Where will all the electricty come from to power AI? AIA Weekly Free Email 3.18.24

Very likely nuclear power will have an increasing role as recent news from Amazon demonstrates

Declining Alcohol Consumption

The rise of hemp-infused beverages

I have been looking at this sector more and more. I'm unsure if there is a public way to play it, but I have my eye on it.

So, what is the consumer who no longer wants to wake up groggy or with a hangover and no longer wants the negative long-term effects of alcohol turning to? Non-alcoholic sales are soaring. The Wall Street Journal recently had a long article on non-alcoholic beer company, Athletic Brewing Company.

But what about if you want a drink that actually causes an effect? What can you drink that isn’t alcohol but gives you a bit of a buzz?

Enter low dose hemp THC beverages. Imagine a drink that relaxes you, gives you a slight buzz, food is more pleasurable, music is more enjoyable, your sex drive increases, you sleep great at night and most importantly you wake up the next morning with no hangover. Sounds like a miracle drink.

This sector will likely take more and more market share from alcohol, especially among younger consumers.

Energy and the Poverty of Nations

If we recognize how energy sources differ, we can understand how Europe and then the rest of the world became so prosperous. More importantly, we can begin to see why Western societies now seem to be unraveling.

A short film that describes the importance of energy and its contribution to enabling civilization and human progress. It is well worth watching. Many people are just up to speed on how important energy is in our daily life.

Uranium

Amazon is putting a data center next to a nuclear power plant in a $650 million dollar deal.

Why Amazon's AWS Is Paying $650 Million for Access to Nuclear Power

Artificial intelligence needs a lot of power, and Amazon thinks nuclear energy is the solution.

Amazon Web Services is paying as much as $650 million for a data center campus adjacent to a nuclear power plant in Pennsylvania. The cloud provider reportedly plans to build several data centers there, according to The Information.

The site was previously attracting interest from other cloud providers seeking adequate power to fuel AI computing. While AWS' deal wouldn't be the first time providers turned to nuclear for additional power for AI, it does represent the first campus with direct nuclear power access. That proximity, however, had given some cloud providers pause due to safety concerns, according to the Information.

We will see if other cloud and data center operators follow this lead and look to nuclear power as a solution for their growing power requirements and as a way to ward off criticism from environmentalists about the carbon footprint of these data center operations. It's a trend worth watching.

The AI Boom Could Use a Shocking Amount of Electricity

Here is an article from Scientific American from October 2023 discussing the exact issue of AI electricity use.

Every online interaction relies on a scaffolding of information stored in remote servers—and those machines, stacked together in data centers worldwide, require a lot of energy. Around the globe, data centers currently account for about 1 to 1.5 percent of global electricity use, according to the International Energy Agency. And the world’s still-exploding boom in artificial intelligence could drive that number up a lot—and fast.

Researchers have been raising general alarms about AI’s hefty energy requirements over the past few months. But a peer-reviewed analysis published this week in Joule is one of the first to quantify the demand that is quickly materializing. A continuation of the current trends in AI capacity and adoption are set to lead to NVIDIA shipping 1.5 million AI server units per year by 2027. These 1.5 million servers, running at full capacity, would consume at least 85.4 terawatt-hours of electricity annually—more than what many small countries use in a year, according to the new assessment.

Power is consumed not only for processing the information itself but also for cooling the chips.

Cooling is not included in my article, but if there were any data to go on, it would have been. A big unknown is where those servers are going to end up. That matters a whole lot, because if they’re at Google, then the additional cooling energy use is going to be somewhere in the range of a 10 percent increase. But global data centers, on average, will add 50 percent to the energy cost just to keep the machines cool. There are data centers that perform even worse than that.

If AI is going to grow as some anticipate, it would be logical to assume that nuclear power will play a role as the power requirements are not going to be met by traditional renewable sources such as wind and solar. Is this trend actionable tomorrow? No, but it is worth watching as the AI revolution gains steam.

All Eyes on Uranium Part 2

Per Jander from WMC is back for Part 2 of our All Eyes on Uranium series. Per and host Ed Coyne discuss the recent production guidance announcements from Kazatomprom and Cameco and the overarching issue of the structural supply deficit in uranium.

Snippets from the interview:

My view is that I'm surprised. I thought the spot price would be higher than what it is now. Whether you want to see that as a purchase opportunity or whether it's, "We are going to sit here for a bit," my personal view is that as much production has disappeared this year because of the challenges that Kazatomprom has, I think that tightness is going to shine through a bit later on.

(skip)

Considering the challenges that the big producers are having, clearly, that means everybody's going to be struggling. I think, if nothing else, the supply shortage is just going to be extended, and there is no clear relief in sight. When is this relief going to come? The year's out, so we're looking at a structural supply deficit that is going to run for years to come. I think the takeaway for us is prices are going to be higher for longer. That's essentially it.

(skip)

One of the more profound moments I had at this conference was a Swiss uranium trader who has been in the business for 20 years at least. He was there for the last spike and said, "Yes, everybody makes the comparison to 2007 where we are right now. This is not 2007; this is 1970 when the birth of nuclear energy occurred." We had a decade-long bull market because of all the ramp-ups and all the demand increase. That's the demand increase we're seeing now.

