More people believe in Bigfoot than think they will get Social Security

Another example of wrongthink

Chart of the Week

If you want to know why gold and other hard assets are moving higher part of the reason is the chart above. People are beginning to realize that US government spending is out of control.

Again, let me ask the following question: Who in DC advocates for spending cuts or, at minimum, slowing spending? Practically, no one. This ends badly with either a deflationary collapse or, more likely, long-term inflation and continued debasement of the dollar.

+$106 Uranium, China-Kazakhstan Issues, Cheap Junior Stocks | Ben Finegold Interview

Ben Finegold from Ocean Wall Advisory was interviewed about the state of the uranium market. I am a big fan of Ocean Wall, and Ben is outstanding. Here is the link to Ocean Wall.

Old West Investment Management LLC Q1 2024 letter

Another excellent investment firm I like to follow is Old West. Great insight into the commodity bull market we are entering.

The trillions of dollars invested passively in index funds feed into all of the Mega Cap tech companies driving the A.I. machine. But very few investors own companies producing the metals necessary to compute, store and network data. These facilities are loaded with copper, tin, and silver, and possibly receive nuclear generated power. We believe we are in the early stages of a multi-year bull market in these industrial metals, and we have selected companies that should take full advantage of this generational opportunity.

The supply of many metals is insufficient to meet future demand, and prices are too low to give an incentive for new development. We believe prices must rise to levels that make development projects economical, and the companies that can deliver supply into that environment will benefit.

Copper is a good example of this, and an area we have invested in for years. The growth in electricity demand as the world shifts to cleaner sources of energy and transportation, and necessary investments in the modernization of global power grids, will require a near doubling of copper production over the coming decade. Challenges in mine supply related to declining production, worsening grades, higher costs, shortage of skilled labor and inadequate spending on exploration and development suggest we may be unable to meet that demand. Inflationary pressures have also driven up the cost of project development, with some industry analysts suggesting it would take prices of $7 per pound to balance the market in the near term.

$7/lb. copper to balance the market? I don't know, but I do know that we need higher prices that are sustained for a long period of time to incentivize the investments needed in new supply.

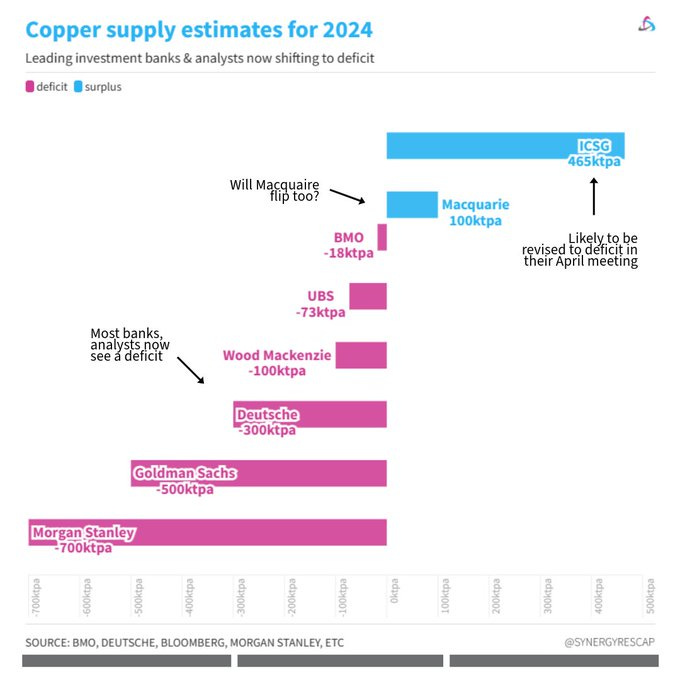

Copper deficit being recognized

In a recent video, I mentioned this copper stock (ARG.TO) as a free pick. I have owned it in the past and currently own it. It does well when copper prices are on the rise.

The stock and copper are currently overbought, but keep an eye on it if it pulls back, and if you have a view that the copper price will move higher you might find it interesting.

Is natural gas the next uranium?

