Uranium End Game AIA Weekly Email 3.3.24

Ben Fiengold of Oceanwall interviewed on uranium, bottom line is the price is going higher

Lots of videos in this weeks email bu’s email but in my view they are good ones. I was sick the last week, so I did not have much time or motivation to do a lot of reading this week. Hence, a short version.

If you want to understand how I translate the information and ideas in these weekly emails into actionable investment themes, consider paying for my newsletter “Actionable Intelligence Alert.” Hit the subscribe now button for information.

Uranium

The Uranium Endgame (Ben Finegold Interview)

Ben Finegold of Oceanwall interviewed about all things uranium. He’s a wealth of knowledge on Kazakhstan, the sulphuric acid issues, transportation routes (& their importance), the rise of China, the West’s enrichment capacity, alternatives to miners and lots more.

Uranium Panel: Mike Alkin and Guy Keller | Red Cloud's Pre-PDAC 2024

Mike Alkin, Chief Investment Officer, Sachem Cove Partners LLC, and

Guy Keller, Portfolio Manager, Tribeca Investment Partners speak on a Uranium panel discussion at Pre-PDAC 2024.

John Polomny & Josh Young Panel on Oil

Oil and Gas Demand is on the Rise, How to Position Accordingly

Emerging Markets

Louis Vincent Gave was interviewed on his view on the bubble in the US and the opportunity in emerging markets. I like his perspective on things especially concerning China and Asia as he has lived in Hong Kong for twenty years.

“A Ticket to Purgatory”

Bill Smead, Smead Capital Management

This is a good article that talks about previous decades and the bubbles present at those times.

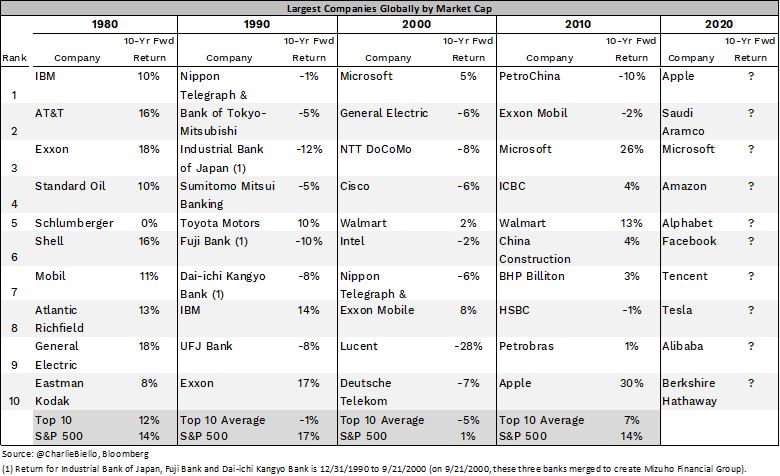

What are the arguments in favor of sticking with the Magnificent Seven and the S&P 500 Index masquerading as a diversified portfolio? First, it is different this time! However, it is always different this time and it is the rhyme with prior manias and top ten lists that sends you to purgatory. How did the Go-Go 1960s and Nifty 50 stocks work over ten years? How have Cisco and Intel done since 2000?

Lastly, many people look at this mania and compare it to the dot-com bubble of 2000. This comparison is like a fraternity brother feeling comfortable drinking 14 beers because his best friend knocked out a whole case. Nobody wrote either of them a letter and said, “You are too well to attend.” As Cole shared with us last week, the difference from the Dotcom Bubble included 1% interest rates for a very extended time period. Therefore, many more of the 500 companies in the index have been inflated by nearly free money. Buffett says, “The kinds of companies we would like to own have been endlessly picked over!” This means the bear market that follows will include company shares outside of tech. The capital that doesn’t get destroyed will flow into a smaller pool of depressed stocks.

Sell overvaluation and buy undervaluation.

That’s it for this week.

To your investing success,

John Polomny