Free Weekly Email 7.1.25

Adam Rozencwajg: Gold Stock Gains, Silver and Uranium Prices — Plus PGMs Bull Case

Adam Rozencwajg of Goehring & Rozencwajg shares his latest thoughts on the gold, silver and uranium markets, also discussing why he's bullish on platinum — in his view, it has "all the hallmarks of something we like to get involved with." More broadly, Rozencwajg sees the commodities space as a whole thriving as a global monetary and trade regime shift takes place. "Commodities, led by gold ... have been the only places to hide so far this year that have not severely disappointed," he said.

Leigh Goehring On The Coming Revolution In Asset Markets

You could say that natural resources run in Leigh Goehring’s blood. The son of two oil and gas engineers, Leigh has spent nearly his entire life studying markets and investments related to commodities. Over the past 30 years, he has become one of the most brilliant and passionate analysts and money managers in the industry. In this conversation, Leigh discusses in detail his case for a major commodities boom dead ahead as part of a broader revolution in the asset markets.

No Way Out' As Debt Crisis Looms | Matt Piepenburg

The ever-growing mountain of it enables nations to spend beyond their means, creating asset price bubbles & wealth inequality in the present, and destroying the purchasing power of their fiat currencies in the long term. So where are we today on the timeline of debt-driven monetary decline? And how are precious metals -- the historic defense against such currency debasement -- faring this year in protecting those savvy enough to own them?

Matt Piepenburg is a favorite of mine. He makes the case for why debt will, at some point, lead to big issues for the economy and investments. He does it while not being a sensationalist. That impresses me.

Mark Carney’s conversion from eco warrior to oil and gas champion

Once considered the Bank of England’s greenest-ever governor, Mark Carney has seemingly undergone a Damascene conversion.

During his time at Threadneedle Street, he called on the world to leave 80pc of oil and gas in the ground.

But now, as Canada’s new prime minister, he wants to pump as much as he can to protect the country’s economy from Donald Trump’s trade war.

Canada is going to become an energy powerhouse, Carney told reporters last week. And he didn’t mean just in renewables.

“When I talk about being an energy superpower, I mean in both clean and conventional energies,” he said. “And yes, that does mean oil and gas.

I am very bullish on Canadian oil and gas companies. In particular, long-life oil sands operators such as CNQ, SU, and CVE. I also believe that the sector is likely to consolidate. Many people are negative about Mark Carney. Yes, he is a WEF globalist. But in the end, Canada is a natural resource-rich country, and it needs the money. It’s called pragmatism.

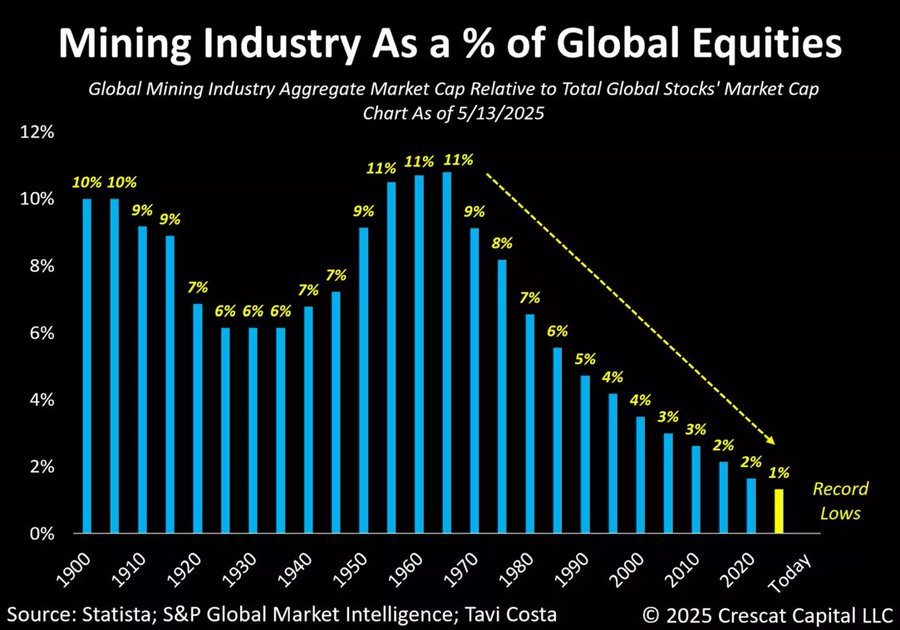

If you dont mine it or grow it you dont have it

The global market cap as a percentage of all equities is at the lowest level ever. I think this will change over the next decade.

Very Interesting

If history is any indication, it's time to get long on Brazil.

VIRTUAL URANIUM CONFERENCE JUNE 27, 8AM ET

Some great speakers, worth listening to if you have time.

That’s it for this week. Thanks for subscribing!

John Polomny