O-I-L-S, Oil Stocks

Today, we feel like Jack McCarthy, and we are screaming at the top of our lungs, “O—I—L—S, Oil Stocks!!!”

We believe this is the second-best buying opportunity of the last 20 years in the oil business and is similar to where bonds were in 1984 relative to 1981.

The best buying opportunity in the energy business for the last 20 years was in March 2020. It took immense courage to buy oil stocks. The industry had just produced a decade of dismal returns on capital during which free cash flow was often negative and balance sheets were leveraged.

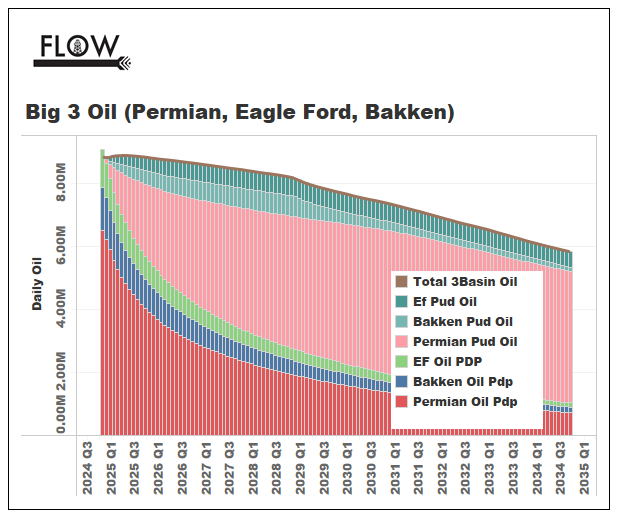

I have been saying for a while, and positioning the AIA portfolio accordingly, for higher oil prices. I have been anticipating higher oil prices because I have the view that the US shale miracle is winding down.

The days of drill baby drill are long gone, and the number of Tier 1 drilling locations is being exhausted. Assuming this is what is happening, I expect the market to begin to price this reality into higher oil prices and oil shares.

There are risks to the thesis, and I expect the journey to be volatile, but I do expect higher oil prices as we move through 2025.

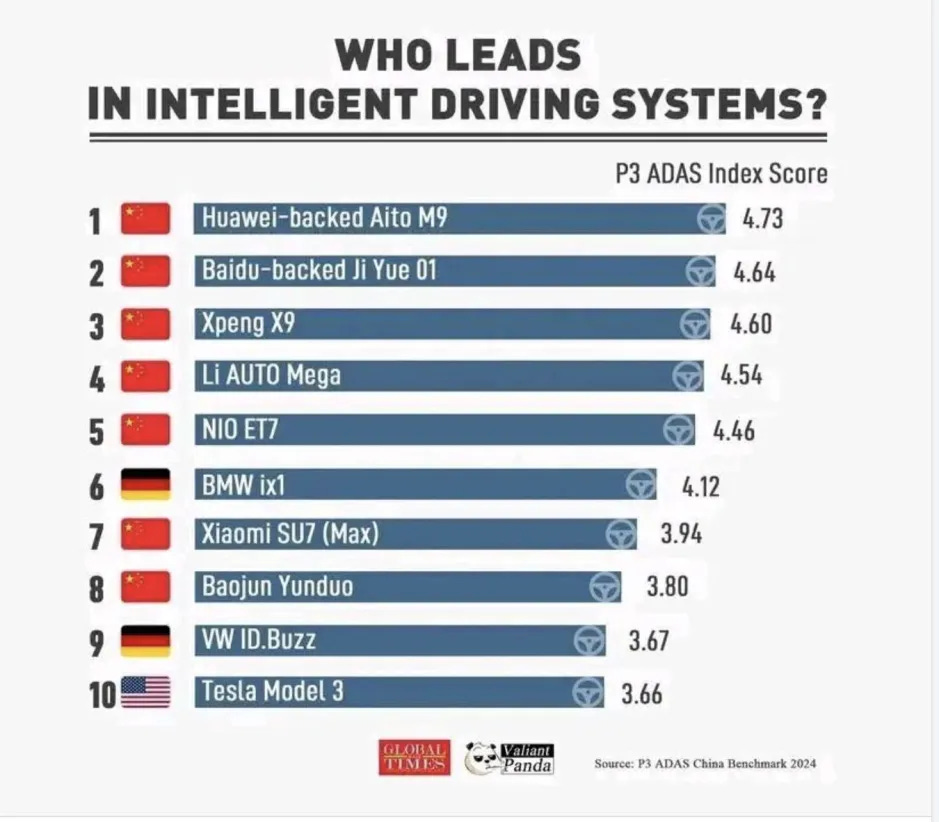

China leads in self-driving vehicle technology

Energy is outperforming tech

These trends have a way of being multi-year events. Energy stocks are starting to move but are still relatively cheap. If US shale has peaked, then expect higher oil prices going forward.

