Videos

Tavi Costa was interviewed by Adam Taggart. Obviously, he is bullish on gold.

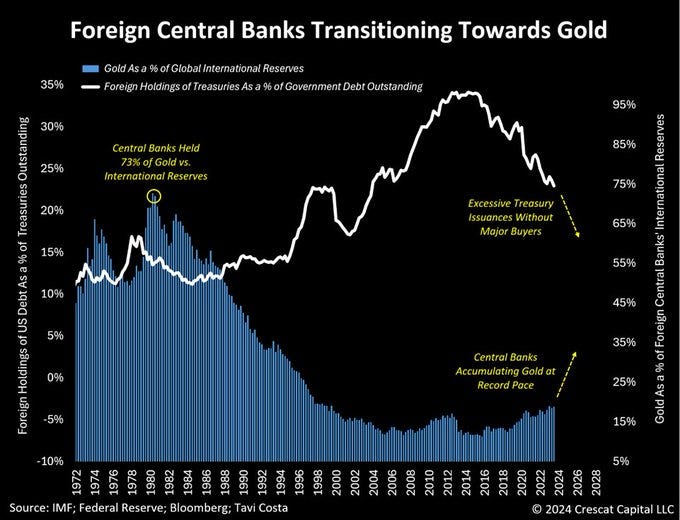

A slide from Crescat Capital's recent presentation.

Modern-Day Asset Management Business w/ Anthony Deden

A subscriber recommended this video to me. It was an informative and thought-provoking interview. This guy hardly ever gives interviews, so it was interesting to hear his perspective, which focuses on permanent capital and finding and investing in scarcity. It is over two hours, but if you are serious about investing, I think you will find it useful.

$15,000 Gold, $125 Uranium, $0 Lithium | Adam Rozencwajg Interview

G&R is bullish on several resource sectors.

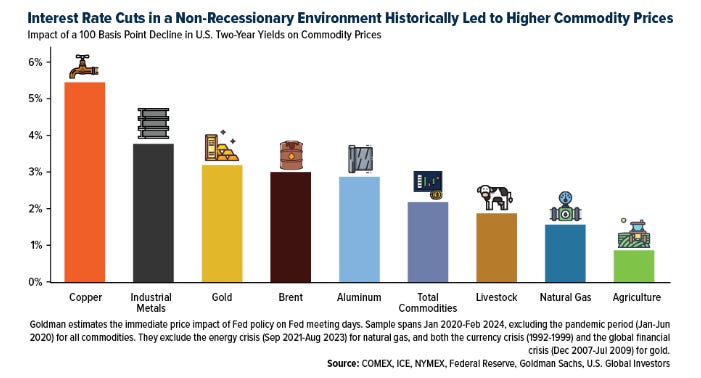

What happens when the FED cuts rates?

This could be the reason hard assets are moving higher. They are anticipating lower central bank rates and increased liquidity.

I have pointed out in the past that I track global central bank actions, and most central banks around the world are now cutting rates and injecting liquidity into their economies. When the three big dogs start, we will likely see continued increases in commodity prices.

Quote

“Be patient. I think investors as a group have a tendency to always want to be doing something, when often the best course of action is to do nothing at all.”

Steve Edmundson

One of the issues that negatively affected my performance early in my investing career was impatience. I would buy a stock, and it would not perform as I wanted it to. I would get frustrated and sell it. I would frequently revisit the name after some time and find that the stock went up as I had initially expected.

My lack of patience led me to sell ideas early before the story fully played out.

I think some important lessons can be gleaned from this.

The first thing to note is that I was focusing on stocks in my previous haphazard investment style. I had forgotten or chose to ignore the fact that these stocks represented fractional ownership stakes in an actual operating business.

It would be best to approach investing as investing in a business. That means understanding the business, its management, products, or services, whether you actually like the business or understand it.

I write down why I buy an ownership stake in a business before I invest. If that thesis changes, I will typically sell. Otherwise, as long as the business is doing what I thought it would do, I will continue to hold and sometimes add to my position if Mr. Market gets schizo and offers me a discount for an additional ownership stake in a good business I own.

The second thing I do is hold for the long term. This takes patience and is something that I find easy. Maybe it is due to my age and some wisdom I have been able to acquire over time. Regardless, it takes patience to buy a business and let it grow for years or let time for your thesis play out. This can be difficult as modern finance and retail investing are geared toward short-term trading, the desire for easy money, skewed time preferences, inflated return expectations, and people who confuse speculating with investing. It usually takes longer for an idea to play out than you originally thought.

With the ease and low cost of transacting securities now, Wall Street and the financial media encourage speculating (gambling) and short-term thinking. If you exercise some patience and look at the stock market as a place to buy and sell ownership interests in actual businesses instead of treating them as trading sardines, you will likely have better investment returns.

Multipolar World

We will likely see more of this as the multipolar world takes shape. Emerging economies will likely be less open to being lectured by hypocrites from the West. The president of Guyana gave the BBC a good tongue-lashing on the development of Guyana’s offshore oil reserves.

https://twitter.com/anasalhajji/status/1773754505059852529

That’s it for this week. Thanks for subscribing!

John Polomny

If you like the information I provide, consider supporting me by buying me a cup of coffee. I am listener and reader-supported.

Are you interested in how I translate the information in these emails into actionable investment ideas?

Consider a subscription to my paid newsletter, “Actionable Intelligence Alert.” You can check it out by following the link below.

Do you believe the best time to deploy your cash is before or after the big dogs cut rates?