Emerging Market Growth To Drive Resource Demand

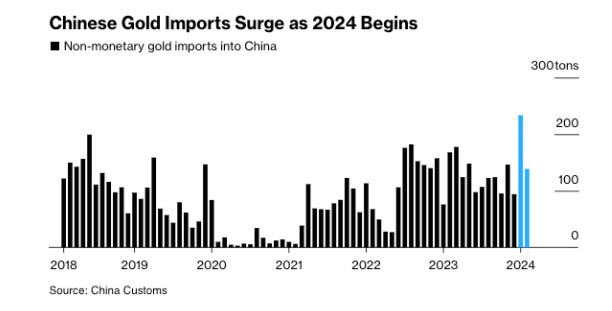

Foriegn central banks continue to vaccuum up gold bullion

Rapid Emerging Market Growth Insanely Bullish For Commodities: Louis Gave

Louis Gave thinks that those bearish on commodities due to a potential recession are discounting the pace and size of emerging market development. Louis argues that as a new middle class establish themselves in places like India, Latin America, and across Asia, precious metals, copper, uranium, and energy prices are headed much higher.

One of my favorite market commentators.

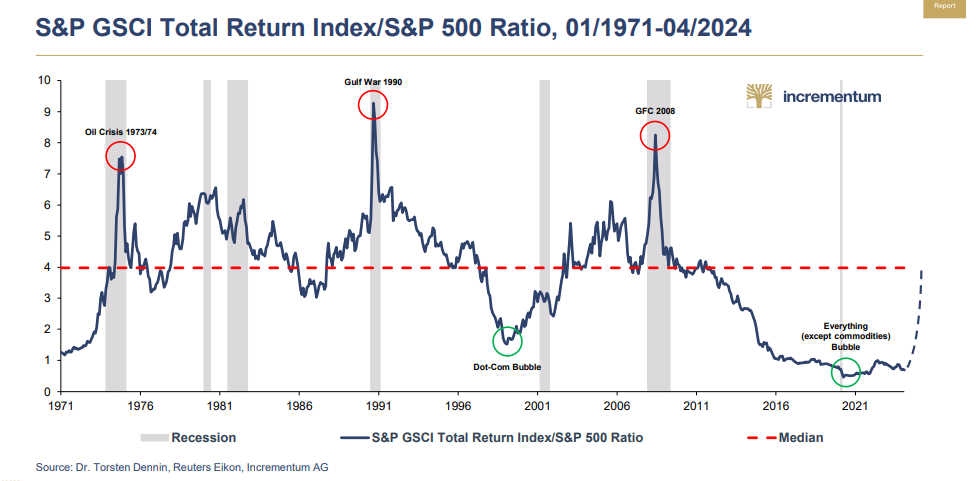

Buy undervaluation, sell overvaluation.

This chart makes the rounds on the financial web. The question I get is when the reversion will happen. It is impossible to know, but the culmination of all the underinvestment in commodities coupled with emerging market populations getting wealthier and demanding more raw material inputs into their economies is, I think, a multi-year trend.

We have already done well in the AIA portfolio, focusing on this theme. When the rotation eventually happens, we will likely see supercharged returns.

Why we are in trouble

This guy is Biden’s Chair of the Council of Economic Advisors. Evidently, he has no idea how the bond market or monetary system works. Link to the clip.

The old canard is resurrected that we can never go bankrupt because we can print our own currency. Yes, this is true technically. The question is, what will the value of all that printed currency be? The US is toast with this kind of “leadership.”

