Social Security And Medicare Will Destroy The United States

That Which Cannot Be Paid Will Not Be Paid

40,000 men and women everyday, Like Romeo and Juliet

40,000 men and women everyday, Redefine happiness

Another 40,000 coming everyday, We can be like they are

Come on baby, don't fear the reaper

Lyrics from "Don't Fear The Reaper"- Blue Oyster Cult

In this case, we are not talking about death but entitlement spending, Social Security and Medicare in particular. I believe that future Social Security and Medicare spending will eventually cause a massive debasement of the US dollar and potentially the dissolution of the United States as a political entity in its current form. That sounds provocative, but let’s look at the facts.

In 2008, the first of 78 million Baby Boomers turned 62 and became eligible to draw benefits from Social Security. When I say another 10,000 are coming daily, this is what I am talking about. Every day for the next 25-30 years, 10,000 Americans will begin to draw benefits from Social Security and Medicare. Mandatory spending on entitlements, such as Social Security and Medicare, already consumes two-thirds of federal spending.

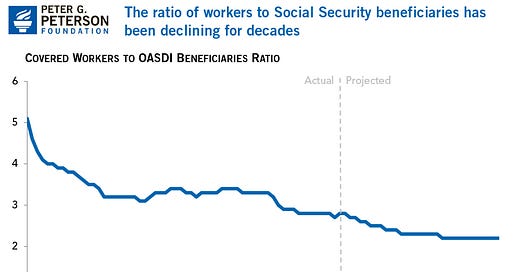

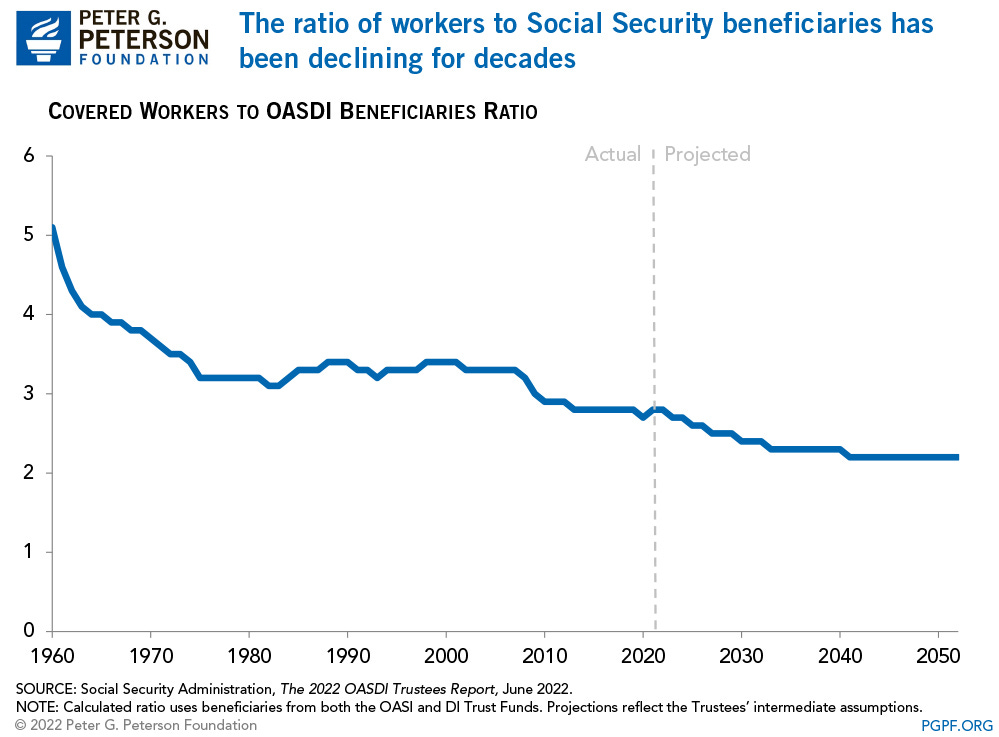

One of the big problems with Social Security is that it is a pay-as-you-go system. Money comes into the system and is paid out to current recipients. This worked well when the program was in its infancy. In 1940, 159 workers supported each retiree. However, today, only approximately 2.8 workers support each worker, and this ratio will only get worse as the number of retirees increases and birthrates continue to decline.