2007, there was no demand increase; there was a short-term supply shortage, and then the Kazakhs ramped up. Cameco de-flooded Cigar Lake and got that back up and running. But it's a completely different setup, and he said, "I'm drawing much more parallels to 1970 than 2007," which is quite an eye-opener. That says something about this thesis for this market.

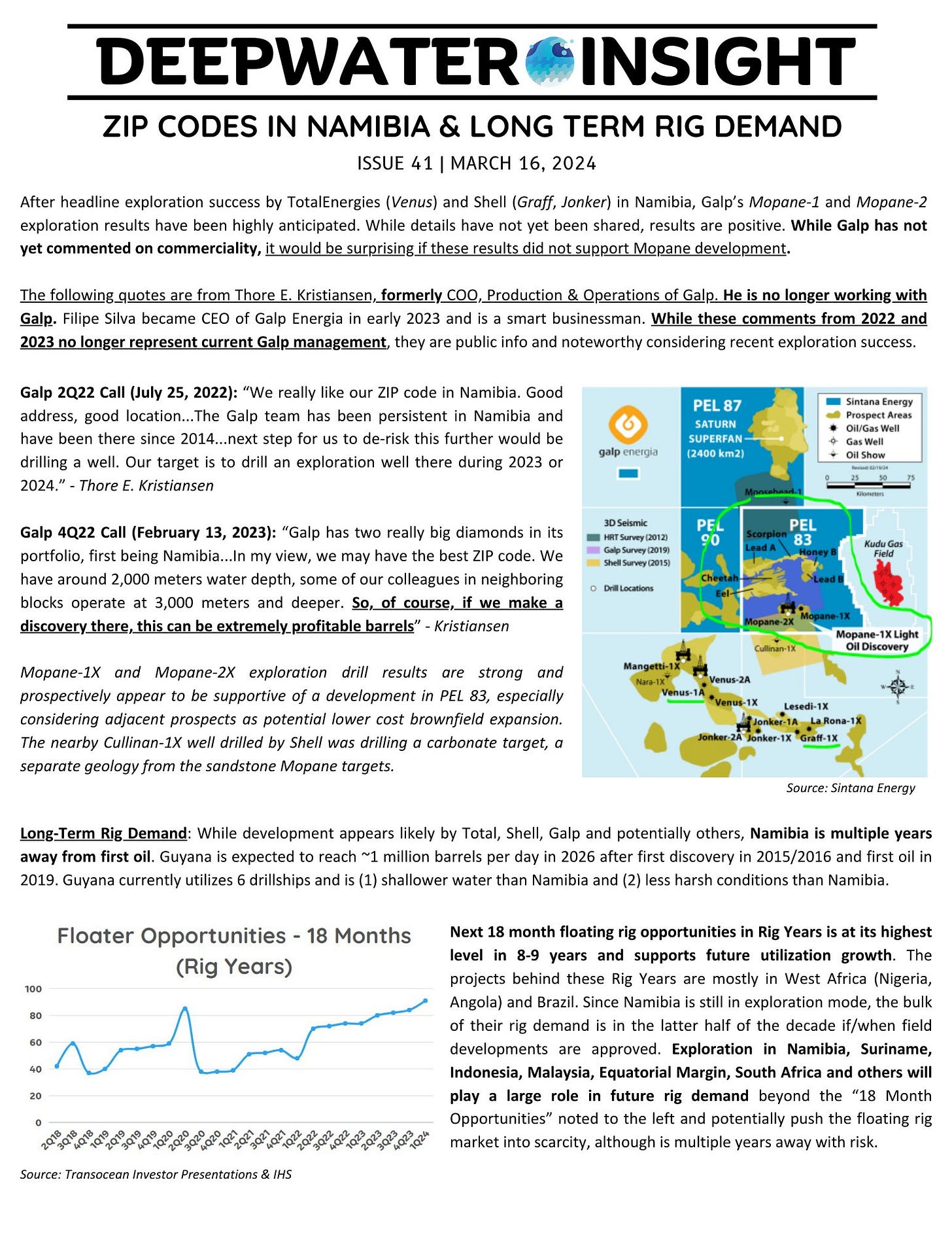

Offshore Nambia continues to impress

I am very bullish on offshore oil services because I believe this will be one of the critical areas of oil supply growth, especially if US shale growth is peaking. The story in offshore Nambia continues to impress as we see continued discoveries across the basin.

The offshore sector has been underinvested in for years and is now growing again. The potential opportunity in offshore services exists because, during the last couple of downturns, tremendous attrition has occurred in the industry. This has given the remaining players pricing power over the next few years.

I have a mid-cap stock in the AIA portfolio. It is invested in prime average offshore Namibia, especially in the blocks Total operates in. They also have prospective acreage further south in the Orange Basin, particularly offshore South Africa. It will take a few years, but this area has tremendous upside potential.

If you like the information I provide, consider supporting me by buying me a cup of coffee. I am listener and reader-supported.

Are you interested in how I translate the information in these emails into investment ideas?

Consider a subscription to my paid newsletter, “Actionable Intelligence Alert.” You can check it out by following the link below.

That’s it for this week. Thanks for reading and subscribing to my work.

Regards,

John Polomny