Free Weekly Email 10/21/24

If you don't own gold, you know neither history nor economics - Ray Dalio

In a recent series of interviews, billionaire investor Ray Dalio, founder of Bridgewater Associates, the world's largest hedge fund, has sounded the alarm on an impending economic paradigm shift that could dramatically reshape the financial landscape.

(skip)

Dalio's concerns stem from what he perceives as unsustainable levels of government and corporate debt, coupled with aggressive central bank policies that are devaluing currencies. He predicts that within the next 18 months, we may witness a significant economic contraction and a restructuring of debt and finance that will catch many unprepared.

"We are currently in the late and perilous phase of the long-term debt cycle," Dalio explained. "The levels of debt assets and liabilities have soared to such heights that it has become challenging to offer lender-creditors a sufficiently high interest rate in relation to inflation."

Dalio has discussed the necessity of holding gold as a hedge against central bank largesse. Gold has broken out to the upside as more and more central banks buy gold to hedge themselves against the US dollar and the decline of the American empire.

Interview with Murray Stahl

Murray Stahl at Hedgeye Fall 2024 Investing Summit: Inflation and Hard Asset Investing (October 9, 2024)

Vimeo does not let me post the video on Substack. You can follow a link to it on the Horizon Kinetics website here.

I have become a big fan of Mr. Stahl and have been reading all of the research on the Horizon Kinetics website. They believe that the long-term disinflation that we enjoyed for forty years is over and is now reversing, and we are heading for a few decades of inflation.

They discussed why this happened, which opened my eyes as I had not fully considered or heard some of these arguments. Mr. Stahl also describes the investing philosophy he and his shop have adopted to take advantage of the higher inflation thesis.

His discussion of AI power needs and how they will be met includes natural gas and a lot of West Texas land. It's very interesting.

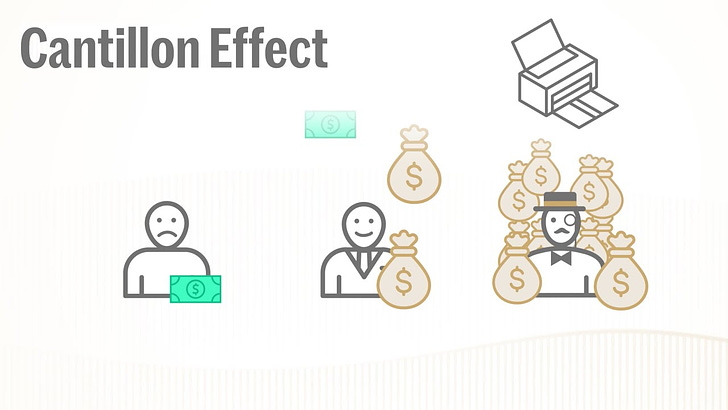

Cantillion Effect Primer

When new money is added to the economy, it will naturally raise the price of goods and assets. However, not all prices will rise by the same amount or at the same time. The Cantillon Effect asserts that the first recipient of the new supply of money has an arbitrage opportunity of being able to spend money before prices have increased.

This is partially due to the fact that new fiat money is created at almost zero cost and given to specific parties, usually banks. These banks have an opportunity to spend this money on goods and assets whose price has not yet reflected the increase in money supply. Banks can thus buy goods at a discounted rate.

As the new money flows from central banks to private banks to investors to ordinary citizens, prices gradually begin to reflect the increase in the money supply. By the time ordinary citizens experience the increased money supply, they will be buying goods at higher prices.

This is why I say you need to be an asset owner. Tangible assets that cannot be created out of thin air will likely allow one to hopefully stay ahead of inflation. Understanding this will likely determine your future over the next several years as the US is entering a debt doom loop that will only result in the creation of trillions of currency units.

The AI Boom and the Need for Power

For years, nuclear power has been out of favor in the U.S. High costs, regulatory hurdles and the public’s lingering fears from accidents like Chernobyl and Fukushima have kept many from embracing it.

But times are changing. This week alone, we saw two major announcements that signal what I believe is a new era for nuclear energy in the U.S.

Amazon signed agreements to support the construction of several new Small Modular Reactors (SMRs) in the Pacific Northwest. These reactors, owned and operated by Energy Northwest, will eventually generate enough power to serve the needs of over 770,000 U.S. homes. Meanwhile, Google announced a partnership with Kairos Power to bring 500 megawatts of SMRs online by 2035.

Perhaps the most eye-catching deal came from Microsoft, which made headlines for partnering with Constellation Energy to revive the Three Mile Island nuclear plant—yes, that Three Mile Island, renamed as Crane Clean Energy Center. Microsoft is betting $1.6 billion to restore the plant by 2028 and secure carbon-free energy for the next 20 years.

Add all this up, and 2025 is expected to usher in a record amount of nuclear generation, with more than half of it coming from China and India, according to the International Energy Agency (IEA).

I was bullish on nuclear and uranium based on the supply/demand dynamics long before this news. Now that all the major tech companies are all-in on nuclear, I don’t know how you can not be bullish on uranium. There is an ongoing uranium deficit of 30-50 million pounds annually. More reactors are being built, and new reactors are planned weekly. Now, there is action to restart idled reactors, including the Three Mile Island reactor, that did not melt down.

Poll

With Silver Hitting a recent 12-year high, where will it finish in 2024?

That is it for this week.

John Polomny

This service and my work are reader—and listener-supported. The best way to support me is to follow me on Substack, YouTube, and X. You can also buy me a coffee if you are inclined.