The problem was outlined in the Washington Post in 1999, when we still had some real journalists in this country.

In 1935, after bank failures and a stock market crash had wiped out the savings of millions of Americans, the country turned to Washington to guarantee the nation's elderly a decent income.

The solution was Social Security.More than six decades later, with the gigantic Baby Boom generation approaching retirement age, Social Security faces a funding crisis. By about 2012 more money will be going out to Social Security recipients than will be coming in from workers' payroll taxes. The system's trust fund can cover the difference for a while, but by about 2032 the trust fund will be empty and the program will no longer be able to meet all its obligations.

Many politicians assert, and most people believe, that there is a "social security trust fund" that will not run out until the 2030s. This is a huge fiction that will cost many people in the future. There is no trust fund, lock box, or individual accounts for each taxpayer. Remember these two "experts" talking about Social Security and Medicare lock boxes over twenty years ago:

The fact is that incoming SS and Medicare taxes go into the federal government's general fund and have been spent by politicians. Here is an older article by Dr. Bill Wattenburg that outlines the problem. He writes:

The Congressional Research Service says bluntly: There is no social security trust fund with real money or assets in it. Most people, and most of the media, don't realize that social security taxes taken from people's paychecks are not paid into a social security bank account. They are paid directly into the federal government's general account. The politicians in Washington have stolen and spent over a trillion dollars of excess social security taxes that were not paid out in benefits to retirees.

For instance, in this year 2000 the government will take in social security taxes of 479 billion dollars taken directly from the paychecks of 95% of the working public. Benefits paid out to retirees will be 409 billion dollars. The Treasury Department will give the Social Security Administration paper IOUs for the 70 billion of excess social security taxes that were supposed to be saved for future retirement benefits. Worse yet, the Treasury will not subtract this 70 billion debt from the federal income surplus that is claimed. Because your social security money was stolen, there was no real federal surplus the last two years.

To cover this smoke and mirrors fraud and keep you unsuspecting suckers quiet, the politicians in Washington even designed the paper IOUs (by law) so that they can never be sold to anyone (banks) for real money. They are not negotiable. This means that the Social Security Trustees can never use the IOUs to pay future social security benefits. These IOUs are not real treasury bills that have value. They are not assets. They are totally worthless that is unless you pay double taxes in the future to pay them off.

So, the bottom line is that entitlement spending (Social Security and Medicare), already consuming two-thirds of the federal budget, will grow massively over the next thirty years (100+ trillion dollars). One might think the politicians will devise something to bail us out. No, they won't, and people who believe that will be severely disappointed. The two and four-year election cycles do not allow for the solving of perceived problems way off in the future. This problem is the ultimate kick the can down the road example. A crisis will have to emerge before anybody can or will do something.

The problem is that there are too many retirees and insufficient money, coupled with politicians' short-term thinking. Unlike the younger cohorts, these older people actually turn out to vote in high proportion to their numbers. That is why Social Security is called the "third rail" of American politics. If you touch it, you are dead politically.

Social Security Is A Welfare Program

In addition, most recipients feel entitled to this money because, as they are fond of saying, "I paid into it for so many years, so I am owed," even though a Supreme Court ruling says they are not entitled to it. Remember the Supreme Court case Fleming v. Nestor? Of course not, as it is not in anyone in politics or the media's interest to discuss it if they even knew about it.

A 1954 amendment to the Social Security Act stripped old-age benefits from contributors who were deported under the Immigration and Nationality Act. The following year Ephram Nestor, an alien from Bulgaria who had paid into Social Security for 19 years, began drawing benefits. Nestor was subsequently deported for involvement in the Communist Party, and his benefits were terminated. He sued the Department of Health, Education, and Welfare on the basis that the amendment had deprived him of a property interest in Social Security without due process and was therefore invalid.