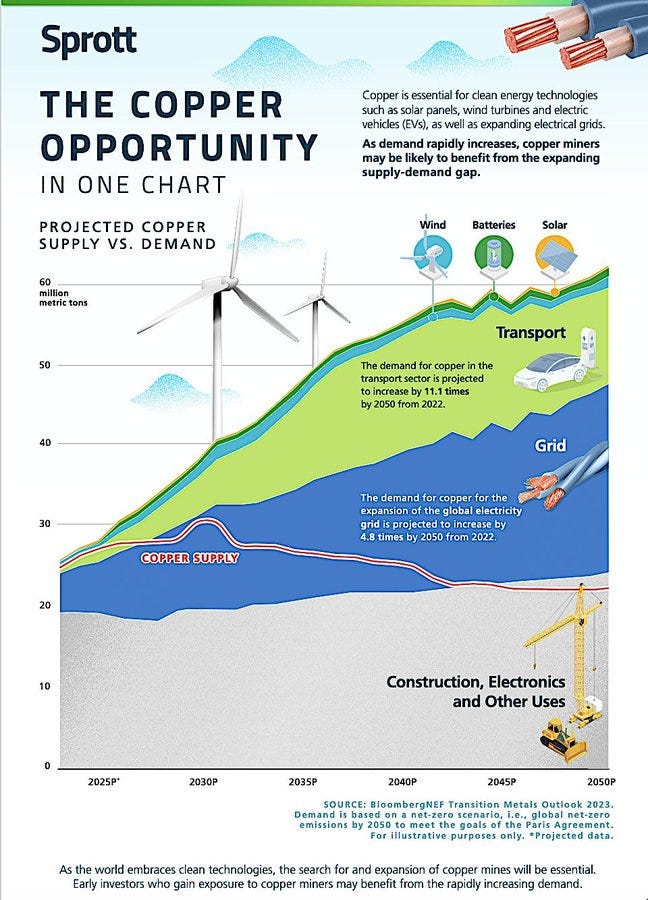

Copper

Copper will have to move much higher to incentivize new mine development.

PJM estimate of power demand for Dominion Energy

Dominion Energy is the utility that services Northern Virginia. This area has tremendous power demand due to the growth in data centers and AI. I'm not sure this type of growth will be replicated everywhere, as infrastructure constraints may come into play. It is interesting to see the system operator raise their projections. Did you have new natural gas electric generation and more nuclear on your bingo card?

Uranium Mine Supply

Kazatomprom announced they would boost 2025 production to between 67 and 69 mm pounds to meet strong demand – a significant 15 mm pound increase above the expected 2024 output. Our 4Q23 letter expressed skepticism over Kazatomprom’s planned expansion, citing a potential sulfuric acid shortage.

Our concerns were justified. In their January 19th announcement, Kazatomprom warned that a lack of sulfuric acid and ongoing construction delays have made their 2024 and 2025 production guidance impossible.

(skip)

Although the uranium market is notoriously opaque, we believe Kazatomprom already sold forward some portion of its previously expected 25 mm pounds of 2024 growth. Depending on how much uranium Kazatomprom has already committed, it may have to buy material in the spot market to fulfill its contract obligations.

The world’s two largest producers are now both short of uranium. On September 3rd, Cameco, the world’s second-largest uranium producer, announced expected production shortfalls at McArthur River and Cigar Lake, totaling 3 mm pounds. Given that before their recent announcements, Cameco and Kazatomprom were likely fully contracted for the next four years, we believe both companies have committed to selling more uranium than they can produce. If correct, both companies may have to buy material on the spot market, driving higher prices.

Supply is constrained, and demand constantly increases as more reactor builds, restarts, and extensions are announced. Uranium is heading much higher. One needs to be patient. In secular bull markets, the key to success is buying on dips coupled with patience to hold as the thesis plays out.

Chinese gold imports surge

China and other foreign central banks have been driving the demand for gold recently, and it seems this trend will continue. I was concerned that these central banks would slow their purchases as the price has risen, but that has not been the case.

Central banks set a new record for quarterly gold purchases at 290 tons. I expect central banks in the global south and east to continue diversifying away from the dollar. Gold seems to be one of the beneficiaries of this trend.

If you like this type of information and want to understand how I invest in these themes, consider subscribing or upgrading your subscription to the paid version of the newsletter.

This service and my work are reader—and listener-supported. The best way to support me is to follow me on Substack, YouTube, and X. You can also buy me a coffee if you are inclined.

That’s it for this week.

John Polomny

Is global de-dollarization an intentional & deliberate effort from within the USA? - Andy Schectman

https://www.youtube.com/watch?v=_rZQrJkyhL0

Andy Schectman says there is a deliberate plot to destroy dollar/reserve currency status, and he blames Senile Joe's chief economic advisor, Jared Bernstein.

Also, fwiw, ,Jared has a BA in Music, and an MSW (social work)--clearly the right educational background for the position as Chief Economic Advisor.