Gold Stocks Are Very Undervalued

However, it will likely take FED rates cuts and QE for them to rally hard

Gold Stocks Undervalued

Gold mining stock valuations are the lowest in 25 years. The spread between the gold price and the discount implied to spot based on the market price of the equities is a massive $700+ per ounce. In other words, cash flow from a gold price 65% of the current spot price would return the entire market value of the group based on existing reserves.

The average annual gold price has increased over 20% since 2011. The gold price is the single most important fundamental driver of earnings and returns on capital. However, gold stocks have declined over 40% (based on GDX1 ) since 2011. We have enumerated several reasons for this 60% performance divergence in an earlier commentary, Gold vs. Gold Stocks, An Unresolved Incongruity. In our view, those factors have been excessively discounted. In our opinion, there is near-term potential for a substantial mean reversion trade even assuming no further rise in the gold price.

I don't think anything meaningful will happen with the gold stocks until the regular stock market is down and interest shifts to the gold stocks as gold makes new highs due to the next bout of liquidity (central bank money printing) which has already started in emerging markets and will continue in developed markets later this year.

Fed Pivots Precede Outsized Performance

Every Fed pivot has been followed by outsized gains in gold mining equities. GDX gains:

• Period 5/00-1/08: 400%

• Period 1/16-8/16: 238%

• Period 3/20-7/20: 208%

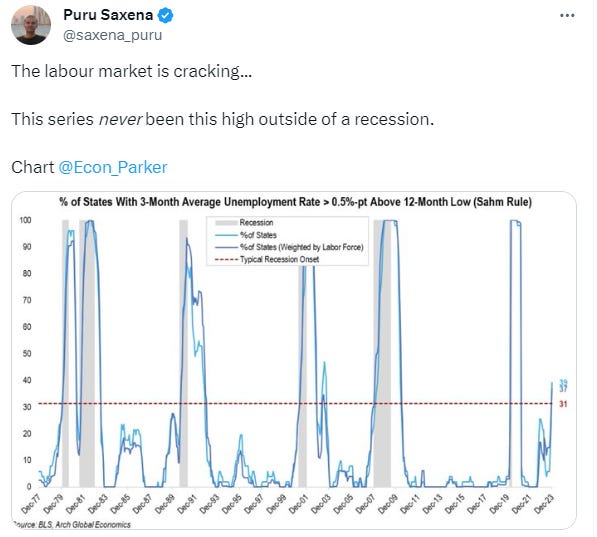

Economic News

The last leg of the bull argument is getting wobbly.

Tankers

As long as the conflict in Yemen is ongoing, it seems shipping will divert from the Red Sea and Suez Canal around the Cape of Good Hope in southern Africa. This means longer journeys for the same amount of ships. Rates are already soaring and should stay strong until this is resolved. There could be an additional upside if the conflict spreads to Iran and involves the Strait of Hormuz. I did say we are living in the Age of Chaos.

Uranium

Why $100 Uranium is Just The Start of a Long Bull Run

Oil

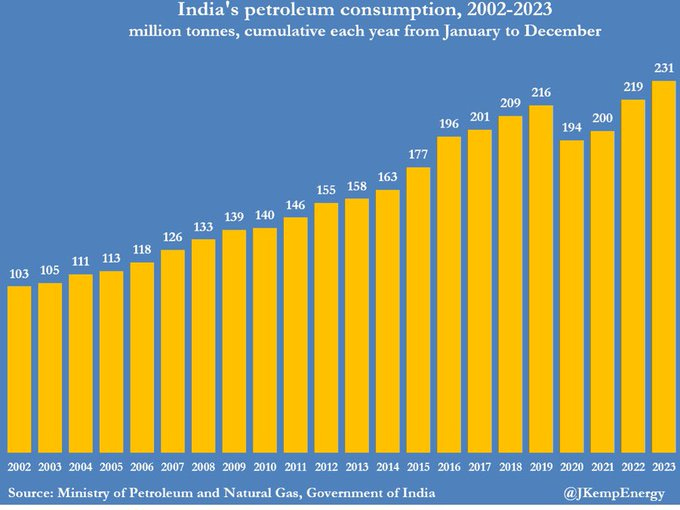

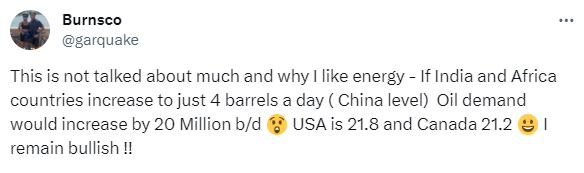

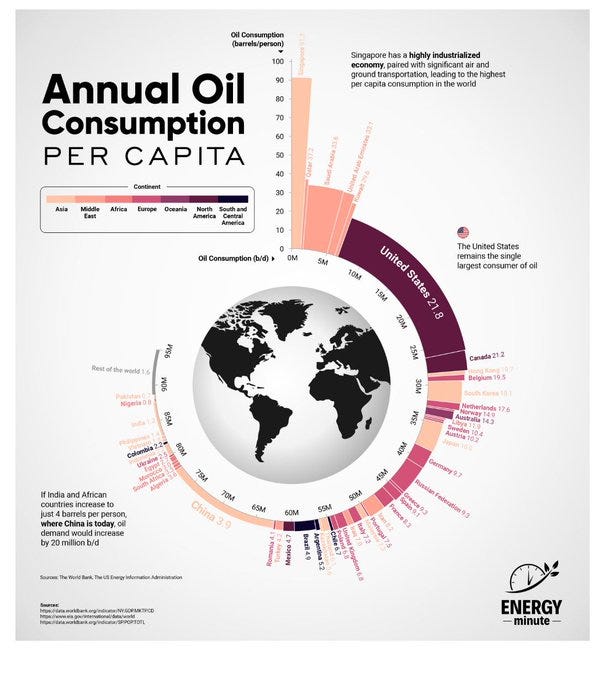

I remain bullish on oil long-term, notwithstanding the short-term volatility, primarily because of emerging market demand. It’s growth will be relentless from a low starting point.

*Correction: I believe he meant 4 barrels per year

Cannabis

I took a stater position in the Cannabis Multi State Operator ETF (MSOS).

I think it is a good bet that in this election year, the Biden Administration will push to reschedule cannabis from a Schedule 1 drug to a Schedule 3 drug to curry favor with millennial voters.

In the February issue of AIA, I will discuss this in more depth and also introduce another new addition to the portfolio. A company that helps cannabis-affiliated companies access the banking system.

That is it for this week.

To your investing success,

John Polomny