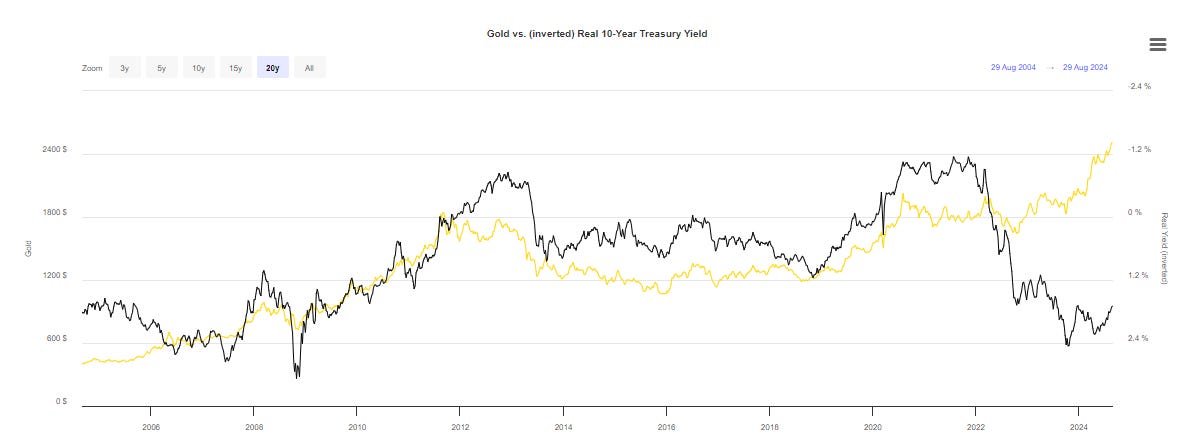

The Intricate Dance Between Real Interest Rates and Gold Prices

Real interest rates are the primary driver of the gold price

The consensus view is that the US Federal Reserve will begin cutting interest rates at its next meeting later this month. Real interest rates are the difference between the nominal and the expected or actual inflation rates and significantly influence the price of gold. Understanding this dynamic can provide valuable insights into the future price of gold.

Real Interest Rates and Gold Prices

Real interest rates play a pivotal role in shaping the demand for gold. When real interest rates are low or negative, the opportunity cost of holding non-yielding assets like gold decreases, making gold more attractive to investors. Conversely, when real interest rates are high, the opportunity cost of holding gold increases, leading to reduced demand and a subsequent decline in its price.

Historically, gold has been viewed as a safe-haven asset, often sought after during periods of economic uncertainty or market volatility. As such, shifts in real interest rates can profoundly impact the perceived value of gold as a hedge against inflation and currency devaluation.

The Inverse Relationship

The relationship between real interest rates and gold prices exhibits an inverse correlation. When real interest rates are declining, the price of gold tends to rise, and vice versa. In fact the correlation between real interest rates and the price of gold is -0.82. In other words, when real yields go down gold goes up.

This correlation explains why inflation is gold's best friend while rate hikes are its worst enemy.This relationship becomes particularly pronounced during times of economic downturns, geopolitical crises, or when central banks implement expansionary monetary policies to stimulate economic growth.

Recent Trends and Implications

In recent years, the persistent low-interest-rate environment across many developed economies has contributed to an upward trajectory in the price of gold. The prolonged near-zero or negative real interest rates have prompted investors to allocate more funds into gold as a means of preserving capital and hedging against potential inflationary pressures.

The unprecedented stimulus measures enacted by central banks and governments to counter the pandemic's economic fallout have heightened concerns about inflation, further bolstering the appeal of gold as an inflation hedge.

The further bifurcation of the world between the Anglo-Atlantic hegemon and the emerging BRICS bloc is also causing BRICS central banks to buy gold as they slowly but consistently sell down their US dollar holdings and buy gold.

Conclusion

In conclusion, the relationship between real interest rates and gold prices is a multifaceted and dynamic interplay. Considering that the majority of central banks in the world are now cutting interest rates, we may see further advances in the gold price as real rates around the world decline.

Gold is near an all-time high. But on the monthly chart, gold is just starting to outperform the S&P 500. This gold bull market is still in the early innings.

Luke groman and Jesse Felder have been talking about this. But it appears to be breaking.

https://x.com/LukeGromen/status/1831006040072052754?t=0ufYoI8Z28Q6gbCohHr2Aw&s=19