrels returning.” The headlines scream “voluntary cuts unwinding.” The IEA and EIA both breathe a sigh of relief. But the real story? I’m starting to wonder if this is a setup. A deliberate, patient, strategic trap.

Great perspective on the oil market. Like many other commodities, underinvestment is getting ready to emerge in constrained supply and likely higher prices. Most analysts are still looking for a glut or peak demand. This has created bargains in the sector.

Trump’s ‘intelligent’ copper tariffs will ‘wake people up’, says mining billionaire

Billionaire mining investor Robert Friedland is backing President Donald Trump’s plan to slap a 50% tariff on copper imports, calling it a smart move that highlights how crucial copper production is to U.S. national security.

While some experts and industry insiders are scratching their heads over such a steep tariff—especially since the U.S. still relies heavily on foreign copper—Friedland, founder of the Toronto-listed Ivanhoe Mines, thinks it’s exactly what’s needed to get people’s attention.

“There’s a new list of key raw materials, and copper’s right up there,” he told the Financial Times. “You can’t fight climate change or build a greener economy without it. And if we don’t produce it ourselves, that’s a big national security risk.”

Friedland added, “I think the Trump administration is doing the right thing here—it just makes sense. America has to start producing more of this metal.”

I have been discussing this for a while. I believe doing this across the board could set off a US mining boom. A

For example:

Pentagon to become rare earth mining company's largest stockholder

Rare earth minerals are not a technology in and of themselves, but are underlying ingredients for some of the most complex systems across the planet including military platforms and automobiles.

Which explains how the U.S. and other countries are concerned about their availability after China started to limit the availability of rare earth exports in April, following President Trump’s placement of higher tariffs on Chinese goods.

China represented approximately 70% of the U.S.’ rare earth imports in 2023, according to U.S. Geological Survey data.

That is the backdrop against which the Defense Department is taking matters into its own hands, agreeing to acquire a 15% stake in MP Materials and become the company’s largest shareholder.

Assuming the government is going to finance critical mineral mine development in the US. In that case, it might be a good idea to identify who some of the potential beneficiaries could be and front-run by buying a portfolio of these names.

Strathcona Hit $4B Faster Than Any Canadian Company—Adam Waterous Wants MEG Next

Strathcona Resources went from startup to $4B in revenue faster than any company in Canadian history. Now, Adam Waterous is making his boldest move yet: a multi-billion-dollar bid for MEG Energy.

On this episode of In the Money with Amber Kanwar, we’ve got a special on-location Calgary Stampede edition hosted by ATB Financial. Amber sits down with the CEO of the Waterous Energy Fund in front of a live audience to unpack Strathcona’s takeover bid for MEG and to discuss why Adam believes Canada’s energy sector is at a turning point.

Waterous breaks down his firm’s unconventional value investing strategy and explains how they manage four key risks: technical risk, price risk, leverage, and exit risk. He explains why reserve life index and breakeven pricing matter more than ever and how these metrics shape their deal logic.

We also explore the rare financial dynamics of the proposed takeover: why MEG trades at a premium to its acquirer, why this deal is accretive for shareholders, and how Strathcona could emerge as North America’s largest pure-play oil company without refineries or mines.

On the macro front, Waterous unpacks Canada’s energy opportunity from declining U.S. reserves to the country’s 50-year reserve life index and why he’s calling for a doubling of Canadian oil and gas production. Plus, what Strathcona’s $2B carbon capture project means for decarbonization and why energy poverty, not just climate change, is the real global emergency.

I am a big fan of Adam Waterous, and I suspect he will be making some big moves in the Canadian oil and gas sector. I want to be onboard with his vision.

That’s it for this week. Stay safe out there.

John Polomny

Thanks John - great stuff.... wonder what you think of China right now? FXI trades at 11x, with say 7% growth and 12% ROE (way below US). Only major market that trades at median P/E ratio... so you get maybe 7% return and possibly upside if P/E expands? Or am I thinking about that incorrectly? thanks again

Great content, John.