Ben Finegold: Uranium's New Paradigm — Market Dynamics and How to Invest

At the 27:00 minute mark, he discusses the need for five more Kazatomproms worth of uranium to meet demand.

Ocean Wall: The Case for Uranium

“I have spent 37 years in this wonderful uranium and nuclear energy industry. We’ve gone through all the highs and lows; I have to say we are probably in the most exciting phase in the nuclear energy industry’s history in these years that lie ahead of us.” – Scott Melbye, Uranium Royalty Corp & VP, Uranium Energy Corp

Nuclear energy is enjoying a renaissance. There is now an almost global political consensus that it presents a scalable, non-intermittent and zero-carbon solution. Intermittent power sources such as wind and solar cannot be relied on for continuous energy output and do not supply the same baseload power that nuclear energy can produce. One only needs to look at the images of frozen wind turbines in Texas in 2021 to visualise the importance of non-intermittency. Additionally, nuclear power presents one of the lowest operating costs and is extremely energy dense.

Currently c.10% of the world’s electricity is delivered using nuclear. With the ‘electrification of everything’ and advancement in nuclear energy delivery through next generation reactors, there is a compelling proposition presented in terms of cost, scalability, and sustainability.

Uranium is going higher. Buy on dips. Hold and be patient—end of lesson.

Doomberg was interviewed by Adam Taggart of Thoughtful Money

I don't always agree with Doomberg's views, but this was a great discussion. I especially enjoyed the discussion about the need for the US to build out its nuclear fleet with the same emphasis we had when we built out the interstate highway system in the 1950s. If we rise to the challenge of building 200 gigawatts of nuclear power in the next twenty years, it will fundamentally improve and change the US economy.

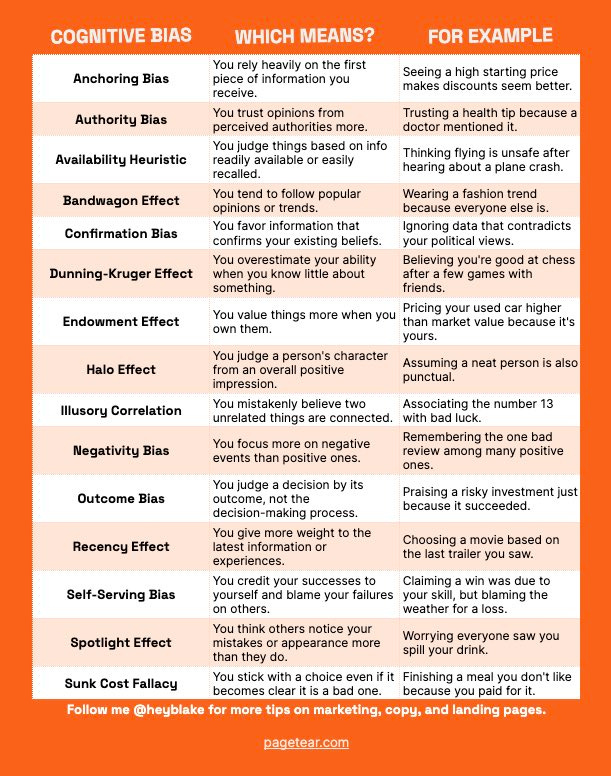

Cognitive Bias

Fighting bias is a major challenge. It pays to focus on your bias and counter it. Not only in investing but life in general.

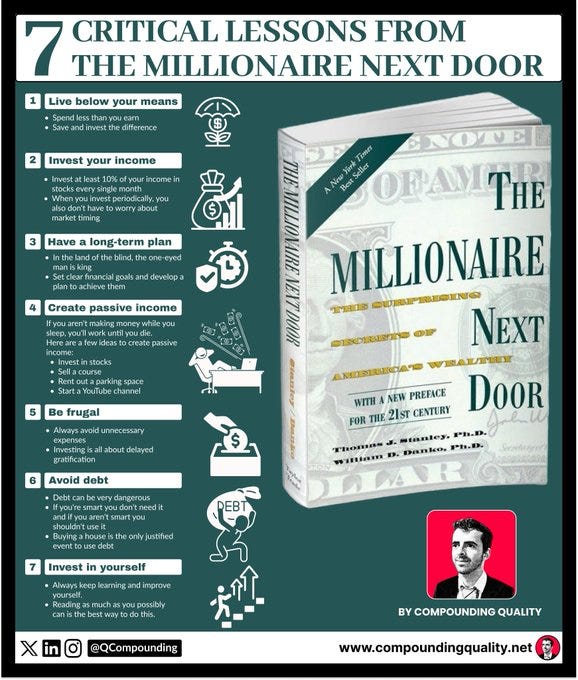

Lessons from “The Millionaire Next Door”

It's a great book that I highly recommend. I have implemented these lessons in my own life and can attest that consistency and discipline over many years works to create wealth.

The two-tier US economy

Palm Beach housekeepers are making $150,000 a year due to massive demand from the wealthy

The mass wealth migration to Florida from New York and other high-tax states has created record demand for household staff in elite Florida enclaves — especially Palm Beach.

Housekeepers in Palm Beach and South Florida are cleaning up, with salaries often topping $150,000 and bidding wars between mansion owners becoming common, according to staffing companies.

It’s the shortage of housekeepers, however, that has created the biggest mess for wealthy homeowners. Many of the wealthy emigres to Florida bought big homes and now need people to clean them. Hotels, resorts and businesses are also vying for cleaning staff. The result: Typical pay for housekeepers has rocketed from about $25 an hour in 2020 to $45 or $50 an hour today, according to some agencies.

Maybe it is time to consider a new career?

401k Millionaires Explode at Fidelity

Many people are benefiting from the recent upside in the stock market. I wonder how many of them know what they actually own?

This service and my work are reader—and listener-supported. The best way to support me is to follow me on Substack, YouTube, and X. You can also buy me a coffee if you are inclined.

That is it for this week. Thanks for reading and your continued support.

John Polomny