Adam Rozencwajg seems to think so:

Five years ago, we became uranium bulls. We explained how the market had quietly slipped into a structural deficit, with reactor demand outstripping mine supply. Fuel buyers used so-called “secondary supplies” to fill the gap -- notably large commercial stockpiles accumulated following the 2011 Fukishima nuclear accident. At the time, investors did not pay uranium any attention at all. The premiere Western uranium producer, Cameco, changed hands at $9 per share – 20% below its tangible book value – and held nearly $800 mm of cash on its balance sheet. By the first quarter of 2019, no uranium company on any exchange sported a double-digit stock price – a sign that investors had given up on the industry. Investor attitude is entirely different today. Bloomberg consistently reports on structural deficits. Instead of trading for $9, a share of Cameco now changes hands for more than $50.

Why start our natural gas essay with a discussion of uranium?

We believe today’s North American natural gas market resembles that uranium market: despite widespread investor pessimism, it too is about to slip into “structural deficit”. Careful research and a differentiated outlook may reward the enterprising natural gas investor just as large profits accrued to the uranium investor back in 2018.

I am not entirely sold on this argument, but I will keep my eye on this possibility. I think there will be a resurgence of natural gas-fired electrical generation in the US as electrical demand for data centers and AI is poised to go through the roof. There is no way “renewables” will be able to supply the base load power that those facilities will require. Nuclear is the ultimate end game, but it will take years.

Tweet of the week

I have been writing about this for years. Now, I do not think it is honest to assume 12% annual growth. However, if you take 8%, which is more consistent with the average yearly returns for the S&P over the last forty years, you would still have $3 million, which assumes no increase in contributions due to salary increases.

This whole thought exercise around social security is an example of the Will Rogers axiom, “It Ain’t What You Don’t Know That Gets You Into Trouble. It’s What You Know for Sure That Just Ain’t So.” Most people think that Social Security is some savings plan, investment plan, or annuity plan. It is not. It is a tax and a welfare program. Now, that seems like a provocative statement, and your grandma will argue, “I paid into it; it’s my money!” However, as with most of these ideas, people are clueless.

The Supreme Court already ruled on a court case in the 1950s and determined that the program is not your money and that you are entitled to only what Congress determines you are entitled to, which they can and have changed by law.

The case was Nestor vs. Flemming.

The Social Security Administration used to have this on their website but I could only find an archival link.

The fact that workers contribute to the Social Security program's funding through a dedicated payroll tax establishes a unique connection between those tax payments and future benefits. More so than general federal income taxes can be said to establish "rights" to certain government services. This is often expressed in the idea that Social Security benefits are "an earned right." This is true enough in a moral and political sense. But like all federal entitlement programs, Congress can change the rules regarding eligibility--and it has done so many times over the years. The rules can be made more generous, or they can be made more restrictive. Benefits which are granted at one time can be withdrawn, as for example with student benefits, which were substantially scaled-back in the 1983 Amendments.

There has been a temptation throughout the program's history for some people to suppose that their FICA payroll taxes entitle them to a benefit in a legal, contractual sense. That is to say, if a person makes FICA contributions over a number of years, Congress cannot, according to this reasoning, change the rules in such a way that deprives a contributor of a promised future benefit. Under this reasoning, benefits under Social Security could probably only be increased, never decreased, if the Act could be amended at all. Congress clearly had no such limitation in mind when crafting the law. Section 1104 of the 1935 Act, entitled "RESERVATION OF POWER," specifically said: "The right to alter, amend, or repeal any provision of this Act is hereby reserved to the Congress." Even so, some have thought that this reservation was in some way unconstitutional. This is the issue finally settled by Flemming v. Nestor.

The amount of money promised to taxpayers exceeds what can be paid. Expect Congress to change the rules, including higher retirement ages before benefits can be drawn, higher FICA taxes, means testing, and other band-aids, including monetization of issued debt. That which cannot be paid will not be paid. Many will become acquainted with the effects of this court case settled in 1960.

I occasionally bring this up, and I think most younger people understand that they will not receive benefits or reduced benefits at best. However, most people get a brain lock because they do not want to face the fact that their retirement plan is somebody else will take care of them instead of planning and working for their own care and retirement. You are on your own. Here endth the lesson.

That’s it for this week.

To your investing success,

John Polomny

If you like the information I provide in these emails, consider supporting me by buying me a cup of coffee. I am listener and reader-supported.

Are you interested in how I translate the information in these emails into actionable investment ideas?

Consider a subscription to my paid newsletter, “Actionable Intelligence Alert.” You can check it out by following the link below.