Here is what the ruling said:

“To engraft upon the Social Security system a concept of ‘accrued property rights’ would deprive it of the flexibility and boldness in adjustment to ever changing conditions which it demands. "The Court went on to say, “It is apparent that the non-contractual interest of an employee covered by the [Social Security] Act cannot be soundly analogized to that of the holder of an annuity, whose right to benefits is bottomed on his contractual premium payments.”

In other words, Social Security is not an insurance program at all. It is simply a payroll tax on one side and a welfare program on the other. Your Social Security benefits are always subject to the whim of 535 politicians in Washington. Congress has cut Social Security benefits in the past and is likely to do so in the future. In fact, given Social Security’s financial crisis, benefit cuts are almost inevitable.

What is the Solution?

So basically, SS payroll contributions are taxes, and the program is welfare. Try that one out on your grandparents at Thanksgiving Day dinner. So what is the solution if there is no politically palatable one? There isn't one, so expect the following as the money runs out:

Benefit cuts, including no COLA increases (been there, done that)

Means testing

Higher taxes

More debt (We are over $35 trillion already)

Money printing

Combination of all of the above

I anticipate that all of the above will still not be enough. Unfortunately, the government will revert to currency debasement (money printing), which all bankrupt governments have done throughout history. They will print the money and hand it out. This will likely result in the eventual destruction of the dollar and the demise of the United States in its current political form.

Hopefully, it will not be too messy, but with hundreds of millions of guns and an undercurrent of racial and class division in the US, I don't see a happy ending. Take heart though, all the western welfare states and Japan are in the same boat. In fact, Japan is furthest down the line toward a currency collapse.

That Which Is Certain Is Not Necessarily Imminent

Will this happen next week or even in ten years? Probably not. Because things are certain, it does not mean they are imminent. Countries seem to go bankrupt slowly, and no one pays attention until a tipping point is reached, and then events happen all at once. This gives people the time to plan and to make sure they are not victims. This is why I like holding gold bullion as a store of wealth and insurance against politicians and government stupidity.

Quite a few advisers suggest storing 5-10% of one’s wealth in physical gold as a wealth preservation tool. Due to all the issues the US and other developed markets face, it may be prudent to go even higher. I am not alone in saying this, as even famous hedge fund managers like Kyle Bass and Ray Dalio agree.

You will note the snickering and laughing when one of the world's most successful money managers says he has a positive view of gold as an insurance policy. I like his follow-up comment: "Not owning any gold shows that you have no understanding of economics or history." Well said.

In the end, you are responsible for yourself. Abdicating responsibility to politicians and their promises will likely result in disappointment and hardship. There is still time to prepare and plan. The best time to plant a tree is twenty years ago. The next best time is today.

That is the purpose of the Actionable Intelligence Alert Newsletter: to discuss issues and topics the mainstream ignores. Assisting people in staying ahead of inflation and currency debasement and hopefully building wealth for our future and our children’s future.

This piece from a few years back outlines the case for 2028 being for when government debt reaches 15 times annual revenue:

https://fee.org/articles/why-2028-could-be-the-year-the-us-debt-crisis-finally-hits-the-fan/

Outcome: US dollar 'deleted' and a new currency created a la the late 1700s.

Interesting take and I agree on the problem, but getting rid of social security isn't the answer and would lead to more problems. I was a top mortgage broker for over 30 years and got a deep dive into a lot of people's financial situations. Most people, and it didn't matter how much income they made, saved almost nothing. They lived up to their means, whatever that might be, and almost all their savings were based on company 401k plans, with much of their wealth tied up in home equity. At the same time we live in an era with wealth disparity at an all-time high. The top 10th of a percent have as much as 90% of the rest of the population, and as much of their wealth is in stock which they can borrow against and pay no taxes, so they pay very little compared to their wealth. Relatively small taxes on the top level could keep the programs solvent, and if we want to have a functioning society, this should be part of the conversation. If we do away with entitlements the middle class will be in the streets with pitchforks (once they realize the reality of their situation). Libertarianism is great in principal, but it won't work when all the people who didn't save enough 9the vast majority) try and move in with their kids or are out in the streets.