FLOW's Tom Loughrey: "our models predict peak production from the combined Permian, Eagle Ford, and Bakken in May 2025."

In-Depth Insights Into the Uranium Market with Expert Bram Vanderelst

In this interview, Jochen Staiger interviews Bram Vanderelst, a uranium trader and part-owner of Curzon Uranium, to discuss the current state of the uranium market. They explore the dynamics of the spot market, the differences between short-term and long-term pricing, and the factors influencing supply and demand. Bram provides insights into the recent price fluctuations, the potential for a market bottom, and the future outlook for uranium prices, emphasizing the importance of long-term contracts and the challenges facing the industry.

People are very disappointed that the fundamentals point to a massive supply/demand deficit for uranium. Yet the uranium spot price is going down, along with uranium mining companies. In this interview, a real uranium trader discusses these issues and the fact that the longer the price stays depressed, the bigger the eventual rebound in price.

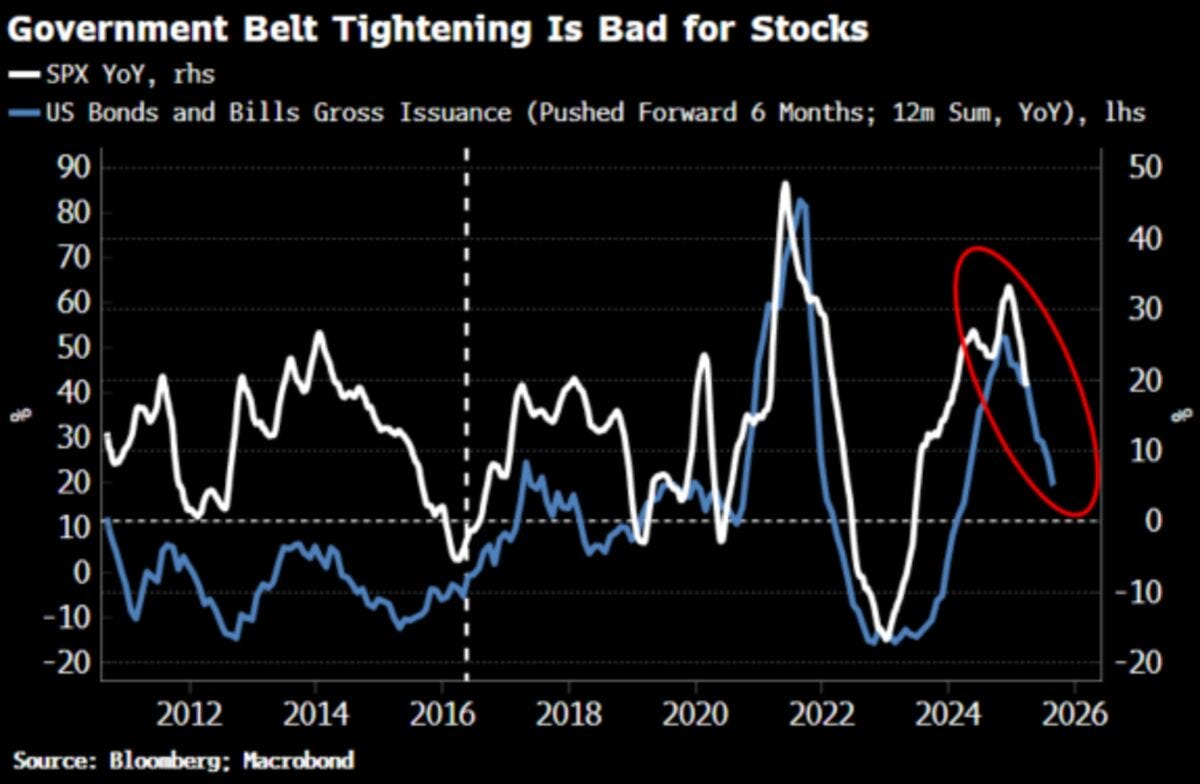

It is all about fiscal spending, and it is fading

I am unsure how effectively DOGE will cut the overall deficit. However, we are seeing personnel reductions in the Federal Government and the shuttering of programs and departments. As this happens, the deficit should decrease, resulting in less debt issuance.

The chart above shows that the stock market has weakened as the Federal Government cuts back on debt issuance. We will see if this correlation continues as it has in the past.

Energy poised for a run?

Energy is out of favor as oil prices have been on a stealth rally this year. I don’t know what will happen, but a break higher from here after three years of consolidation could result in a big move higher.

That’s it for this week.

Readers and listeners support this service and my work. The best way to do so is to follow me on Substack, YouTube, and X. You can also buy me a coffee if you are inclined.

Regards,

John Polomny

As Joe Biden said, we will still need oil for at least a couple of more years. LOL.

Simply the best