Why There Will Never Be A Zero Emissions Electricity System Powered Mainly By Wind And Sun

“Net Zero” — That’s the two-word slogan that has been adopted as the official goal of every virtuous state or country for decarbonizing its energy system. The “net” part is backhanded recognition that some parts of the energy system (like maybe air travel or steelmaking) may never be fully de-carbonized. Thus some kind of offsets or indulgences may need to be accepted to claim achievement of the goal.

But the “net” thing is not for the easy parts of decarbonization. And by the easy parts, I mean the generation of electricity, and the powering of anything that can be run on electricity or batteries. In electrifiable parts of the energy system, there is to be no tolerance for “net”; only “zero emissions” will do. The official line is that zero emissions electricity is easy and cheap because it can be provided by the wind and sun.

The official line is wrong. As the build-out of these wind and solar generation systems continues to progress, it has become increasingly obvious that there will never be a zero-emissions electricity system powered mainly by wind and sun.

The article explains why we are likely not to have a utopia powered exclusively by the wind and sun. The main reason is intermittency.

I have learned never to say never, but this idea of running everything off of wind and solar seems stupid and a waste of resources.

The big money agrees, which is why we are seeing the following announcements.

I know Microsoft has invested in wind and solar plants, but when it comes down to it, they need high-reliability power—and lots of it. They will be forced to go back to nuclear and natural gas-fired power plants.

With this kind of money involved, you can figure out who is making policy in DC. It is not the environmental activists.

Very bullish natural gas generation in the short term. Very bullish nuclear in the long term.

Recommendation

Hey, guys, you know I am always looking for up-and-coming talent in the Finance space. I have been enjoying Alejandro Yela’s channel on Substack, “The Hermit.”

He recently made a great call with PLCE - got short-squeezed, and ended up 3x’ing his investment in the last two weeks.

Check out the slide below that highlights the benefits of his newsletter.

Check it out today and support Substack creators.

US Navy Directed To Prepare For War With China By 2027

The U.S. Navy on Sept. 19 released a new strategic document centered on countering communist China’s aggression in the Indo-Pacific.

It directs the Navy to develop “readiness for the possibility of war with the People’s Republic of China by 2027,” pointing to China’s preparations for a possible invasion of Taiwan in the same year.

“The Navy emphatically acknowledges the need for a larger, more lethal force,” the document, titled “Navigation Plan for America’s Warfighting Navy,” states.

“By 2027, the Navy will be more ready for sustained combat as part of a Joint and Combined force, prioritizing the People’s Republic of China as the pacing challenge and focusing on enabling the joint warfighting ecosystem.”

“The Chairman of the People’s Republic of China (PRC) has told his forces to be ready for war by 2027—we will be more ready.”

Would you go long or short that statement by this CNO person?

The US Navy can’t even deal with the Houthis blocking sea transit of the Red Sea. Now, they are going to go to war with China in China’s backyard. Good luck with that.

Maybe she should concentrate on getting her senior enlisted leadership under control.

It seems that watching Netflix and tracking fantasy football was more important than operational security. This is another example of the West’s decline into a clown world.

I was in the Navy when its mission was to keep the sea lanes open for commerce. I am happy to say I am not part of this new progressive Navy. LOL!

Guess Which Countries He Is Short? Rob Citrone Reveals His Global Strategies

Today’s guest is Rob Citrone, founder of Discovery Capital Management, a hedge fund that invests opportunistically across asset classes in emerging and developed markets. Rob worked for Julian Robertson at Tiger Management in the mid 1990’s and managed money for the Soros family.

He’s also a minority owner of the Pittsburgh Steelers. In today’s episode, Rob explains why he expects the investment regime to shift, with higher volatility and lower returns in the next decade.

He highlights the potential for Latin America to outperform Asia in the coming years and why he sees a huge opportunity in Argentina. He also discusses his investments in cryptocurrencies, why he’s bearish on China and Europe, and the skill and discipline needed to be a short seller.

It was an interesting interview with a guy who was connected with some of the most prominent, most successful investors ever. “The next ten years will be the decade of Latin America.”

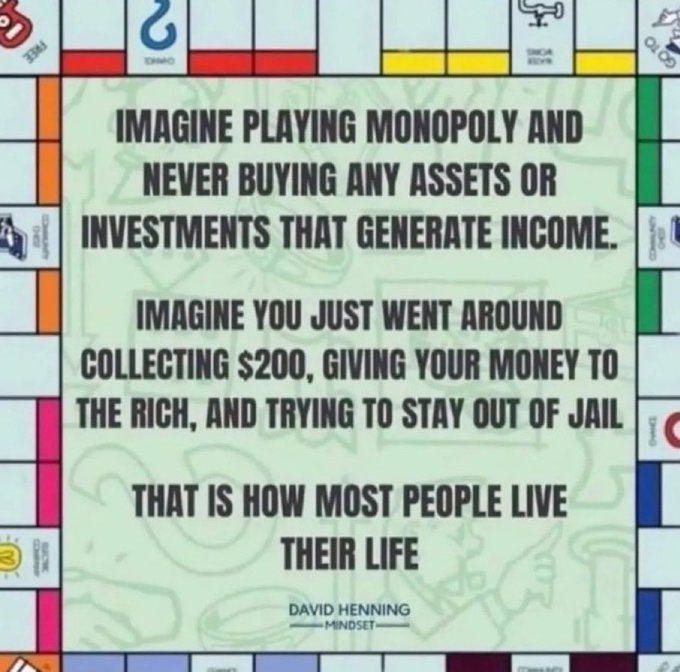

You Have To Get Into The Game

You will never achieve financial freedom by being a paycheck slave all your life.

Charlie Munger said that whatever you need to do, you must get that initial $100k grub stack together to participate in the markets. The way to make yourself wealthy over time is to own businesses that consistently cashflow. You can then earn money while you sleep instead of exchanging time for money. You have to be at the table in order to be in the game. $100k is the price of admission.

That is it for this week. Thanks for subscribing.

John Polomny

This service and my work are reader—and listener-supported. The best way to support me is to follow me on Substack, YouTube, and X. You can also buy me a coffee if you are inclined.

Damn right...