MoneyFest 2024 Continues

I have been tracking central bank monetary policy for a while now. Last month, 25 central banks cut rates versus three that raised rates. We are experiencing a new upward thrust in global liquidity that should flow into various asset classes, likely resources and tangible assets. Recall that in the short term, liquidity and sentiment drive markets.

Market Sea-Change Underway As Asia Repatriates Capital From The West | Louis Gave

While much of Wall Street's focus over past recent years has been on the Big US Tech stocks, aka the Magnificent 7, there are an increasing number of seismic developments happening internationally investors need to be aware of.

For example, emerging market stocks have positively trounced tech stocks since June.

And to name just a few others:

China is now firing its monetary and fiscal bazookas with gusto.

India is now the world's fastest growing major economy & its stock market is booming.

Japan just elected a new prime minister whose hawkish policies might end the yen/dollar carry trade.

And of course, the escalation of hostilities in the MiddleEast threaten to inject a lot more uncertainty into geopolitical and global trade.

Which international trends are the most important for investors to track?

What are the biggest risks? And where are the biggest opportunities?

I always listen to Louis Gave interviews. Like all of us, he isn’t right all the time, but he has perspectives that are unique and thought-provoking, especially about China and emerging markets.

Kopernik Perspective: 2024 Mining White Paper

Mining is an unpopular industry and is unpopular for very valid reasons. Management teams are prone to allocate capital pro-cyclically, destroying vast amounts of capital. Governments take advantage of the fact that companies cannot move a mine out of the country. And, operationally, mining is a difficult business. Many investors have been burned in the past, and vow never to get burned again, no matter the discount.

People are prone to hyperbole and exaggeration, frequently repeating phrases like “never” and “absolutely not.” Our philosophy discourages this binary thinking. The question is not “should we own this?” but “at what price is owning this worthwhile?” Emerging markets, unpopular industries, places with unfamiliar or challenging geopolitical situations – all these present specific challenges and lead to deep discounts and substantial bargains, creating the potential for outsized future gains. We’ll discuss how misanalysis further adds to the compelling values within this space.

This white paper (an update of our 2020 mining paper) explains how we value mining companies and why we currently prefer to own the mining companies, risks attached, to the physical commodities that underpin them. Pertaining to mining companies today, we see this binary thought process as extreme – an extreme that we are taking advantage of.

Kopernik is underfollowed, but they are actual contrarian investors. They are worth following. They have great insight into mining and other undervalued sectors. They think there is tremendous value in various ming assets today. It seems the market is coming around to their thinking.

This quote, in particular, dovetails with my philosophy.

We believe that one of Kopernik’s competitive advantages is behavioral – we are willing to buy unpopular stocks and, in doing so, are willing to accept career risk in order to lower the risk to the portfolio. Further, things can remain unpopular, and fundamentals can stay dislocated for an uncomfortably long period of time. As discussed earlier, one can afford to be patient when the potential upside is significant. Even though our investors had to wait 8 years for uranium to turn, we made substantial returns on many of our uranium holdings. Uranium is one example of how staying the course, and sticking to our disciplined research process, paid off.

China, If not now, when?

Goldman Sachs view on China investing.

As I said a while ago, China is undervalued, and it was a contrarian idea that I had. However, I don’t want to be invested there when the US is planning a war with them and has started the escalation escalator. I learned my lesson with Russian stocks.

However, investing in resource markets allows us to have a second-order effect on China. If, in fact, they continue to fire the bazooka, the resource sector will likely benefit. If people who invest big in China this year beat my returns, I will tip my hat and take the loss.

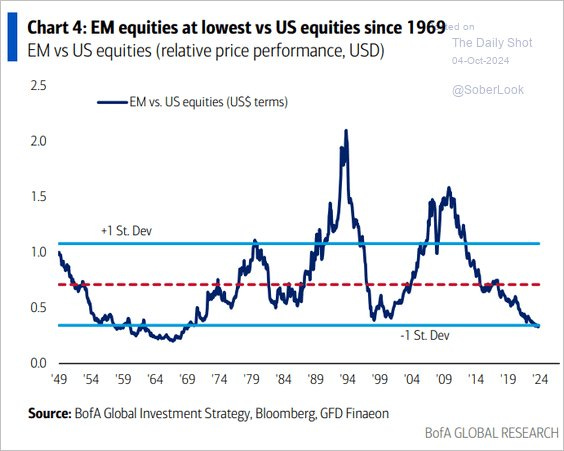

Great Setup in Emerging Markets

In addition, emerging markets are still out of favor among most investors—I, of course, like them for that reason.

That is it for this week. Thanks for subscribing.

John Polomny

This service and my work are reader—and listener-supported. The best way to support me is to follow me on Substack, YouTube, and X. You can also buy me a coffee if you are inclined.

Seems mainstream is disappointed by China’s fiscal drive. It’s not perceived as impressive as their monetary drive. John, can you separate the signal from the noise in this?

John, I like your strategy of benefiting from a boom in China without the risk of investing in Chinese stocks.

I'm waiting to buy more copper, oil, uranium on pullbacks because China will be buying more of them. I also lost my Russian stocks and I don't want to take that risk.

The best risk-reward way to play China is to buy undervalued commodity stocks. Chinese stocks may make more on the upside, but the downside is a 100% loss in the event of war. As Warren Buffet has said, anything times zero is zero.